IRS ITIN Certifying Acceptance Agent

Instead of sending original documentation, you may use an IRS-authorized Certifying Acceptance Agent (CAA) or make an appointment at a designated location. Alejandro Mendoza, EA CAA is an IRA Certified Acceptance Agent in Maryland, the District of Columbia, and Virginia. CAAs can authenticate all the identification documents for the primary and secondary applicants. For dependents, they can authenticate their passport and civil birth certificate.

To find a local CAA in your area, you can visit Acceptance Agent Program

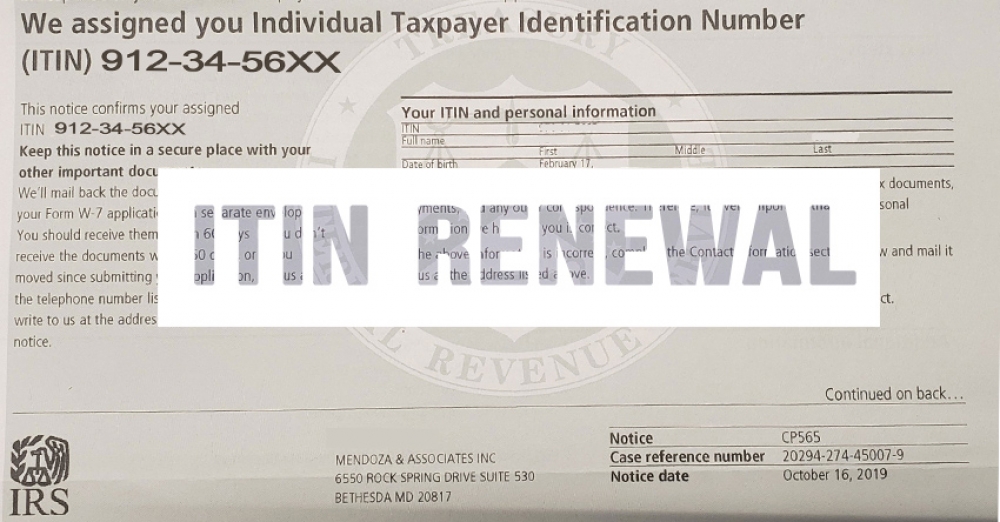

The IRS issues Individual Taxpayer Identification Numbers (ITIN) to individuals who are not eligible to obtain a Social Security Number.

The IRS is sending the Notice “CP-48” to all ITIN holders who must renew their numbers. However, the ITIN holder is not required to wait until receiving this notice to begin the process. You can start the process anytime until the end of the year. It is recommended to comply with the renewal as soon as possible to avoid delay from the IRS.

The ITIN renewal Only process is simple, and a tax return is not required to be filed with the request. The taxpayer will need to submit a new Form W7 and supporting documentation to the IRS. However, the IRS does not accept copies of taxpayer-supporting documentation unless issued by an IRS Agent or Certifying Acceptance Agent (CAA).

The Mendoza & Company team is certified to request your renewal and authenticate your supporting documentation. Therefore, you are not at risk of losing your original documents or waiting for weeks until it is returned to you. We will certify copies of your documents and return your originals to you at your appointment. It is faster and easier!

Avoid common errors now and prevent delays next year.

Federal tax returns submitted with an expired ITIN will be processed. However, certain tax credits and any exemptions will be disallowed. Taxpayers will receive a notice in the mail advising them of the change to their tax return and their need to renew their ITIN. Once the ITIN is renewed, applicable credits and exemptions will be restored, and any refunds will be issued.

Additionally, several common errors can slow down and hold some ITIN renewal applications. These mistakes generally center on missing information or insufficient supporting documentation, such as name changes. The IRS urges any applicant to check over their form carefully before sending it to the IRS.

As a reminder, the IRS no longer accepts passports that do not have a date of entry into the U.S. as a stand-alone identification document for dependents from a country other than Canada or Mexico or dependents of U.S. military personnel overseas. The dependent’s passport must have a date of entry stamp. Otherwise, the following additional documents to prove U.S. residency are required:

- U.S. medical records for dependents under age 6,

- U.S. school records for dependents under age 18, and

- U.S. school records (if a student), rental statements, bank statements, or utility bills listing the applicant’s name and U.S. address if over age 18.

ITIN Documentation Frequently Asked Questions (FAQs) - IRS Website

Which documents are acceptable?

See the instructions for Form W-7PDF. These instructions list the 13 acceptable documents.

Will the IRS return my original documents to me? How long will it take to get them back? (updated December 2021)

Original documents will be returned to the address on record after processing your application. The IRS is currently processing Form W-7s within 11 weeks after receipt. If you need your original documents for any purpose within this processing timeframe, you may wish to apply in person at an IRS Taxpayer Assistance Center or CAA. You may also choose to submit certified copies from the issuing agency instead. Original documents you submit will be returned to you at the mailing address shown on your Form W-7. You don’t need to provide a return envelope. Applicants are permitted to include a prepaid Express Mail or courier envelope for faster return delivery of their documents. The IRS will then return the documents in the envelope provided by the applicant.

Whom should I contact if I do not receive the documents within the allotted period? (updated September 10, 2021)

If your original documents aren’t returned after the timeframe noted above, you can call the IRS at 800-908-9982 (U.S. only), or for international, call 267-941-1000 (this is not a toll-free number).