Figuring out what is tax-deductible can be confusing for businesses. The requirements for meals deductions especially can be subjective, with broad specifications as to what is allowable and what is not. Luckily, in this article, we will be outlining how you and your business can make the most of the recent modifications to meals tax deductions.

The way businesses handle meals and entertainment deductions hasn’t changed much since the 2017 Tax Cuts and the Jobs Act permanently disallowed entertainment write-offs. However, as of 2020, the way businesses can write off meals has changed. In previous years, only 50% of restaurant meals were deductible. Now, meals can be 100% deductible if met by certain, specific requirements. In response to the pandemic, the Consolidated Appropriations Act was signed into law in December 2020 in an effort to temporarily help the struggling restaurant industry.

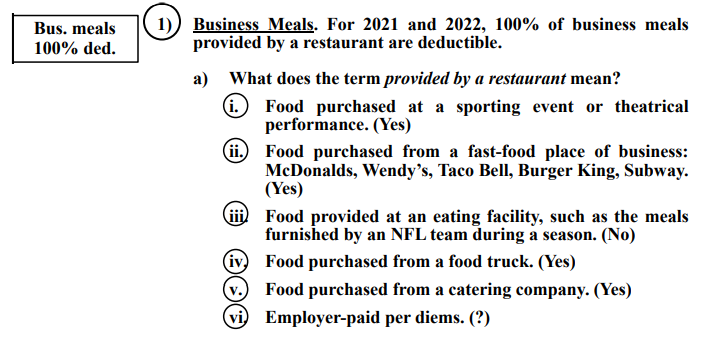

Now that deducting entertainment expenses is off the table, we should focus on what classifies a meal deduction. The IRS released Notice 2021-25 as guidance. Here is a quick summary of the notice:

- The Notice is effective from Dec. 31, 2020 to January 1, 2023.

- Food and beverages are 100% deductible if purchased from a restaurant within 2021 and 2022.

- Entertainment is no longer deductible under Section 274(a).

As mentioned above, it can be difficult to classify which expenses are deductible. You may have questions such as, “What if I cater food for my business?”, or “What are the limitations to deducting meals?”. According to the notice, no deduction is allowed for the expense of meals unless:

- The expense is not lavish or extravagant under the circumstances; and

- The taxpayer (or an employee of the taxpayer) is present at the furnishing of such food or beverages.

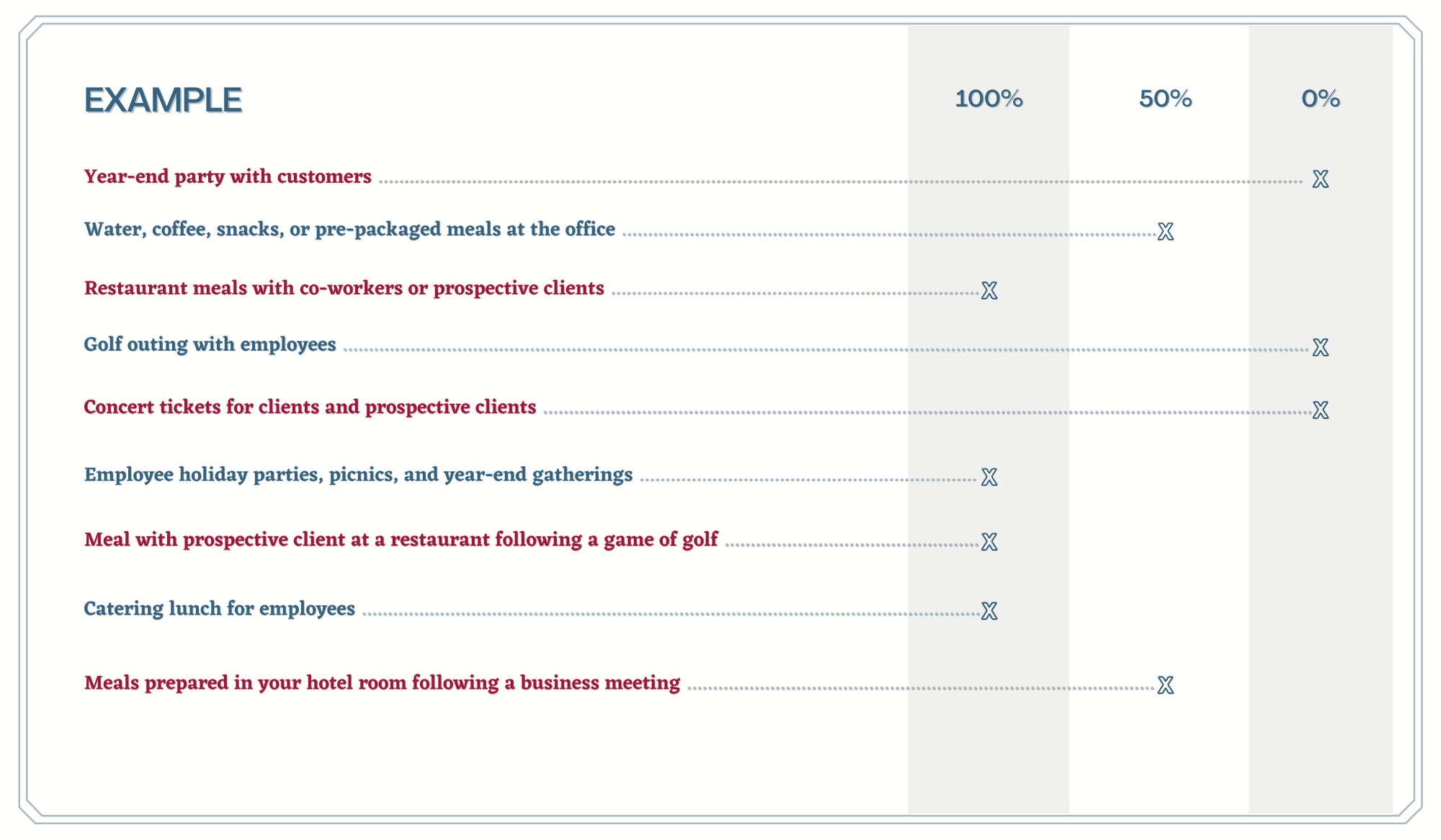

Team building activities, according to the tax code are “expenses for recreational, social, or similar activities (including facilities therefore) primarily for the benefit of employees'. This includes, but is not limited to, holiday parties, annual picnics, company retreats, and summer outings. Activities that are not deductible include sporting event tickets, concert tickets, and golfing, amongst others. Rather, these types of events are categorized as ‘entertainment’ by the IRS. However, it is important to note that food and beverages purchased separately from these ‘entertainment’ activities are still deductible.

As long as the meals are provided by a restaurant, they are 100% deductible. This also includes catering. The IRS defines "restaurants as a business that prepares and sells food or beverages to retail customers for immediate consumption, regardless of whether the food or beverages are consumed on the businesses’ premises”. Meals that are de minimis fringe benefits, cooked, or prepackaged, are now 50% deductible. That means, if your business provides meals in an in-house cafeteria, or if you prepare a cooked meal in your hotel room while traveling, you are still able to deduct 50%. So if you plan on treating your best client to lunch and a game of golf at the country club, make sure to separate your receipts in order to claim the 100% deduction for your meals.

Making sure you are up to date with your business’s record-keeping is going to be essential in itemizing your meal and entertainment deductibles. It is crucial that you accurately document and record your receipts. If not properly maintained, you may be faced with additional penalties and interest from the IRS in the event of an audit.

We understand that itemizing deductions isn’t always black and white. So, to help you distinguish what is, or is not deductible, we're including a free chart of examples found below. Sometimes, mistakes can happen when using even the best bookkeeping software. Consult your local tax advisor today to take advantage of this new, temporary tax rule.