Blog - Tax Related

With the new year underway, it’s time to turn our attention to another annual milestone — Tax Day. To help, I thought I'd provide an abridged tax guide so you can know exactly what to expect as you prepare to file.

The big picture is this: When it comes to the 2022 tax year, it’s pretty clear it’s the year of the reset. The IRS rolled out many credits, increases, and stimulus payments in 2020 and 2021 to help taxpayers weather the pandemic and its subsequent fallout.

Now, provisions like the child tax credit, the earned income tax credit, and the child and dependent care credit are reverting back to their pre-pandemic parameters. That said, here are 22 questions — and answers — about the 2022 tax year.

General Tax Questions

1. When is the deadline for filing taxes this year?

The deadline for filing taxes is Tuesday, April 18, 2023.

2. What are the tax rates and brackets for 2022?

|

2022 Marginal Tax Rates |

Single Filer |

Married Filing Jointly |

Head of Household |

Married Filing Separately |

|

10% |

$0–10,275 |

$0–20,550 |

$0-14,650 |

$0-10,275 |

|

12% |

$10,276-41,775 |

$20,551–83,550 |

$14,651-55,900 |

$10,276-41,775 |

|

22% |

$41,776-89,075 |

$83,551–178,150 |

$55,901-89,050 |

$41,776-89,075 |

|

24% |

$89,076–170,050 |

$178,151–340,100 |

$89,051-170,050. |

$89,076-170,050 |

|

32% |

$170,051–215,950 |

$340,101–431,900 |

$170,051-215,950 |

$170,051-215,950 |

|

35% |

$215,951–539,900 |

$431,901–647,850 |

$215,951-539,900 |

$215,951-323,925 |

|

37% |

Over $539,901 |

Over $647,851 |

Over $539,901 |

Over $323,926 |

3. How do tax brackets work?

Here’s a quick review:

The tax bracket that the highest dollar of your income falls into is called your marginal tax rate. But because of the U.S. tax system, your tax liability isn’t simply your marginal rate multiplied by your taxable income. The rate you pay is your effective tax rate. Here’s a real-life example that shows how it works:

Let’s say Kelly is a single filer with $50,000 in taxable income.

- From $0 to $10,275, Kelly is taxed at 10%.

- From $10,276 to $41,775, she is taxed at 12%.

- From $41,776 to $50,000, Kelly is taxed at 22%.

Kelly’s marginal tax rate is 22%. But once she runs the calculations, Kelly will pay around 12% of her income. This is her effective tax rate, equal to about $6,000.

4. What is the standard deduction for 2022?

For 2022, the standard deduction has increased slightly to adjust for inflation.

|

Filing Status |

2021 |

2022 |

|

Single |

$12,550 |

$12,950 |

|

Married Filing Jointly |

$25,100 |

$25,900 |

|

Married Filing Separately |

$12,550 |

$12,950 |

|

Head of Household |

$18,800 |

$19,400 |

*Note that if you are age 65 or older or blind, your standard deduction is higher. If you fall into one of these categories, your standard deduction is increased by $1,750 if you’re single or $1,400 if you’re married.

5. Should I itemize or take the standard deduction?

The option you choose depends on the one that will maximize your tax benefits. Taxpayers usually claim the option that lowers their tax bill the most. You get to decide which is better for you each year.

The standard deduction allows you to deduct the set amount from your taxes, no questions asked. If you plan to itemize, you’ll need documentation to verify your qualifying expenses from a list approved by the IRS.

6. What is a tax credit, and which ones should I take?

A tax credit is the amount of money you're permitted to subtract, dollar for dollar, from any income taxes you owe. Here are seven of the most common ones:

- Child Tax Credit: For 2022, the child tax credit is non-refundable. The tax break reverts to the previous amount — up to $2,000 per child under age 17. Note that this credit starts phasing out for higher-income taxpayers.

- Earned Income Tax Credit (EITC): The EITC helps low- to moderate-income workers and families get a tax break. If you were married filing jointly and earned less than $59,187 in 2022, you may qualify for the credit or even a refund check. Find out if you qualify by looking at the 2022 EITC tables.

- Child and Dependent Care Credit: For 2022, the child and dependent care credit is non-refundable, and the maximum credit percentage is 35%. The credit allows up to $3,000 in expenses for one child or disabled person and $6,000 for more than one. The full child and dependent care credit will only be allowed for families making less than $15,000 a year in 2022 (down from $125,000 in 2021).

- Adoption Tax Credit: Families that grew through adoption might qualify for the Federal Adoption Tax Credit. Adoptive parents must earn $223,410 or less to be eligible for the full credit, which provides up to $14,890 per eligible child — defined as any person under the age of 18 that is mentally or physically unable to take care of themselves.

- American Opportunity Credit: The American Opportunity Credit allows parents to claim up to $2,500 per student for tuition, activity fees, books, supplies, and equipment during the first four years of college. Students must be enrolled at least half-time.

- Lifetime Learning Credit: The 2022 Lifetime Learning Credit is worth as much as $2,000 to help offset higher education expenses. Taxpayers can use the credit for tuition and related expenses paid for undergraduate, graduate, and professional degree courses for themselves, their spouses, or dependents.

- Saver’s Credit: This tax credit is worth up to $1,000 ($2,000 if married and filing jointly) for mid-and low-income taxpayers who contribute to a retirement account.

7. Are there any deductions for student loan interest?

Yes. You may be able to deduct up to $2,500 of student loan interest paid in 2022. Keep in mind the credit amount is gradually reduced if your modified AGI reaches a certain threshold.

8. What are the standard mileage rates for 2022?

The 2022 standard mileage rate for business driving from January 1 to June 30 is 58.5¢. Effective July 1 through December 31, 2022, the IRS raised the mileage rate to 62.5¢.

9. What are the medical travel and military mileage rates for 2022?

The mileage rate for medical travel and military moves is 18¢ for the first six months of 2022 and 22¢ for July through December.

Retirement Tax Questions

10. What are the retirement plan contribution limits for 2022?

2022 Retirement Plan Contribution Limits and Catch-Up Contributions:

- 401(k), 403(b), and 457 plans: Contributions for these plans are capped at $20,500 for 2022. Taxpayers 50 and older can once again put in $6,500 more as a "catch-up" contribution.

- Simple IRAs: The 2022 cap on contributions to SIMPLE IRAs is $14,000, plus an extra $3,000 for people age 50 and up.

- Traditional and Roth IRAs: Limits for IRAS are $6,000, plus $1,000 as an additional catch-up contribution for those aged 50 and up.

11. What about required minimum distributions (RMDs) for 2022?

The IRS updated the table used to calculate required minimum distributions (RMDs) to account for longer life expectancies beginning in 2022. See the updated table here.

12. Are there any tax breaks for senior adults and retirees?

Yes! Here are a few to look for:

- Larger standard deduction: The standard deduction for seniors is $1,750 higher for those younger than 65 who file single or head of household. Married filing separately or jointly taxpayers receive a $1,400 boost in the standard deduction.

- Property tax breaks: Property tax rules differ by state and local jurisdiction. In some areas, people above a certain age who earn below a particular income level qualify for property or school tax exemptions. Be sure to look at specific rules in your area.

- Credit for the elderly and disabled: To qualify for this credit, you must have an AGI below $17,500 ($25,000 if both spouses are 65 and older) and Social Security and pension income under $5,000 ($7,500 for couples).

- Additional IRA contribution: Employees 50 and older can save an additional $1,000 in an IRA for a total of $7,000 in 2022.

- 401(k) catch-up contributions: Older workers with a 401(k) plan can make catch-up contributions. If you were 50 or older in 2022, the catch-up limit is $6,500 for workplace plans.

- No early withdrawal penalty: Once you turn age 59½, you can withdraw money from your IRA for any reason without the 10% penalty. Finally!

- Qualified charitable distributions: Retirees aged 70½ and older who give up to $100,000 directly from their IRA to a qualified charity won’t owe income tax on the gift.

- HSA contribution limit: Individuals aged 55 or older by the end of the 2022 tax year can contribute up to $4,650 to a health savings account (up $50 from 2021).

- Long-term care insurance premium limits remain the same: Taxpayers 71 or older can write off up to $5,640 per person.

Miscellaneous Tax Questions

13. What are the lifetime estate and gift tax exemptions for 2022?

The lifetime estate exemption for 2022 jumped from $11.7 million to $12.06 million ($24.12 million for couples).

The gift tax exclusion rose to $16,000 per recipient. This means you can give up to $16,000 to each child, grandchild, or any other person in 2022. So long as you stay below the limit, neither you nor your recipient will be required to file a gift tax return or tap the lifetime estate and gift tax exemption.

14. What are the capital gain rates for 2022?

Remember, if you sold stocks, mutual funds, or other capital assets that you held for at least one year, any gain is taxed at a 0%, 15%, or 20% rate.

The 0% rate applies to those with taxable income:

- Up to $41,675 for individual taxpayers

- Up to $55,800 for head of household filers

- Up to $83,350 for married filing jointly returns

- Up to $41,675 for married filing separately returns

The 15% rate applies to those with taxable income:

- $41,676 to $459,750 for individual taxpayers

- $55,801 to $488,500 for head of household filers

- $83,351 to $517,200 for married filing jointly returns

- $41,676 to $258,600 for married filing separately returns

The 20% rate applies to those with taxable income:

- Over $459,751 for individual taxpayers or married filing separately

- Over $488,501 for head of household filers

- Over $517,201 for married filing jointly returns

- Over $258,601 for married filing separately returns

You can get a general idea of your after-tax investment gains with a capital gains calculator.

15. What is the Residential Clean Energy Credit?

The Inflation Reduction Act, signed into law on August 16, 2022, renamed the former Residential Energy Efficient Property Credit to the Residential Clean Energy Credit. For 2022, the credit amount was increased to 30% from 26% in 2021. The credit can offset the cost of installing electric, water heating, or temperature control systems in homes that use solar, wind, geothermal, biomass, or fuel cell power.

16. Are HSA contributions tax-deductible? What else has changed with HSAs?

Yes! The contributions to an HSA are tax-deductible, and the earnings (if invested) are tax-free, as are withdrawals foreligible medical expenses. You report your contributions on Form 8889 with the total contributions transferred to and reported on your Form 1040.

HSA funds, flexible spending arrangements (FSAs), and health reimbursement arrangements (HRAs) can purchase over-the-counter medicines without a doctor's prescription.

17. Are charitable contributions eligible for a tax deduction in 2022?

Any contribution—of cash or non-cash assets—received by December 31, 2022, is eligible for a tax deduction. Generally, you may deduct up to 50% of your AGI. Keep in mind that charitable contributions are only deductible if you are itemizing.

18. Are there any tax deductions for teachers in 2022?

Yes! Teachers and other educators who pay out of pocket for books, supplies, and other materials used in the classroom can deduct up to $300 for these expenses.

19. What’s changing this year with platforms like Paypal and Venmo?

It turns out, nothing. The IRS previously announced that payment platforms like Venmo and Paypal would be required to send Form 1099-K to anyone who earned $600 or more on the platform in 2022. On December 23, the IRS reversed course for the 2022 tax year, reverting to the previous requirement that platforms provide 1099-Ks to those who earned at least $20,000 from 200-plus transactions on the platform.

This is not a cancellation of the new requirement, but a delay for the 2022 tax year. Reach out if you have any questions at all about this.

Just-for-Fun Tax Deductions

20. Can clarinet lessons for my child reduce my taxes?

Why, yes, they can! It’s true. Clarinet lessons for your son or daughter can qualify as a medical expense because they may help correct a misaligned bite. Lessons might also qualify as dependent care expenses if they happen outside the normal school day.

21. Can I deduct the cost of my backyard swimming pool?

If you have a medical condition like arthritis that doctors believe could be helped by regular time in the water, you may be able to write off the cost of putting in a pool.

22. Do summer camp expenses for my child qualify me for the child and dependent care credit?

Yes! If you are single and working or married and both you and your spouse work, the costs of day camp during the summer generally count as expenses toward the child and dependent care credit.

I hope this guide was helpful — and maybe a tad amusing. Feel free to share it with others, and as you shift into high gear with your 2022 tax return, don’t hesitate to reach out if you have questions, no matter how small. We’re here to make this tax season easy, efficient, and headache-free.

We are accepting new tax clients for 2022. Schedule a complimentary tax call. Schedule Online

As we move towards tax season, I wanted to get a jump on sharing a few IRS tax updates for 2022, so you can plan accordingly. The theme almost entirely across the board? Brackets, limits, and thresholds are increasing for 2022.

As you read over these changes, let me know if you have questions or would like to know if/how they apply to you. I’m here to find ways to help you save and pay no more than you need to this tax year and always.

- Tax brackets increase. Here are the adjusted minimum income levels for the top tax brackets for each filing status for 2022:

- Single: $539,901 (up from $523,601 in 2021)

- Head of household: $539,901 (up from $523,601 in 2021)

- Married filing jointly: $647,851 (up from $628,301 in 2021)

- Married filing separately: $332,926 (up from $314,151 in 2021)

- Standard deduction rises. All taxpayers are entitled to the standard deduction unless they itemize their deductions. Here are the 2022 standard deductions:

- Single: $12,950 (up from $12,550 in 2021)

- Head of household: $19,400 (up from $18,800)

- Married filing jointly: $25,900 (up from $25,100)

- Married filing separately: $12,950 (up from $12,550)

- Retirement contribution limits increase, too. The 2022 contribution limit for elective deferrals to 401(k), 403(b), most 457 plans, and the Thrift Savings Plan (for federal employees and members of the uniformed services) increases to $20,500. The total you and your employer can contribute combined also rises to $61,500 from $58,000. Note that the catch-up contribution for taxpayers aged 50 and older remains at $6,500.

- Health savings account (HSA) limits go up. For 2022, the amount you can set aside for qualified medical expenses increases to $3,650 for self-only coverage and $7,300 for family coverage.

- Earned income credit decreases for individuals with no children. The earned income tax credit (EIC) is a refundable tax credit for low- and moderate-income Americans. The credit amount depends on income and the number of children, but workers without children can still qualify. In fact, the largest change for 2022 is a significant decrease in the credit for persons with no children. This is because the American Rescue Plan boosted it from $543 to $1,502 in 2021; however, this increase doesn’t apply in 2022.

- The estate tax exemption and gift tax limits will rise. In 2022, the federal estate tax exemption grows to $12.06 million from $11.7 million. The gift tax annual exclusion also increases to $16,000 from $15,000 in 2021.

- Capital gains tax thresholds increase. Although the capital gains tax rates for long-term investments remain the same for 2022, income thresholds have increased. Learn more about 2022 capital gains tax rates on the IRS’s website.

- New tax credit for the purchase of an electric vehicle (EV). Beginning next year, new EV owners will enjoy a tax credit of up to $7,500. To qualify, the EV must have “final assembly” in North America. The credit also offers a $4,000 credit for people who buy used electric cars.

I hope you found this information helpful. If nothing else, you’re better prepared than most to finish out the year strong from a tax perspective.

As always, if we can be of assistance to you, please reach out anytime—that’s why we’re here.

We are accepting new tax clients for 2022. Schedule a complimentary tax call. Schedule Online

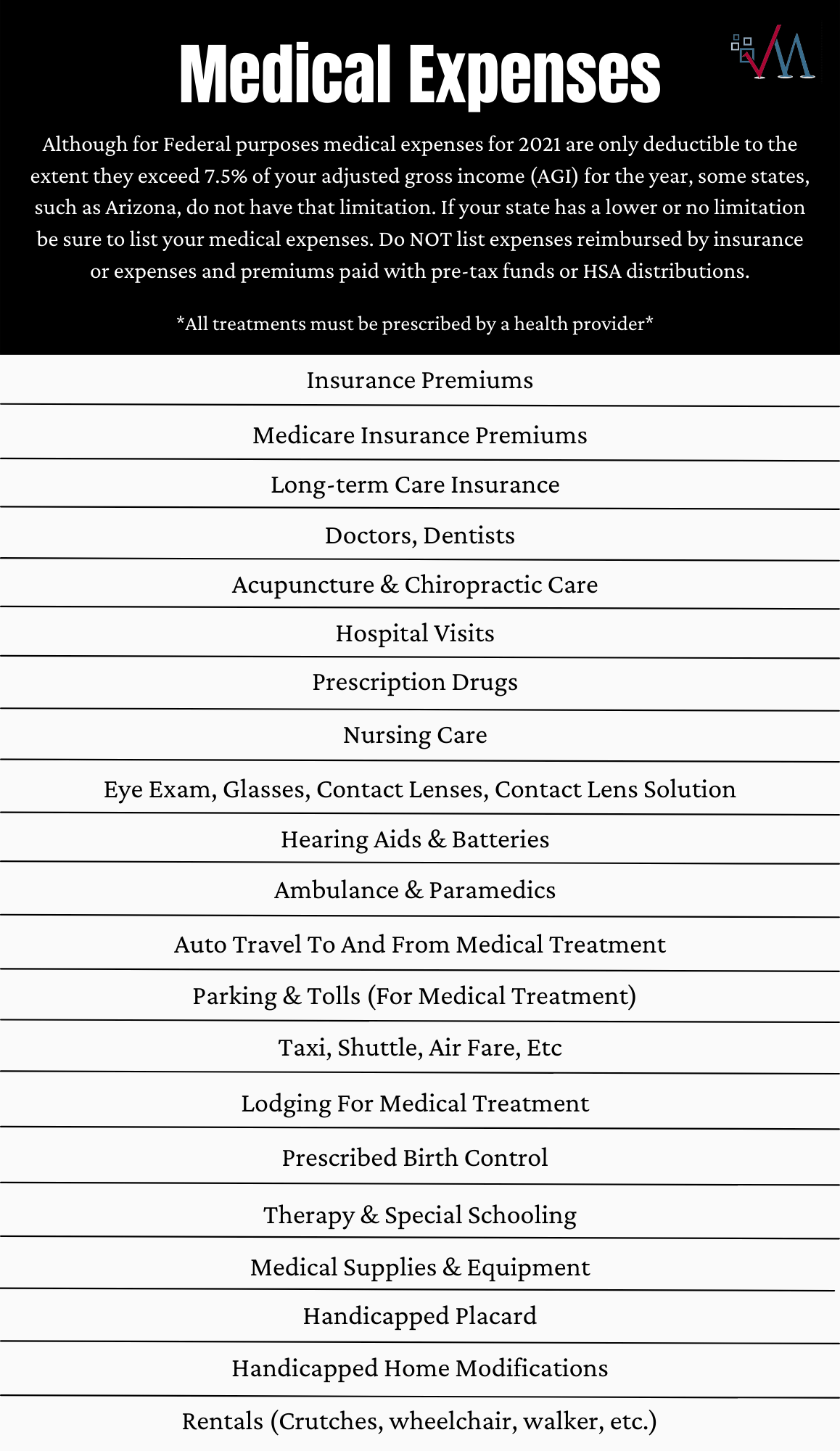

Medical Expense Deductions

Written by Marina Stolbovaia & Alejandro MendozaMedical expenses are a financial burden that many of us face any given year. In fact, researchers found that between 2009 and 2020, medical expenses became the number one source of debt owed to collection agencies in the U.S. To help ease the burden, the IRS allows you to deduct most unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (AGI) when filing a Schedule A. If your out-of-pocket medical expenses have consumed more than 7.5% of your AGI, pay attention! The following examples can help you get a clearer picture of what medical expenses you can deduct this tax year.

According to the IRS, “medical expenses include payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, or payments for treatments affecting any structure or function of the body.” This includes fees for doctors, surgeons, dentists, psychologists, and others, in-patient hospital care or residential nursing home care, payments for insulin, false teeth, reading or prescription glasses, hearing aids, and even insurance premiums. The full list of covered medical expenses can be found in the attached image to this post. Although medical expense deductions cover a broad spectrum of medical services, it still has its limitations.

What is, and is not deductible, can be hard to determine. For items that are not covered in this article, refer to this free IRS questionnaire that can help you figure out what you can deduct: https://www.irs.gov/help/ita/can-i-deduct-my-medical-and-dental-expenses For example, the IRS only allows medical deductions if the expenses were paid in the same year as the deduction. You must also reduce your total deductible expenses for the year by any reimbursement of deductible expenses, including medical insurance or if it is paid on behalf of your doctor, hospital, or other medical provider. The agency also notes that you may not deduct for funeral or burial expenses, nonprescription medicines, toiletries, cosmetics, trips or programs for your mental health, or most cosmetic surgeries. Although smoking-cessation programs can potentially be deductible if prescribed by your medical provider, nicotine gum and nicotine patches are not deductible since it is an over the counter treatment, and not medically prescribed by a physician. Generally, if a treatment is prescribed to you by your health provider, it is deductible.

Of course, we are here to help. If you have any additional questions regarding medical deductions, please feel free to leave us a comment on this post or send us an email at This email address is being protected from spambots. You need JavaScript enabled to view it..

Planning on going to GoodWill or Salvation Army to drop off your donations? On our itinerary next week, we will be talking about charitable contributions. This is a popular deduction that can help most of you save this tax season. You don’t want to miss out.

How to Deduct Meals and Entertainment this Tax Year- IRS Notice 2021-25

Written by Marina Stolbovaia & Alejandro MendozaFiguring out what is tax-deductible can be confusing for businesses. The requirements for meals deductions especially can be subjective, with broad specifications as to what is allowable and what is not. Luckily, in this article, we will be outlining how you and your business can make the most of the recent modifications to meals tax deductions.

The way businesses handle meals and entertainment deductions hasn’t changed much since the 2017 Tax Cuts and the Jobs Act permanently disallowed entertainment write-offs. However, as of 2020, the way businesses can write off meals has changed. In previous years, only 50% of restaurant meals were deductible. Now, meals can be 100% deductible if met by certain, specific requirements. In response to the pandemic, the Consolidated Appropriations Act was signed into law in December 2020 in an effort to temporarily help the struggling restaurant industry.

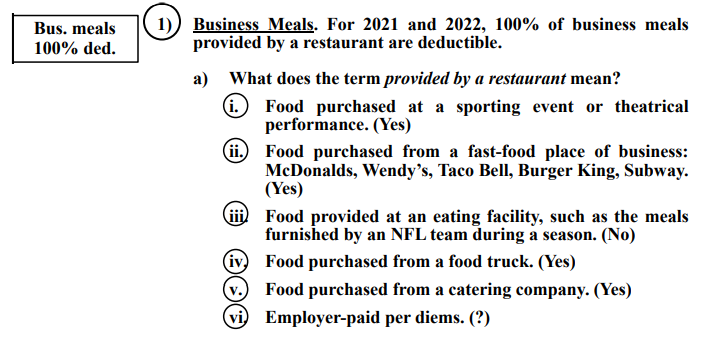

Now that deducting entertainment expenses is off the table, we should focus on what classifies a meal deduction. The IRS released Notice 2021-25 as guidance. Here is a quick summary of the notice:

- The Notice is effective from Dec. 31, 2020 to January 1, 2023.

- Food and beverages are 100% deductible if purchased from a restaurant within 2021 and 2022.

- Entertainment is no longer deductible under Section 274(a).

As mentioned above, it can be difficult to classify which expenses are deductible. You may have questions such as, “What if I cater food for my business?”, or “What are the limitations to deducting meals?”. According to the notice, no deduction is allowed for the expense of meals unless:

- The expense is not lavish or extravagant under the circumstances; and

- The taxpayer (or an employee of the taxpayer) is present at the furnishing of such food or beverages.

Team building activities, according to the tax code are “expenses for recreational, social, or similar activities (including facilities therefore) primarily for the benefit of employees'. This includes, but is not limited to, holiday parties, annual picnics, company retreats, and summer outings. Activities that are not deductible include sporting event tickets, concert tickets, and golfing, amongst others. Rather, these types of events are categorized as ‘entertainment’ by the IRS. However, it is important to note that food and beverages purchased separately from these ‘entertainment’ activities are still deductible.

As long as the meals are provided by a restaurant, they are 100% deductible. This also includes catering. The IRS defines "restaurants as a business that prepares and sells food or beverages to retail customers for immediate consumption, regardless of whether the food or beverages are consumed on the businesses’ premises”. Meals that are de minimis fringe benefits, cooked, or prepackaged, are now 50% deductible. That means, if your business provides meals in an in-house cafeteria, or if you prepare a cooked meal in your hotel room while traveling, you are still able to deduct 50%. So if you plan on treating your best client to lunch and a game of golf at the country club, make sure to separate your receipts in order to claim the 100% deduction for your meals.

Making sure you are up to date with your business’s record-keeping is going to be essential in itemizing your meal and entertainment deductibles. It is crucial that you accurately document and record your receipts. If not properly maintained, you may be faced with additional penalties and interest from the IRS in the event of an audit.

We understand that itemizing deductions isn’t always black and white. So, to help you distinguish what is, or is not deductible, we're including a free chart of examples found below. Sometimes, mistakes can happen when using even the best bookkeeping software. Consult your local tax advisor today to take advantage of this new, temporary tax rule.

The IRS Crackdown on Venmo, Zelle Payments

Written by Marina Stolbovaia & Alejandro MendozaRumors of a new tax rule have spread over all major platforms this past week regarding additional taxation on third-party transactional apps. Social media users say peer-to-peer (P2P) platforms such as Zelle, PayPal, Venmo, and CashApp will face new tax reporting requirements when annual transactions exceed $600. But how accurate is this claim?

Although there is some truth to the claim, it is not as daunting as it seems. The American Rescue Plan Act of 2021 proposes to lower IRS reporting requirements from $20,000 in aggregate payments to $600 effective January 1, 2022. The aim is to collect unreported income, which the IRS estimates to be nearly $166 billion every year. Before the bill, if a seller using a P2P app receives over $20,000 in over 200 aggregate payments over a year, platforms such as Venmo, CashApp, and Zelle, will send you a 1099k form. The new proposal’s threshold is decreased to $600 in aggregate payments, with no minimum transaction number. Note that states like Maryland, Virginia, and Vermont already have a $600 threshold enacted for P2P apps.

If you are a business owner, it’s likely that you already receive a 1099k each tax year from the IRS. The sale of goods or services is considered income, and in the eyes of the IRS, should be reported. However, it’s important to differentiate the difference between taxable income and other forms of payments. Payments made through P2P apps for living expenses such as rent or paying a friend to cover the dinner bill are not taxable income. Your family sending you rent money is also not considered taxable income. Paying your friend back for dinner is considered a reimbursement, while the latter is considered support from your family members. For payments to be considered inflows of income, they have to result from a sale of goods or services in exchange for compensation. Reimbursements for things such as rent is not considered income and therefore are not taxable.

Let’s clarify what is considered taxable income with an example. Joe is a college student with a corporate job. On the weekends, Joe details cars for extra cash. All of his car detailing transactions occur on Venmo, totaling $2,300 a month in gross receipts. Even though he is working part-time as a W2 employee and is a freelancer on the side, he struggles to pay off his school and living expenses. So to help, his father sends him money through Venmo to help cover his bases. Once his grandparents heard of this, they also decided to contribute. Monthly, Joe’s father sends Joe $1,200 for his rent, and his grandparents send $1000 to cover books and other college expenses through Venmo. On top of that, Joe’s roommate sends his half of the rent also through Venmo. Collectively, Joe’s account is deposited $4,500 monthly through the platform.

Since Joe meets the $600 threshold for the tax year, he is sent a 1099k form. Within the form, Joe must classify all of his transactions. Otherwise, he is subject to paying the taxes at the full amount. Out of the $4,500 he receives monthly, only his car detailing business proceeds are income and taxable after allowable expenses. The money he receives from his father and his grandparents is exempt from taxation, as it is a gift and not income. His roommate’s contribution to the rent is also not income. Instead of paying the taxes for the total $4,500 of earnings, Joe is only obligated to pay taxes on the income earned from providing car detailing services.

In the event of an audit, the IRS can claim that the entire $4,500 per month is taxable income.

Of course, we now know that this claim is incorrect. Suppose Joe classified all of his transactions from Venmo correctly. In that case, he is only subject to paying taxes on the $2,300 per month earned, less his deductible expenses. Personal loans, gifts, and debt reimbursements have never been taxable, and even with this new proposal, that will not change. What will change, however, is the volume of people who receive a 1099k form. With the threshold dropping from $20,000 to only $600, most people who regularly use third-party transactional apps will receive one.

The new proposal, if enacted, will likely affect most people using transactional apps such as Venmo, Zelle, CashApp, and PayPal. Although these platforms are already required to report their activity to the IRS, lowering the threshold requirement from $20,000 to $600 will complicate many people’s taxes. Those who file their own taxes are at risk of either over-reporting or under-reporting their taxes, likely with a heavier emphasis on the latter. Given the additional complexities of this upcoming tax season, it is important to seek the advice of a tax professional when preparing your taxes. For those who have a shared account for personal and business transactions, it’s important to separate the accounts to simplify the classification process during tax season. Such as opening a separate bank account for all business activity, including deposits.

A couple of months ago, we published an article entailing the repercussions of a $900 million increase in the IRS budget. The goal of the increased budget is to increase the auditing capacity of the IRS to ensure that the wealthy are paying their fair share of taxes. Make no mistake; however, the increase in audits will not just be directed towards the rich. The unfortunate reality is that everyone will have a greater chance of being audited. On top of the budget increase, this proposal to tax transactional apps will leave even more room for IRS audits.

If you are a user of third-party transactional apps, you will likely receive a 1099k form to classify your transactions, given that this proposal is enacted. With the exponential increase in potential audits, consulting your local tax advisor regarding your tax filings this tax season is more important than ever. With the help of a tax professional, you can put yourself in a better position in the event of an audit. Here at Mendoza & Company, we work in favor of you and not the government. Given the uncertainty and increased power of the IRS this tax season, it is pertinent to file your tax returns correctly and with certainty.

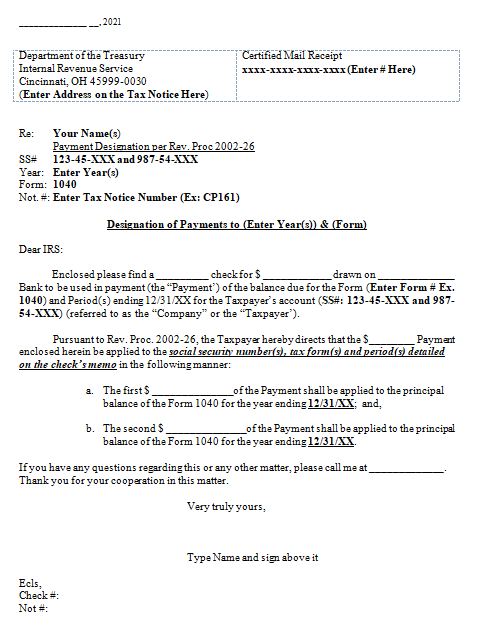

Tips on Paying Your Tax Bill: Designated Payments

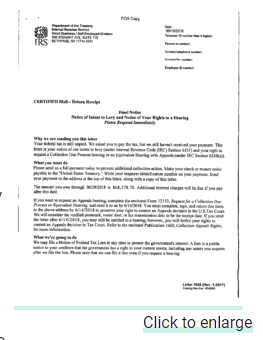

Written by Marina Stolbovaia & Alejandro MendozaMany people don’t think twice about sending a check to the IRS to pay off their tax liability. They write the check, send it to the IRS, the check will clear, and they go about their day. That is until the IRS sends them a notice of intent to levy several months later, claiming that the debt was never paid off. The check could be cleared, the money could be taken out of your checking account, but the IRS can still claim that you owe a debt. But, this would be at no fault of your own. Sometimes the IRS will take payments and apply them to balances at their own discretion, even though you logically expect the payment to be applied to your debt. Now you are faced with additional penalties and interest, and the IRS is threatening to levy your property.

Aside from online payment, using a regular check from your normal bank account is the most simple method for the IRS to locate your payment. Each canceled check comes with an endorsement stamp when it is processed by the IRS. The endorsement will include an IRS confirmation number and where the payment was deposited. A stamped endorsement on the check is essential if you come to find out whether the IRS has misallocated your payment. At times, the IRS can make a mistake and deposit the payment into accounts belonging to the wrong SSN entirely. IRS employees can accidentally mix up the numbers while entering them. Although unlikely, it is often due to simple human error. More common are the cases where the payments are applied to current tax liabilities instead of previous debts. Without specifying the tax year, the IRS will use their own discretion and often designate the payment to the most recent tax year. The older liability will continue to accrue penalties and interest during that time and the debt will continue to grow larger, unbeknownst to the taxpayer.

Here at MendozaCo, we formulated a reliable method of ensuring that your payment to the IRS goes to the right place. We went over the first step of the process: the importance of sending a check from your bank account. On the check, you should provide your SSN, the year of the liability in which you are paying, and the form you are addressing. We understand it can be uncomfortable to include sensitive details like your SSN on a check, but it is a crucial step in getting the check to the right place. For every check we send on behalf of our clients, we also attach a certified letter. The letter includes the name or person of reference, the purpose of the letter, the form, SSN, the year being paid, and a tax notice number if applicable.

Not sure how to write your certified letter? No problem! We are giving out a complementary template letter free of charge. It’s simple- just click here: Designation Letter Template and fill in the blanks. Now you will have everything you need to securely pay your debt and avoid additional letters or fees from the IRS.

**Note: All opinions discussed in this blog are for general informational purposes only. The contents of Mendoza & Company blog posts are not intended to, and shall not be construed as, provide specific legal, financial, or tax advice. The contents expressed by Mendoza & Company are from the personal research and experience of the owner of the site and are intended as educational material. We encourage you to seek professional advice on the complementary templates.

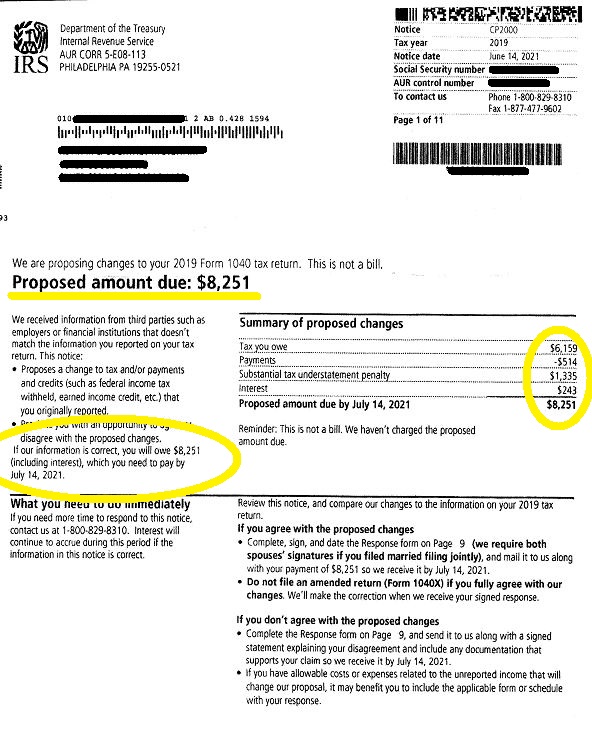

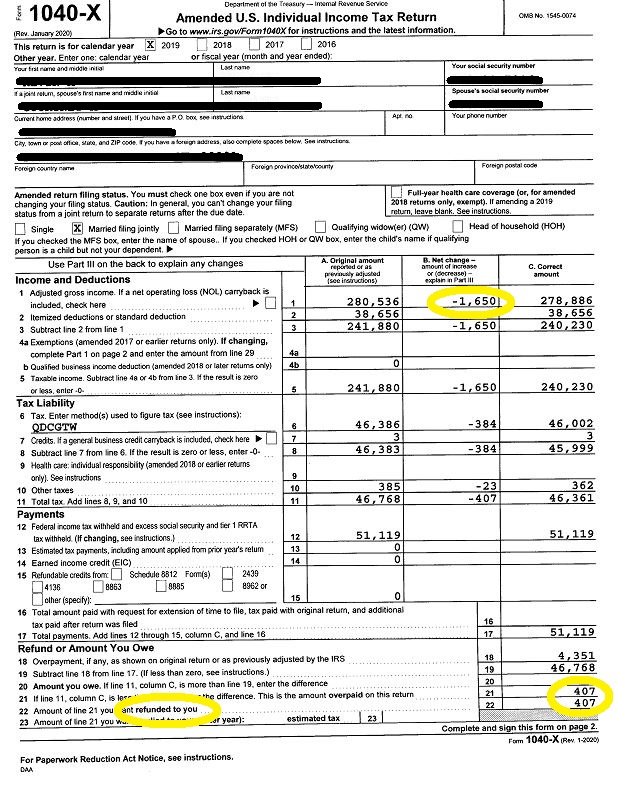

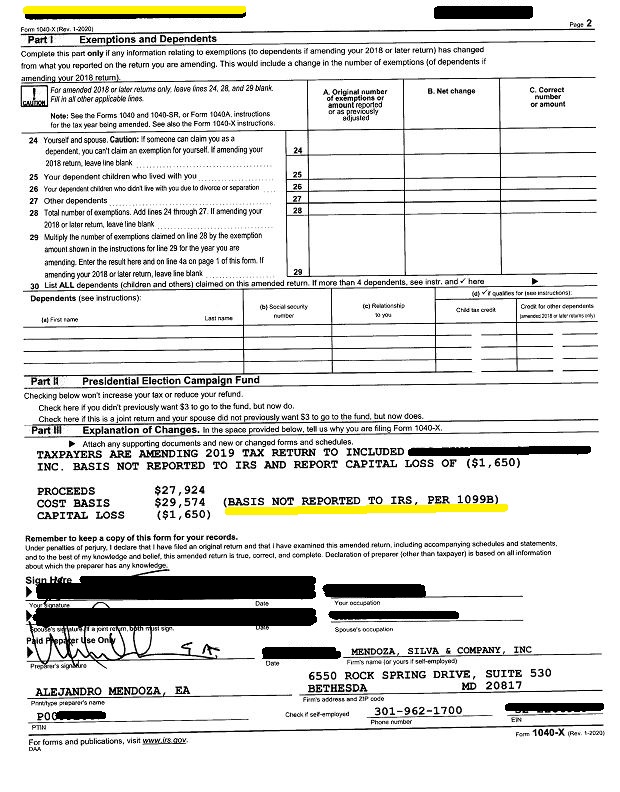

Watch Out for IRS CP2000

Written by Marina Stolbovaia & Alejandro MendozaWatch out for IRS CP2000 letters! It has come to our attention that we are receiving several calls regarding taxpayers receiving CP2000 letters from the IRS proposing corrections to their tax returns. If you have complicated tax returns, multiple streams of income, or you filed your taxes on your own, there is a chance you may receive a letter from the IRS claiming that you pay additional taxes.

In 2019, before our client was engaged with us, our client filed her tax return using a free tax-filing software. There, she did as anyone else would: she input all of her revenue streams, calculated her taxes, and paid- all on time. She did as she was supposed to. What she didn’t realize, however, is that she forgot to include the sale of a stock that she had made earlier last year. During that time, the IRS was receiving her investment information from the financial institutions she had an activity with, and noticed that she did not report the stock sale. The discrepancy between the IRS tax calculations and her’s, prompted the IRS to send a CP2000 letter. Over two years later, in June of 2021, she finally receives the letter in the mail.

After reviewing the letter with the client, we asked her to send us a copy of her 2019 Investment Activity Summary. The first thing we thought to ask was, “did the IRS include her cost basis in their calculation?”. As we came to find out, as eager as the IRS was to send her a proposed tax bill, they were not nearly as eager to check her 1099B form to account for the stock’s cost basis. Although the stock was sold for $27,000, she had purchased it for $2,000 more than what she had sold it for. The stock was sold at a loss. We promptly amended her 2019 tax return, and our client left with a refund of $407.00 plus a refund from Maryland.

The key takeaway from this is in the event you receive a CP2000 letter, to have it reviewed by a tax professional. Sometimes, when using a free tax-filing software, mistakes can happen. The unfortunate fact is that there is more room for error, and you may end up paying more in taxes than you would if you had directly paid a tax professional to correctly file your taxes. If you have business income, foreign income, investments, capital gains income, rental income, or real estate income, consider Mendoza&Company, Inc. for your tax needs.

Our results in response to IRS CP2000: At the start the client owed the IRS $8251.00, but by the end, they left with $407.00 in their pocket.

The New IRS Budget May Lead to More Audits

Written by Marina Stolbovaia & Alejandro MendozaPresident Biden is proposing to increase IRS funding by $80 billion over the next ten years to aid in collecting taxes from America’s wealthiest individuals and businesses. The proposal aims to increase audits for individuals earning $400,000 or more in order to “ensure that the wealthy are paying their fair share” of taxes. The goal with the increase in funding is to generate $700 billion in revenue by the end of the decade. On the outside, it sounds like a good way to help fund the trillion dollars being allocated toward the infrastructure project. But, how can we make sure that the average American won’t increase their chances of being audited?

There is no debate that the IRS is severely underfunded, however. Even though counterintuitive, this can be a good thing from the perspective of our clients. From 2010 to 2020, the agency lost over 33,000 employees, with the number of millionaires nearly doubling during that same time period. With the increase in spending, the IRS will hire nearly 78,000 new employees over the next decade- with many delegated to tax enforcement and audit procedures. Although the goal of the agency is to decrease the levels of tax evasion among the wealthy Americans, there is no guarantee that the increase in spending will play out this way. The increase of new IRS employees will likely increase the cases of audits in Americans with an average income. With the additional employees, there will be an increase in audits overall, since new recruits have to gain experience in the audit field. In reality, the wealthier individuals and businesses have the resources for effective defense against audits, while the average citizen may not have the same resources to protect themselves from an audit- making the average American a likely target for upcoming audits.

It’s a common occurrence for the IRS to abuse their power and coerce individuals into paying more taxes than they owe. As a tax resolution firm, we see this very often. We often see audits where a client’s deductions are disputed, and the client ends up with a multi-thousand dollar bill. The occurrence of these scenarios don’t exclusively affect the ultra-wealthy. Individuals, and especially businesses, who do not have the means to have a bookkeeper or an accountant, face an increased chance of losing audits. In general, having proper documentation and representation to dispute audit allegations increases the likelihood of winning the audit. Hence why individuals and businesses with greater means are less likely to lose an audit. Newly hired IRS auditors, which will represent nearly half of IRS staff, likely won’t be handling these types of audits.

An increase in workers is going to increase the overall occurrence of audits- all around. Regardless of how much you or your business makes, you will have an increased chance of getting audited. So what should you do if you get a “notice of discrepancy” letter in the mail from the IRS? Don’t accept the proposal by simply paying the bill- no matter how small. If you are in compliance, provide the proper documentation, and dispute against the discrepancy. Otherwise, there will be a possibility of further investigations into previous years. That means more audits, and a larger bill. What might be a small proposal of discrepancy, can possibly grow into multiple years of audits.

Take for example our client, who had her business deductions dismissed by the IRS. In March 2019, she received the CP2000 letter claiming that she had a tax discrepancy of $11,000 from December 2016. With penalties and interest accumulating over the three years, the bill grew to $15,000. She is a classic example of the IRS chasing after regular Americans, not the ultra-wealthy. Our client only had a combined AGI of $90,000 with her husband. Her story is similar to what we see all the time: a new IRS agent conducted the audit, and misappropriated her rightful deductions, and now the taxpayer is faced with an inflated bill. After coming to us, we settled with the IRS and the agent conducting the audit, provided documentation, and eventually eliminated her proposed tax liability altogether. Not only did she win the audit, but she is also spared from any additional audits for previous years. With some help, she stopped the audit abuse at the hands of the IRS.

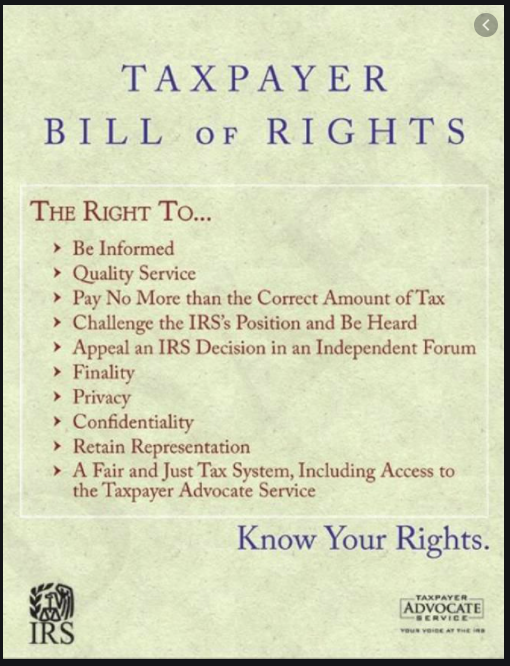

With the increase in IRS spending, please make sure that you or your business are in compliance with the agency. If you own a business, it is important that your business finances are well organized in the event of an audit. We recommend hiring a bookkeeper or accountant to help keep your business in compliance and increase your chances of success in winning an audit, if one were to ever occur. If you find yourself with a CP2000 letter, or notice of discrepancy letter, do not hesitate to reach out to your local tax professional. No matter how small the amount, it is important that you understand your rights.

Reasonable Compensation

Written by Alejandro Mendoza & Marina StolbovaiaAttention all S corporation shareholder-employees: be aware of upcoming IRS audits! If you own and perform business under an S corporation, you may already know to compensate yourself as an employee. Failing to provide yourself with compensation or providing too little compensation can get you into a problematic audit with the IRS. With IRS operations slowly going back to normal, expect an increase in audits.

This morning while getting the mail, I noticed a letter from the IRS. The letter reminded us that our company was elected under an S corporation, which we had established nearly twenty years ago in 2001. What would be the motivation behind the IRS sending a friendly reminder? Without explicitly saying it, what the IRS means is ‘hey, we’re doing our due diligence by reminding you that you must pay payroll taxes on the compensation you received from your s corporation. Be prepared for the possibility of an audit.’ If you do not compensate for a ‘reasonable’ salary, the IRS can target you.

This morning while getting the mail, I noticed a letter from the IRS. The letter reminded us that our company was elected under an S corporation, which we had established nearly twenty years ago in 2001. What would be the motivation behind the IRS sending a friendly reminder? Without explicitly saying it, what the IRS means is ‘hey, we’re doing our due diligence by reminding you that you must pay payroll taxes on the compensation you received from your s corporation. Be prepared for the possibility of an audit.’ If you do not compensate for a ‘reasonable’ salary, the IRS can target you.

It can be difficult to determine what a reasonable salary is, so let’s tie everything together with a simple example:

Joe owns a plumbing company. He has eight employees, all under W2’s, and he pays them about $600,000 as a part of payroll. He also pays himself a ‘reasonable’ salary of $65,000, which is approximately the average salary for a plumber in his area.

He pays his employees and collects payroll taxes from them, relaying the tax amount to the government. Joe is in compliance. In the event of an audit, he is in good shape.

Mike, too, owns a plumbing company in the same state as Joe. He also has eight workers, but he classifies them under 1099-NEC even though they all work for him 40 hours a week and depend on him financially. According to the IRS, these are not workers; they are employees. Employees are paid under W2’s, similar to Joe’s employees. On top of that, Mike doesn’t pay himself a salary but instead withdraws the business’ profits into his account. He is not paying the payroll taxes from all workers, including Mike’s withdraw. Mike was sent the same friendly reminder but decided to take his chances and ignore the letter. A year later, the IRS knocks on his door and audits his plumbing business.

The IRS audit causes a ripple effect. His 2018 tax year gets audited, then the 2017 year, and the 2016, and the 2015 tax year. Mike gets audited for six years, and as a result, the IRS also reclassifies the workers as employees. The next thing he knows, his business owes $750,000, and he personally owes $480,000 in payroll taxes to the IRS. Mike will need to reclassify all of his employees and pay off his debt. If he can’t afford to pay off his personal debt, the IRS will threaten to levy his personal assets.

Luckily, Mike should not lose hope. Here at MendozaCo, we handle these kinds of situations often. The key in Mike’s scenario, like most scenarios with the IRS, is that he needs to get into compliance. Without compliance, negotiating with the IRS is near impossible, and penalties will continue to accrue. If Mike’s situation sounds similar to yours, please don’t hesitate to call us. We can take care of your IRS tax problems, as well as keep you in compliance by managing your payroll for you.

How are Maryland Unemployment Benefits Taxed?

Hundreds of thousands of people filed for state-led unemployment benefits as unemployment reached record numbers over the last year. Chances are you or someone you know has filed for some form of assistance. Under Maryland's new RELIEF Act, individuals will be exempt from state and local income taxes on unemployment benefits from 2020 and 2021 tax years. The exemption is estimated to save Maryland taxpayers more than $400 million and help people get more tax refunds during the tax season over the next two years.

The same income tax exemption is available at a federal level, as well. In other words: if you received Maryland unemployment benefits, income tax exemptions could apply to you at a local, state, and national level. According to the IRS, you don't have to pay federal taxes on your employment benefits up to $10,200- as long as your adjusted gross income is less than $150,000 for joint filers ($75,000 single filer). If you are married, each spouse receiving unemployment doesn’t have to pay taxes for up to $10,200 of the compensation received.

It’s important to note that you must request this exemption in your state and federal tax returns in order to receive the exemption. Unfortunately, it is not enough to simply be eligible for relief. The last year has been complicated enough- don’t hesitate to reach out to us at Mendoza&Co or a trusted tax advisor to maximize your return this tax season.

More...

Updated Tax Filing Date 2021

In response to the pandemic, the IRS pushed the 2020 federal tax filing deadline. The Treasury moved the deadline from the expected date of April 15th to the following month, May 17th, 2021, to accommodate the “most vulnerable individuals” this tax season. For our DMV locals, Washington, D.C, Maryland, and Virginia have also adopted the filing day of May 17th.

There is significant confusion between the new filing deadline of May 17th and the first 2021 estimated quarterly tax deposit, which remains unchanged as April 15, 2021. Although the date to file has changed, the due date for estimated quarterly tax deposits has not. The 2021 estimated tax deposit applies to individuals owing more than $1,000 for income taxes for the year. For business owners, this means that the first-quarter estimated tax payments are still subject to the original estimated deposit date. Indeed, this can create some confusion.

Our recommendation at MendozaCo is to file the 2020 tax returns as soon as possible, and as for the 2021 estimated quarterly tax deposits to apply one of the “Safe Harbor” tests:

- 90% of the tax shown on the individual’s tax return for the current year (2021), or;

- 100% of the tax shown on the prior year’s return (2019) for adjusted gross income (AGI) less than $150,000 for married filing jointly (AGI less than $75,000 for single individuals) or;

- 110% if your previous year’s adjusted gross income was more than $150,000.

If you satisfy one of the three tests, you won’t have to pay the estimated tax penalty.

This tax season may be the most complicated yet. The unforeseen circumstances of the COVID-19 pandemic have brought both leniencies and more confusion into the equation. Starting sooner than later is the best way to avoid facing penalties or overpaying for your taxes- don’t wait until the last minute to file! Call MendozaCo to schedule an appointment today.

COVID Relief - 10% Penalty on Retirement Distribution

Written by Alex Mendoza and Marina StolboviaHave you withdrawn a portion of your retirement funds due to COVID-19 and are now stuck with paying the 10% early withdrawal penalty? As we know, the pandemic left millions of Americans in economic despair- so it seems unfair that people are still required to pay these penalties when the transfer was made out of necessity. Many people have found themselves in financial hardship and have resorted to taking out some of their retirement funds to stay afloat. Luckily, the IRS has released some recent guidance.

In the recent publishing of IRS Notice 2020-50, the IRS addressed coronavirus-related distributions within the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Here is the basic rundown of the benefits:

|

To qualify for assistance, the IRS requires an ‘acceptable self-certification’:

|

|

Learn how we turned Martha’s $22,000 tax liability into a tax refund:

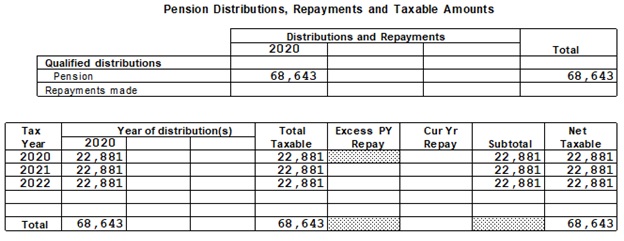

Martha came to us after she withdrew $68,643 from her pension plan. Since she distributed her funds before the mandated retirement age, she accrued $6,864 in penalties. On top of the penalties, there are also federal and state taxes, adding $16,000 to her overall bill. Before Martha came to us, she owed $22,864 in taxes and penalties.

Her husband's furlough from his job last August qualified the couple for relief. After consulting Alejandro, our EA and tax advisor, she was able to abate the $6,864 penalty entirely and split her withdrawal into three separate, taxable distributions. For the years 2020, 2021, and 2022, she will recognize $22,881 from her retirement plan. This way, Martha can meet her family's needs while paying only a fraction of what she owed in taxes. In the end, reducing her taxable income resulted in Martha receiving a tax refund for the 2020 tax year. Thanks to Alejandro, Martha went from being tens of thousands of dollars in debt to the IRS to have the IRS owe her money back during a time of need.

Don't let the pandemic pressure you to go into debt with the IRS. Consult Mendoza&Co today to see how we can work for your tax needs.

Partial Payment Installment Agreement (PPIA)

Written by Alex Mendoza and Marina StolboviaWhat is a Partial Payment Installment Agreement (PPIA)?

The Partial Payment Installment Agreement (PPIA) is a monthly payment plan with the IRS that allows a Taxpayer to pay only a portion of their tax debt. Although the IRS can sometimes be willing to accept a partial payment, securing an agreement is only possible for those Taxpayers that qualify under certain guidelines. Within the Internal Revenue Manual, IRS Code section 6502 states that the IRS is limited to a ten-year collection authority on taxes due from the Taxpayer. This statute is called the Collection Statute Expiration Date or CSED. Starting from the day you filed your tax returns, the statute begins. Here, it becomes essential to file your tax returns on time. If you or your business have unsubmitted tax returns or have had tax returns prepared by the IRS, called Substitute for Returns (SFRs), the CSED will not begin until you file.

To better understand if you may be eligible for a PPIA, let's consider a few examples:

Example # 1: Taxpayer (Jane Smith) filed her 2012 Form 1040 tax returns on April 15, 2013, but never had a chance to pay the taxes due. Following IRS Code 6502, Jane's CSED for the 2012 tax return will expire on April 15, 2023. Before she knew it, her overall tax liability grew to $80,400, including principal, interest, and penalties. As of December 31, 2020, the CSED for her unpaid 2012 tax return will expire in 28 months. Jane consults a local tax resolution firm, and they determine that her monthly ability to pay is $100.00. With the PPIA payment plan, Jane will pay only $2,800 out of her $80,400 tax debt. The IRS CSED then writes off the remaining $77,600 balance.

Example # 2: The IRS prepared a Substitute for Return (SFR) on behalf of the Taxpayer (Billy Miller) for the 2012 tax year. His assessed tax liability is $80,400, including principal, interest, and penalties. The CSED for 2012 has not started, and the ten-year collection period moves forward, benefiting the IRS. In this scenario, Billy will not qualify for the PPIA since the IRS still has plenty of time to collect his debts. Instead of a PPIA, he may be eligible for a full-pay installment agreement (IA).

Like Jane, Billy's ability to pay is $100.00 monthly, but he has 120 months to pay his debt. Suppose Billy's PPIA offer is accepted. The IRS will grant him the agreement, but the IRS will reassess his ability to pay every two years. If Billy's financial situation were to improve, and his ability to pay has increased, the IRS will see this improvement and request an increased monthly payment. Two years later, during Billy's evaluation, they determined that his ability to pay increased to $1,000 monthly. Billy's new monthly payment will then be $1,000 for the remaining 78 months.

Like the full-pay installment agreement, PPIA and Offer In Compromise require the Taxpayer to be in compliance with the IRS. In order to be in compliance, The Taxpayer will need to have filed all tax returns or the last six-year minimum in certain cases. Regardless of whether a PPIA or Offer in Compromise is used, it is important to file your taxes and start the statute of collections. Haven’t filed taxes in years? Visit our blog post to learn more.

Knowing Your Rights - Be Informed

Most Taxpayers are not aware of their rights regarding the 10-year CSED when dealing directly with an IRS revenue officer (RO). Close to 100% of the time, taxpayers are pressured by the RO to sign a waiver, called Form 900, extending the CSED. In Example # 1 above, if Jane Smith signs a Form 900, the IRS would have gained the right to add 60 months or $6,000.00 to her bill. All when she was not required to sign the form in the first place. Don’t fall into this trap!

IRS Internal Revenue Manual (IRM 5.14.2.2.3(2)) clearly states “A waiver is no longer required to be secured when the taxpayer’s only ability to satisfy the tax liability after the CSED expiration is through a continuation of the installment agreement and there is no significant change in ability to pay as identified through the two-year financial review process”

AND confirmed in the following federal act;

The 2004 American Jobs Creation Act: I.R.C §6159(a) “A waiver is no longer required to be secured when the taxpayer’s only ability to satisfy the tax liability after the CSED expiration is through a continuation of the installment agreement and there is no significant change in ability to pay as identified through the two-year financial review process.”

What We Do!

Step 1: Evaluating your Financial Assets and Tax Compliance

For the IRS to accept your PPIA settlement, you must be in compliance. Without compliance, negotiating with the IRS will be very challenging. The IRS will not consider a full-pay installment agreement, PPIA, or an Offer in Compromise if you haven't filed your tax returns. We begin strategizing how to tackle your debt by first preparing unfiled tax returns and analyzing your asset's risks. The assets can include your bank account balances, cash value life insurance, 401ks, equity in your house, and your vehicle(s). If you do not have assets, that could be a good thing when dealing with the IRS.

Step 2: Statute of Limitations

A significant component of how the IRS will review your PPIA application is how close your tax debt is from the statute of limitations for collections ('CSED'). The IRS has only ten years to collect your debt, and once the ten-year statute of limitations has expired, the remaining debt balance is diminished. It is essential to know how much time you have left until your CSED comes into effect. A debt closer to the CSED will have a better chance of obtaining the PPIA than one with eight years left, for example. In the case that there are eight years until the CSED, it will be unlikely that the IRS will accept a PPIA as the IRS has plenty of time to collect your payment. In this case, the Taxpayer is most likely qualified to enter into an installment agreement rather than a PPIA based on the Taxpayer's ability to pay for the eight years.

Step 3: What is your ‘Ability to Pay’?

If the statute of limitations for collections is coming into effect, then the IRS only has a short period to collect as much as the law allows the IRS to collect from you. In example # 1, the Taxpayer's ability to pay is a $100 monthly payment for the PPIA; the IRS will have no choice but to accept the PPIA before they cannot collect within the CSED.

Example # 3

Let's consider a scenario where you have a tax debt of $150,000. You have the ability to pay $100 per month, and your financial condition is unlikely to change in the future, you have no assets besides your home which is worth $350,000 and the mortgage on your home is $200,000. The IRS sees that you have equity in your home and threatens to levy your property. You are in compliance but you are lacking funds to fully pay the tax liability. You tried to refinance the house and you’re unable to utilize the equity. In most cases, our clients have equity in their homes, but because their credit has been ruined by the IRS tax lien placed on the home, the bank will deny any form of refinancing. This is a good thing from a bad situation.

IRS IRM 5.14.2.2.2(2) Asset Equity and Partial Payment Installment Agreement “Asset Cases: A PPIA may be granted if a taxpayer does not sell or cannot borrow against assets with equity because: (b) the taxpayer is unable to utilize equity”

If the IRS is pressing for the available equity in your home, we will stop the IRS request by proving that you were unable to obtain financing from the bank. When the bank denies your request to refinance, this shows that you were unable to acquire the equity from your home, and ultimately, the IRS will not be able to seize the equity. Additionally, suppose the property is jointly owned and the non-liable spouse declines to go along with the attempt to borrow against the equity to pay the IRS. The spouse has the right to deny refinancing. Since the non-liable spouse has a right to deny refinancing, this will freeze the IRS from obtaining the equity.

Step 4: Stoping IRS Collections and Evaluating Options

Before we submit a PPIA, we will first analyze the Offer in Compromise (OIC) option. An OIC is a minimum amount you can pay and ‘settle’ with the IRS. In some special cases that we have handled, we could settle a tax debt for $1. However, not all cases are alike. This is the best-case-scenario. If you cannot pay the entirety of the debt and have a limited ability to pay, the IRS may grant an OIC. After you pay the agreed-upon amount, you will no longer be in tax debt!

OICs are complicated to do alone. We have a solid team of experts working on OIC year-around. Not all cases qualify for an OIC, but it may likely be your first solution to settle.

Example # 4 The IRS is knocking on your door with the “Final Notice – Notice of Intent to Levy and Notice of Your Rights to a Hearing” Letter 1058, but you only have 40 months remaining on your CSED - What steps should I take?:

|

1. Fax and Certified Mail “Request for a Collection Due Process or Equivalent Hearing” Form 12153 ASAP or within 30 days. This step is important. You don’t want to lose your appeal rights by not responding on-time. |

|

|

2. Compliance, Compliance, and Compliance – File unfiled tax returns, |

|

|

3. Here, we would prepare your financial statements to show the IRS that you are only able to pay $100 a month and demonstrate your financial condition is unlikely to change in the future. Like we had mentioned earlier, the IRS will try to take as much as they can get by collecting your tax debt. If the IRS sees that you are unable to pay your tax balance in full, they will grant your request for a PPIA. |

|

| 4. Instead of paying $150,000 of tax debt, you will only pay $100 for 40 months- so only $4,000! | |

PPIA's have a strict application process, and they are often the 'last resort’ for the IRS to collect your debts. As nice as only paying-off only a portion of your debt sounds, the IRS does not make obtaining this agreement easy. Not only does the taxpayer have to check all of the requirements, if the PPIA is granted, the taxpayer also consents to be financially re-evaluated every two years. This means that if the taxpayer’s financial situation were to improve, then they can be subject to an increase in their monthly payments.

PPIA is complicated, but not difficult to obtain if you qualify. The good news is that we are here to help. At Mendoza & Co, our tax experts will position your PPIA in the light most favorable to you and not the IRS. Every tax solution is different. Don’t wait and tackle the IRS on your own- schedule an appointment now!

Haven’t paid your taxes in 5 years? 10 years? Have unfiled tax returns?

Have a tax debt of $30,000 or more?

Don’t panic! At MendozaCo, we are here to help.

Failing to file or pay for your taxes can bear some serious consequences. Not only is it the law to file your taxes, but the unfiled tax return debt will also continue accumulating penalties and interest. On top of that, the IRS can legally levy your assets, stop business operations, garnish future tax refunds and your paychecks, and can even prevent you from obtaining your professional license or a passport. Although it is relatively unlikely that you will be sent to jail, the penalties and interest alone are enough to get anyone nervous. Even famous celebrities can’t escape the fright:

|

“In my daily life, the goal was to muffle the anxiety that I’d feel as I tried to drift off to sleep knowing that, at any point, what little money I had in my bank account could be garnished by the IRS”. -Anthony Bourdain |

We understand that filing or paying your taxes can be a daunting task. Many Americans overlook their taxes for a multitude of reasons - maybe you were sick in the hospital, you were afraid to file because you didn’t have the money to pay, or you just never got around to it. Regardless of your reasoning, you are not alone. In fact, approximately seven million Americans fail to file federal income tax returns every year. We see these kinds of things all the time; it is nothing to be ashamed about. Together, we can come to an effective solution.

Step 1: You need to be in COMPLIANCE:

If you haven’t filed, you should first file your current return and the prior six years' tax returns as soon as possible to begin to bring yourself into compliance with the IRS. Remember: compliance is key! This will be essential for subsequent actions to get you back on track to being tax debt-free. The IRS considers a taxpayer to be in compliance if returns have been filed up to six years and the current tax year.

For some filings, however, the IRS will file the tax return for you, a procedure called a Substitute Filed Return (“SFR”). The IRS is not filing the tax returns to help you. The SFR creates the assessment (Inflated IRS tax bill) and starts the collection process against you without you being aware. The SFR is a legal procedure within the IRS IRM (Internal Revenue Manual).

In the case that there are SFRs, we will need to replace them with your actual tax return in order to adjust the IRS inflated assessment (the tax bill). Remember, we only need to file the prior six years to be in compliance, but if we can identify any SFRs beyond the sixth non-file years, we would need to also file those additional tax returns. SFRs can significantly inflate your tax bill for the Installment Agreement (IA), so it is important to identify and replace the SFRs with your actual tax returns. Make sure to file the required tax returns and stop the bleeding. If we perpetuate the cycle of non-filing, the bleeding of additional penalties will continue to flow.

Here is the tricky part - we need to be careful about how many unfiled tax returns to submit. Sometimes submitting too few can result in a criminal act called tax evasion or audit exposure, while filing too many may end up paying more than you should! But don’t worry, tax resolution is our specialty!

|

- IRS Internal Revenue Manual (5.14.1.4.1) |

|

|

“Six-Year Rule: When a taxpayer is unable to full pay immediately and does not qualify for a streamlined installment agreement, the taxpayer may still qualify for the six-year rule. “ |

|

- IRS Internal Revenue Manual (5.14.1.4.2.8) |

|

|

"Compliance and Installment Agreements (IA): Prior to granting IAs, ensure that tax returns due within the past sixteen months were filed. If not filed, address compliance even if a Del Ret is not indicated using the procedures provided in IRM 5.14.1.4.1" |

Now what?

Now the clock starts ticking. Don’t worry, though, not in a bad way! It’s important to submit your returns and be in compliance with the IRS in order for the statute of limitations on the collection period to begin. The IRS has a statute of limitations for collections of 10 years. Meaning, once you file your taxes, the collection period begins, and if your debt has not been collected within 10 years, the remaining balance of your debt will be removed and you will no longer be liable to pay it. Of course, a ten-year-long waiting game sounds exhausting, which it is, but it will at least get the ball rolling!

Now that we are in compliance with the IRS, we now need to look into your financial situation and your ability to pay.

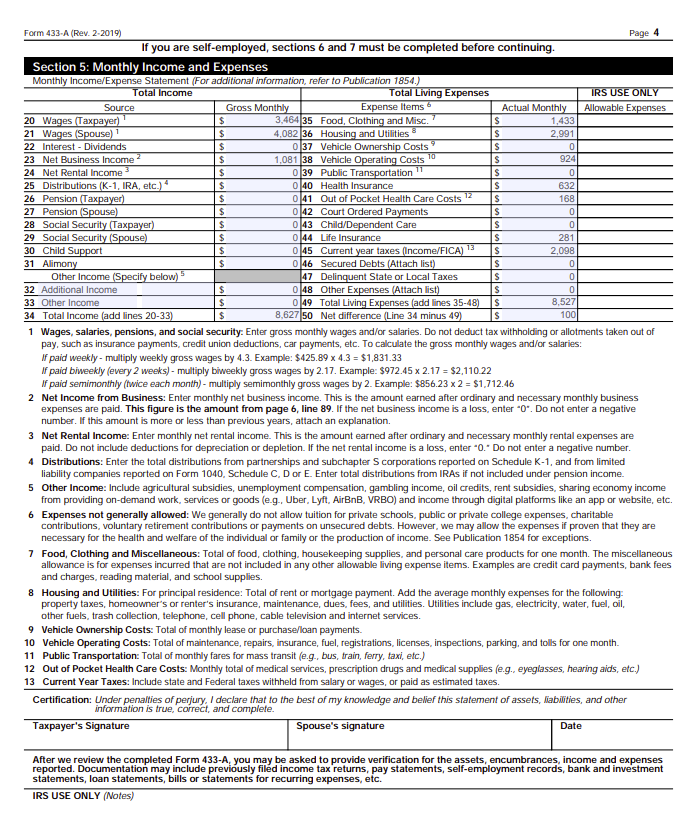

Step 2: What Are my Payment Options with Uncle Sam?

Once we stop the bleeding, we finally start to strategize a game plan. This is where we come in and do what we do best. There is no one-size-fits-all solution. We approach each individual tax problem with a unique and individual strategy, placing you in the best outcome possible. In assessing your financials, we first prioritize you and your family’s needs. Before you address your tax burden, we first need to make sure that you have food on your plate, a roof over your head, and you are able to pay all of your necessary living expenses such as;

- Food, Clothing and Other Items (Housekeeping supplies, Apparel & Services, Personal Care Products & Services, and other Miscellaneous,

- Out of Pocket Health Care, Health and Dental Insurance,

- Housing and Utility Expenses (Including Mortgage and Property Taxes),

- Local Standard Transportation Cost such as Car Ownership Costs, Operating Cost or Public Transportion.

This will allow us to see your ability to pay. Your ability to pay is the remaining disposable income after we take into account all of your necessary living expenses. Then, we will look into the following options:

Step 3: Installment Agreements:

An installment agreement is an IRS program that allows you to pay back your tax debt in monthly payments. We determine the monthly payment amount using your ability to pay. After taking into account your financial needs, the remaining amount is the disposable income and this amount is what is available to be used to pay back your tax debt. Even if your ability to pay is one-hundred dollars on a one-hundred thousand dollar tax debt, that can be your monthly IRS installment agreement. In order for an installment agreement to be accepted, though, you will need to be in compliance. This is why compliance is key - the IRS will not work with us unless you have followed the correct requirements.

You must evaluate other conditions as well. For instance:

- If you’re considered self-employed, you must be up-to-date on all your quarterly estimated tax payments for the year.

- Do you have equity in your assets? If you cannot access the equity, the IRS can't garnish it.

We need to evaluate your ability to pay, assets and safeguard what the IRS can garnish.

Don’t tackle your tax debt alone. Consult your local tax experts and save yourself the money, time, and energy needed to fight the IRS alone. Settle your tax debt and close this chapter. At MendozaCo we understand how stressful and possibly embarrassing this process can be.

Remember, this is what we do best! We are here for you and are determined to help.

Search

Categories

Recent Posts

-

23 Jan, 202322 Questions About 2022 Taxes

-

23 Jan, 2023Tax Updates for 2022

-

15 Dec, 2021Medical Expense Deductions

-

06 Oct, 2021The IRS Crackdown on Venmo, Zelle Payments

About Us

Mendoza & Company, Inc. is a full-service accounting, Payroll, and Tax Resolution firm in Bethesda, MD and Miami, FL. As a client, you gain a professional team with expertise in multiple fields, providing you the right advice to strengthens your organization and long-term goals.