Blog - Tax Related

Items filtered by date: February 2018

2018 Luxury Auto Limits for Business Auto Deductions

Luxury Auto Limits for Business Autos

The 2018 tax bill increased the luxury auto depreciation deduction limits for the 1st, 2nd, 3rd and subsequent years with the year first increased to $10,000 and the second year to $16,000.

What is a Luxury Auto?

The IRS definition of a "luxury vehicle," is a four-wheeled vehicle regardless the cost of the vehicle, used mostly on public roads, and has an unloaded gross weight of no more than 6,000 pounds.

What is the Corporate Tax Savings?

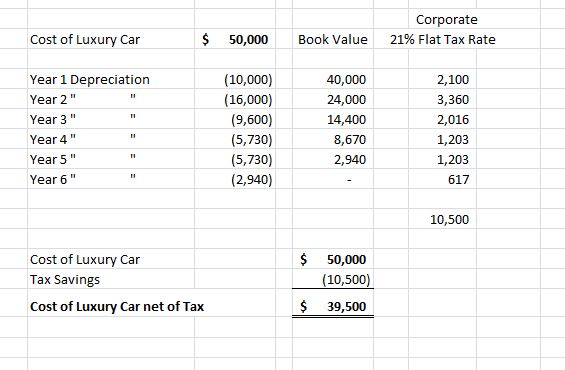

The most dramatic changes made by the 2018 Tax bill is on the corporate rate. For starters, the bill lowers the corporate tax rate to a flat 21% on all profits from 35% through January 1, 2026. This is not only a massive tax-cut, but is a major simplification as compared to the 2017 corporate tax rates. The flat 21% corporate tax change can save an entity up to $10,500.00 in corporate taxes for an auto costing $50,000.

Here is an example of a Luxury Auto costing $50,000 and put in services on January 1, 2018. Notice, the tax saving is $10,500 over five and half years and resulting in the actual cost to $39,500 net of corporate taxes.

If you have questions about your Luxury Auto tax saving for a corporation, please give this office a call at 301-962-1700.

H.R.1 - An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for the fiscal year 2018.

How to Save for a Child's College Education

Article Highlights:

- Planning for a Child’s College Education

- Tax-Favored Plans

- Tax-Free Earnings

- Coverdell Accounts

- Qualified Tuition Plans

- Have Others Contribute

- Gift Tax Issues

A frequently asked question is, “How might I save for a child’s college education?” The answer depends on how much education is expected to cost and how much time is left until the child heads off to college or university.

The amount of funds that will be required will depend upon whether your child will be attending a local college, attending a local college and then transferring to a university, or going straight to the university. If attending college locally, you generally only need to be concerned about tuition, and the child can live at home, whereas attending a university unless it is local, will add the cost of housing and food on top of substantially higher university tuition. Another factor is whether the student will leave school after obtaining a bachelor’s degree or will be doing graduate studies for an advanced degree.

When the time comes, your child may qualify for a scholarship or grant, but you can’t depend on that when working out a college savings plan.

The federal tax code has two beneficial savings plans that can be used. In both plans, there is no tax benefit to making any contributions. The benefit is that growth due to appreciation in investments if any, and earnings (dividends and interest) are tax-free when withdrawn for qualified education expenses. Thus, the sooner the plan is started, the better because it will have more years to grow in value.

More tax benefit is gained by front-loading the contributions and thus having a larger amount on which to compound the growth and earnings. You should also be aware that anyone, not just you, can make a contribution to the child’s college savings plans. So if your child has any well-heeled grandparents, other relatives or friends who would like to help, they can also contribute.

The two savings plans currently available for college savings are the Coverdell Education Savings Account and the Qualified Tuition Plan, most commonly referred to as a Sec. 529 Plan (529 denotes the section of the tax law code that governs it).

Coverdell Education Savings Account – This plan only allows up to $2,000 in contributions per year, and although it allows withdraws for kindergarten education and above, the contribution limitations generally rule it out as a practical method for college savings.

Sec 529 Plan – This approach is likely your best option. State-run Sec. 529 plan benefits are limited to postsecondary education, but they allow significantly larger amounts to be contributed; multiple people can each contribute up to the gift tax limit each year without being subjected to gift tax reporting. This limit is $15,000 for 2018. A special rule allows contributors to make up to five years of contributions in advance (for a total of $75,000 in 2018).

Sec. 529 plans allow taxpayers to put away larger amounts of money, limited only by the contributor’s gift tax concerns and the contribution limits of the intended plan. There are no limits on the number of contributors, and there are no income or age limitations. The maximum amount that can be contributed per beneficiary (the intended student) is based on the projected cost of college education and will vary between the states’ plans. Some states base their maximum on an in-state four-year education, but others use the cost of the most expensive schools in the U.S., including graduate studies. Most have limits in excess of $200,000, with some topping $370,000. Generally, additional contributions cannot be made once an account reaches that level, but that doesn’t prevent the account from continuing to grow.

When the time comes for college, the distributions will be part earnings/growth in value and part contributions. The contribution part is never taxable, and the earnings part is tax-free if used to pay for qualified college expenses. In addition, the portion of the distribution that represents the return on the contributions and is used for qualified education expenses qualifies for the American Opportunity Tax Credit, which can be as much as $2,500, provided your income level does not phase it out.

For additional details or assistance in planning for a child’s higher education, please give this office a call.

Using Online Agents to Rent Your Home Short Term?

You May Be Surprised at the Tax Ramifications

Article Highlights:

- Schedule C vs. Schedule E

- Rentals of Less Than15 Days

- Rentals of 7 Days or Less

- Rentals of 8 to 30 Days

- An exception to the 30-Day Rule

If you are among the many taxpayers renting your first or second home using rental agents or online rental services that match property owners with prospective renters, such as Airbnb, VRBO and HomeAway, then you should know the IRS has special rules related to short-term rentals.

When property is rented for short periods, special (and sometimes complex) taxation rules come into play, which can make the rents excludable from taxation; other situations may force the rental income and expenses to be reported on Schedule C (as opposed to Schedule E). If you have been renting your home or second home for short periods of time, here is a synopsis of the rules governing short-term rentals so you can prepare yourself for the upcoming tax season.

- Rented for Fewer Than 15 Days During the Year: If you rent your property for fewer than 15 days during the tax year, the rental income is not reportable, and the expenses associated with that rental are not deductible. However, interest and property taxes are still deductible as itemized deductions on your Schedule A.

- Rented for an Average of 7 Days or Less: Under normal circumstances, rentals are treated as passive activities, which are reported on a Schedule E, and net profit from the rental activity is not subject to self-employment tax. But the special rules treat short-term rentals averaging 7 days or less as a trade or business similar to that of a hotel or motel, with the income and expenses reported on Schedule C, and the profits are subject to both income tax and self-employment tax.

- Rented for an Average of 8 to 30 Days: Even rentals for longer than 7 days are treated as a trade or business when substantial personal services are provided to the short-term tenant. Substantial services are those that are primarily for your tenant's convenience, such as regular cleaning, changing linen, or maid service. Substantial services do not include the furnishing of heat and light, the cleaning of public areas, trash collection, and such.

When extraordinary services are provided, the rental is treated as a trade or business and reported on Schedule C regardless of the average rental period. However, it would be extremely rare for this to apply to short-term rentals of your home or second home.

- Exception to the Significant Services Rule – If the personal services provided are similar to those that generally are provided in connection with long-term rentals of high-grade commercial or residential real property (such as the cleaning of public areas and trash collection), and if the rental also includes maid and linen services at a cost of less than 10% of the rental fee, then the personal services are neither significant nor extraordinary for the purposes of the 30-day rule.

A loss from this type of activity, even when reported on your Schedule C as a trade or business, is still treated as a passive activity loss and can only be deducted against passive income. The $25,000 loss allowance that applies to some Schedule E rentals is not available for rental activities reportable on Schedule C.

It is important that you keep a record of not only the rental income from each tenant but also the duration of each rental, so the average rental term for the year can be determined. If you have questions about your rental activities, please give this office a call.

Search

Categories

Recent Posts

-

23 Jan, 202322 Questions About 2022 Taxes

-

23 Jan, 2023Tax Updates for 2022

-

15 Dec, 2021Medical Expense Deductions

-

06 Oct, 2021The IRS Crackdown on Venmo, Zelle Payments

About Us

Mendoza & Company, Inc. is a full-service accounting, Payroll, and Tax Resolution firm in Bethesda, MD and Miami, FL. As a client, you gain a professional team with expertise in multiple fields, providing you the right advice to strengthens your organization and long-term goals.