Blog - Tax Related

Items filtered by date: December 2018

Passport Alert – IRS Tax Debts May Revoke Your Passport

Owing more than $51,000.00 of taxes can stop your travel plans.

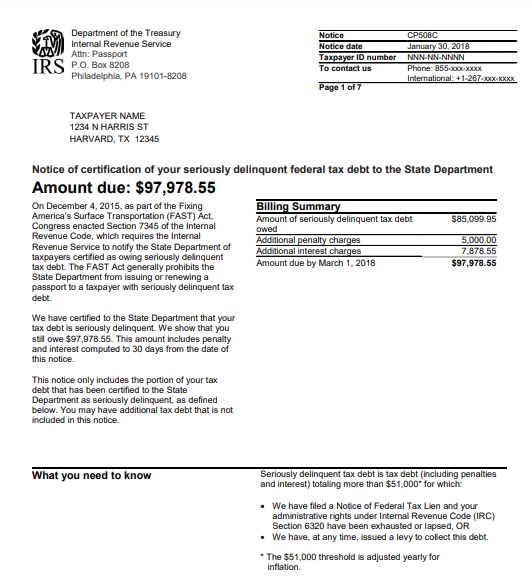

Beginning in 2018, The IRS started mailing to Taxpayers owing more than $51,000.00 a notice called "CP508C - Notice of Certification of your Seriously Delinquent federal tax debt to the State Department".

If you owe taxes over $51,000, the IRS may inform the State Department which can then revoke your passport. And you might not even know until you get to the airport.

"On December 4, 2015, as part of the Fixing America’s Surface Transportation (FAST) Act, Congress enacted Section IRC §7345 of the Internal Revenue Code, which requires the Internal Revenue Service to notify the State Department of taxpayers owing more than $51,000.00 and certifying the Taxpayer as “Seriously Delinquent. The FAST Act generally prohibits the State Department from issuing or renewing a passport to a Taxpayer with seriously delinquent tax debt. (per IRS)"

The IRS has the following power if you don’t act soon;

- Filed a Notice of Federal Tax Lien,

- Issued a levy to collect the debt to your employer or from your customers,

- If you apply for a passport or passport renewal, the State Department will deny your application,

- If you currently have a valid passport, the State Department may revoke your passport or limit your ability to travel outside the United States.

It is estimated that about 270,000 Taxpayers are about to receive Notice CP508C in 2019.

Step 1: What to Do?

- Give us a call,

- Request the IRS to provide the detail of accounting for the years and the balances under question. We will call on your behalf and request IRS “Account Transcripts.”

- Evaluate the Account Transcripts for missing payments and locate the canceled check(s) for account adjustments.

- Verify if the amount owed is correct.

Step 2: Propose a Viable Collection Alternative

- Stablish Installment agreement (IA). The installment agreement must be accepted with the IRS prior the passport revocation can be reversed.

- Offer in Compromise (OIC). Same as IA, it must be accepted.

- Request for an Innocent Spouse Relief. While the request is pending, reversal is available. IRC §6015(e)(1)(B) prohibits enforcement while the application is pending. If the debt is related to your spouse income or business and you did not participate in the business activity, Innocent Spouse Relief can be a good avenue for passport revocation reversal. The key is that the request does not need to be accepted by the service. It only needs to be pending.

Key Facts

Before denying a passport, the State Department will hold the application for 90 days to allow a citizen to:

Before denying a passport, the State Department will hold the application for 90 days to allow a citizen to:

- Resolve any erroneous assessment issues (Incorrect tax debts or identity theft matters)

- Make full payment of their debt,

- Enter into a satisfactory payment arrangement – IRM 5.1.12.27.7(6).

Reversal Certification under IRC §7345(c)

You have established a collection alternative with the IRS and accepted. The IRS must give notice to the State Department reversing the certification if:

- Certification is found to be erroneous,

- Debt is legally unenforceable,

- Debt is fully satisfied,

- Debt is no longer “seriously delinquent” per §7345(b),

- Installment Agreement is entered into,

- Offer in Compromise is accepted,

- Justice Department enters into a settlement agreement,

- Innocent Spouse Relief is requested.

Once the (IA) and (OIC) are accepted or Innocent Spouse Relief request is pending, the IRS will mail the “Reversal” notice to taxpayer CP508R and to the State Department.

If you have questions or concerns about the passport revocation, please call Mendoza, Silva & Company today!

We are here to help.

Search

Categories

Recent Posts

-

23 Jan, 202322 Questions About 2022 Taxes

-

23 Jan, 2023Tax Updates for 2022

-

15 Dec, 2021Medical Expense Deductions

-

06 Oct, 2021The IRS Crackdown on Venmo, Zelle Payments

About Us

Mendoza & Company, Inc. is a full-service accounting, Payroll, and Tax Resolution firm in Bethesda, MD and Miami, FL. As a client, you gain a professional team with expertise in multiple fields, providing you the right advice to strengthens your organization and long-term goals.