What is a Partial Payment Installment Agreement (PPIA)?

The Partial Payment Installment Agreement (PPIA) is a monthly payment plan with the IRS that allows a Taxpayer to pay only a portion of their tax debt. Although the IRS can sometimes be willing to accept a partial payment, securing an agreement is only possible for those Taxpayers that qualify under certain guidelines. Within the Internal Revenue Manual, IRS Code section 6502 states that the IRS is limited to a ten-year collection authority on taxes due from the Taxpayer. This statute is called the Collection Statute Expiration Date or CSED. Starting from the day you filed your tax returns, the statute begins. Here, it becomes essential to file your tax returns on time. If you or your business have unsubmitted tax returns or have had tax returns prepared by the IRS, called Substitute for Returns (SFRs), the CSED will not begin until you file.

To better understand if you may be eligible for a PPIA, let's consider a few examples:

Example # 1: Taxpayer (Jane Smith) filed her 2012 Form 1040 tax returns on April 15, 2013, but never had a chance to pay the taxes due. Following IRS Code 6502, Jane's CSED for the 2012 tax return will expire on April 15, 2023. Before she knew it, her overall tax liability grew to $80,400, including principal, interest, and penalties. As of December 31, 2020, the CSED for her unpaid 2012 tax return will expire in 28 months. Jane consults a local tax resolution firm, and they determine that her monthly ability to pay is $100.00. With the PPIA payment plan, Jane will pay only $2,800 out of her $80,400 tax debt. The IRS CSED then writes off the remaining $77,600 balance.

Example # 2: The IRS prepared a Substitute for Return (SFR) on behalf of the Taxpayer (Billy Miller) for the 2012 tax year. His assessed tax liability is $80,400, including principal, interest, and penalties. The CSED for 2012 has not started, and the ten-year collection period moves forward, benefiting the IRS. In this scenario, Billy will not qualify for the PPIA since the IRS still has plenty of time to collect his debts. Instead of a PPIA, he may be eligible for a full-pay installment agreement (IA).

Like Jane, Billy's ability to pay is $100.00 monthly, but he has 120 months to pay his debt. Suppose Billy's PPIA offer is accepted. The IRS will grant him the agreement, but the IRS will reassess his ability to pay every two years. If Billy's financial situation were to improve, and his ability to pay has increased, the IRS will see this improvement and request an increased monthly payment. Two years later, during Billy's evaluation, they determined that his ability to pay increased to $1,000 monthly. Billy's new monthly payment will then be $1,000 for the remaining 78 months.

Like the full-pay installment agreement, PPIA and Offer In Compromise require the Taxpayer to be in compliance with the IRS. In order to be in compliance, The Taxpayer will need to have filed all tax returns or the last six-year minimum in certain cases. Regardless of whether a PPIA or Offer in Compromise is used, it is important to file your taxes and start the statute of collections. Haven’t filed taxes in years? Visit our blog post to learn more.

Knowing Your Rights - Be Informed

Most Taxpayers are not aware of their rights regarding the 10-year CSED when dealing directly with an IRS revenue officer (RO). Close to 100% of the time, taxpayers are pressured by the RO to sign a waiver, called Form 900, extending the CSED. In Example # 1 above, if Jane Smith signs a Form 900, the IRS would have gained the right to add 60 months or $6,000.00 to her bill. All when she was not required to sign the form in the first place. Don’t fall into this trap!

IRS Internal Revenue Manual (IRM 5.14.2.2.3(2)) clearly states “A waiver is no longer required to be secured when the taxpayer’s only ability to satisfy the tax liability after the CSED expiration is through a continuation of the installment agreement and there is no significant change in ability to pay as identified through the two-year financial review process”

AND confirmed in the following federal act;

The 2004 American Jobs Creation Act: I.R.C §6159(a) “A waiver is no longer required to be secured when the taxpayer’s only ability to satisfy the tax liability after the CSED expiration is through a continuation of the installment agreement and there is no significant change in ability to pay as identified through the two-year financial review process.”

What We Do!

Step 1: Evaluating your Financial Assets and Tax Compliance

For the IRS to accept your PPIA settlement, you must be in compliance. Without compliance, negotiating with the IRS will be very challenging. The IRS will not consider a full-pay installment agreement, PPIA, or an Offer in Compromise if you haven't filed your tax returns. We begin strategizing how to tackle your debt by first preparing unfiled tax returns and analyzing your asset's risks. The assets can include your bank account balances, cash value life insurance, 401ks, equity in your house, and your vehicle(s). If you do not have assets, that could be a good thing when dealing with the IRS.

Step 2: Statute of Limitations

A significant component of how the IRS will review your PPIA application is how close your tax debt is from the statute of limitations for collections ('CSED'). The IRS has only ten years to collect your debt, and once the ten-year statute of limitations has expired, the remaining debt balance is diminished. It is essential to know how much time you have left until your CSED comes into effect. A debt closer to the CSED will have a better chance of obtaining the PPIA than one with eight years left, for example. In the case that there are eight years until the CSED, it will be unlikely that the IRS will accept a PPIA as the IRS has plenty of time to collect your payment. In this case, the Taxpayer is most likely qualified to enter into an installment agreement rather than a PPIA based on the Taxpayer's ability to pay for the eight years.

Step 3: What is your ‘Ability to Pay’?

If the statute of limitations for collections is coming into effect, then the IRS only has a short period to collect as much as the law allows the IRS to collect from you. In example # 1, the Taxpayer's ability to pay is a $100 monthly payment for the PPIA; the IRS will have no choice but to accept the PPIA before they cannot collect within the CSED.

Example # 3

Let's consider a scenario where you have a tax debt of $150,000. You have the ability to pay $100 per month, and your financial condition is unlikely to change in the future, you have no assets besides your home which is worth $350,000 and the mortgage on your home is $200,000. The IRS sees that you have equity in your home and threatens to levy your property. You are in compliance but you are lacking funds to fully pay the tax liability. You tried to refinance the house and you’re unable to utilize the equity. In most cases, our clients have equity in their homes, but because their credit has been ruined by the IRS tax lien placed on the home, the bank will deny any form of refinancing. This is a good thing from a bad situation.

IRS IRM 5.14.2.2.2(2) Asset Equity and Partial Payment Installment Agreement “Asset Cases: A PPIA may be granted if a taxpayer does not sell or cannot borrow against assets with equity because: (b) the taxpayer is unable to utilize equity”

If the IRS is pressing for the available equity in your home, we will stop the IRS request by proving that you were unable to obtain financing from the bank. When the bank denies your request to refinance, this shows that you were unable to acquire the equity from your home, and ultimately, the IRS will not be able to seize the equity. Additionally, suppose the property is jointly owned and the non-liable spouse declines to go along with the attempt to borrow against the equity to pay the IRS. The spouse has the right to deny refinancing. Since the non-liable spouse has a right to deny refinancing, this will freeze the IRS from obtaining the equity.

Step 4: Stoping IRS Collections and Evaluating Options

Before we submit a PPIA, we will first analyze the Offer in Compromise (OIC) option. An OIC is a minimum amount you can pay and ‘settle’ with the IRS. In some special cases that we have handled, we could settle a tax debt for $1. However, not all cases are alike. This is the best-case-scenario. If you cannot pay the entirety of the debt and have a limited ability to pay, the IRS may grant an OIC. After you pay the agreed-upon amount, you will no longer be in tax debt!

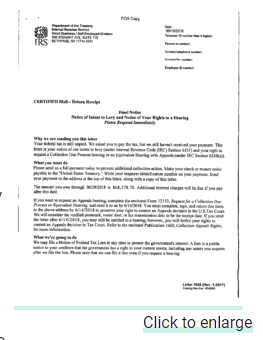

Example # 4 The IRS is knocking on your door with the “Final Notice – Notice of Intent to Levy and Notice of Your Rights to a Hearing” Letter 1058, but you only have 40 months remaining on your CSED - What steps should I take?:

|

1. Fax and Certified Mail “Request for a Collection Due Process or Equivalent Hearing” Form 12153 ASAP or within 30 days. This step is important. You don’t want to lose your appeal rights by not responding on-time. |

|

|

|

|

|

2. Compliance, Compliance, and Compliance – File unfiled tax returns, |

|

|

|

|

|

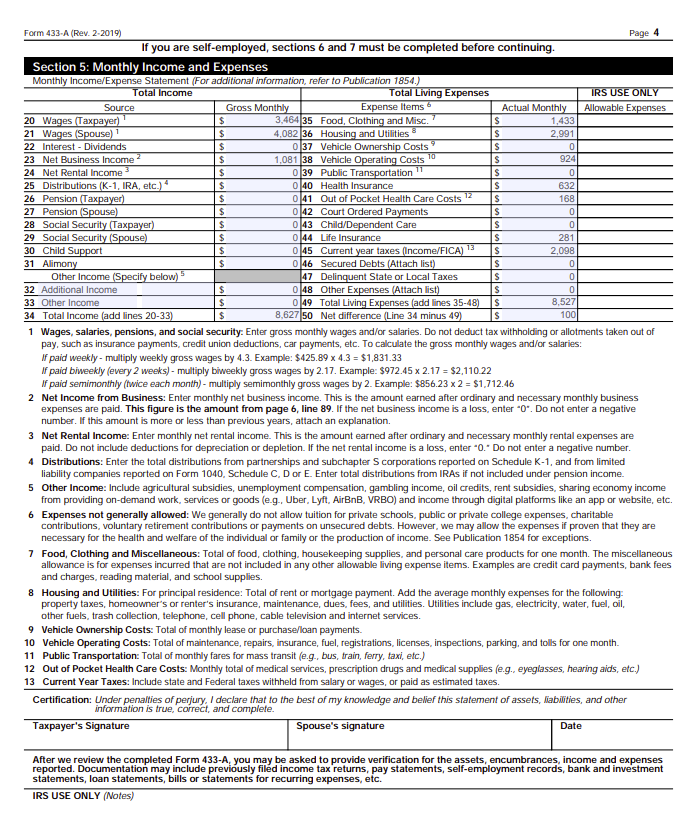

3. Here, we would prepare your financial statements to show the IRS that you are only able to pay $100 a month and demonstrate your financial condition is unlikely to change in the future. Like we had mentioned earlier, the IRS will try to take as much as they can get by collecting your tax debt. If the IRS sees that you are unable to pay your tax balance in full, they will grant your request for a PPIA. |

|

|

|

|

| 4. Instead of paying $150,000 of tax debt, you will only pay $100 for 40 months- so only $4,000! | |

PPIA's have a strict application process, and they are often the 'last resort’ for the IRS to collect your debts. As nice as only paying-off only a portion of your debt sounds, the IRS does not make obtaining this agreement easy. Not only does the taxpayer have to check all of the requirements, if the PPIA is granted, the taxpayer also consents to be financially re-evaluated every two years. This means that if the taxpayer’s financial situation were to improve, then they can be subject to an increase in their monthly payments.

PPIA is complicated, but not difficult to obtain if you qualify. The good news is that we are here to help. At Mendoza & Co, our tax experts will position your PPIA in the light most favorable to you and not the IRS. Every tax solution is different. Don’t wait and tackle the IRS on your own- schedule an appointment now!