Blog - Tax Related

Items filtered by date: March 2021

Updated Tax Filing Date 2021

In response to the pandemic, the IRS pushed the 2020 federal tax filing deadline. The Treasury moved the deadline from the expected date of April 15th to the following month, May 17th, 2021, to accommodate the “most vulnerable individuals” this tax season. For our DMV locals, Washington, D.C, Maryland, and Virginia have also adopted the filing day of May 17th.

There is significant confusion between the new filing deadline of May 17th and the first 2021 estimated quarterly tax deposit, which remains unchanged as April 15, 2021. Although the date to file has changed, the due date for estimated quarterly tax deposits has not. The 2021 estimated tax deposit applies to individuals owing more than $1,000 for income taxes for the year. For business owners, this means that the first-quarter estimated tax payments are still subject to the original estimated deposit date. Indeed, this can create some confusion.

Our recommendation at MendozaCo is to file the 2020 tax returns as soon as possible, and as for the 2021 estimated quarterly tax deposits to apply one of the “Safe Harbor” tests:

- 90% of the tax shown on the individual’s tax return for the current year (2021), or;

- 100% of the tax shown on the prior year’s return (2019) for adjusted gross income (AGI) less than $150,000 for married filing jointly (AGI less than $75,000 for single individuals) or;

- 110% if your previous year’s adjusted gross income was more than $150,000.

If you satisfy one of the three tests, you won’t have to pay the estimated tax penalty.

This tax season may be the most complicated yet. The unforeseen circumstances of the COVID-19 pandemic have brought both leniencies and more confusion into the equation. Starting sooner than later is the best way to avoid facing penalties or overpaying for your taxes- don’t wait until the last minute to file! Call MendozaCo to schedule an appointment today.

COVID Relief - 10% Penalty on Retirement Distribution

Have you withdrawn a portion of your retirement funds due to COVID-19 and are now stuck with paying the 10% early withdrawal penalty? As we know, the pandemic left millions of Americans in economic despair- so it seems unfair that people are still required to pay these penalties when the transfer was made out of necessity. Many people have found themselves in financial hardship and have resorted to taking out some of their retirement funds to stay afloat. Luckily, the IRS has released some recent guidance.

In the recent publishing of IRS Notice 2020-50, the IRS addressed coronavirus-related distributions within the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Here is the basic rundown of the benefits:

|

To qualify for assistance, the IRS requires an ‘acceptable self-certification’:

|

|

Learn how we turned Martha’s $22,000 tax liability into a tax refund:

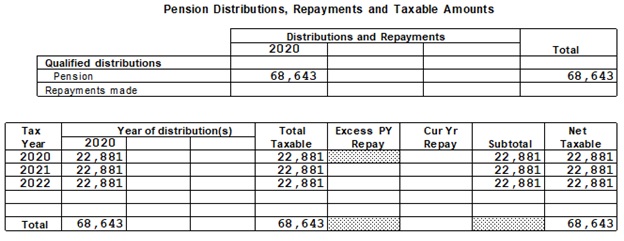

Martha came to us after she withdrew $68,643 from her pension plan. Since she distributed her funds before the mandated retirement age, she accrued $6,864 in penalties. On top of the penalties, there are also federal and state taxes, adding $16,000 to her overall bill. Before Martha came to us, she owed $22,864 in taxes and penalties.

Her husband's furlough from his job last August qualified the couple for relief. After consulting Alejandro, our EA and tax advisor, she was able to abate the $6,864 penalty entirely and split her withdrawal into three separate, taxable distributions. For the years 2020, 2021, and 2022, she will recognize $22,881 from her retirement plan. This way, Martha can meet her family's needs while paying only a fraction of what she owed in taxes. In the end, reducing her taxable income resulted in Martha receiving a tax refund for the 2020 tax year. Thanks to Alejandro, Martha went from being tens of thousands of dollars in debt to the IRS to have the IRS owe her money back during a time of need.

Don't let the pandemic pressure you to go into debt with the IRS. Consult Mendoza&Co today to see how we can work for your tax needs.

Search

Categories

Recent Posts

-

23 Jan, 202322 Questions About 2022 Taxes

-

23 Jan, 2023Tax Updates for 2022

-

15 Dec, 2021Medical Expense Deductions

-

06 Oct, 2021The IRS Crackdown on Venmo, Zelle Payments

About Us

Mendoza & Company, Inc. is a full-service accounting, Payroll, and Tax Resolution firm in Bethesda, MD and Miami, FL. As a client, you gain a professional team with expertise in multiple fields, providing you the right advice to strengthens your organization and long-term goals.