Blog - Tax Related

The New IRS Budget May Lead to More Audits

President Biden is proposing to increase IRS funding by $80 billion over the next ten years to aid in collecting taxes from America’s wealthiest individuals and businesses. The proposal aims to increase audits for individuals earning $400,000 or more in order to “ensure that the wealthy are paying their fair share” of taxes. The goal with the increase in funding is to generate $700 billion in revenue by the end of the decade. On the outside, it sounds like a good way to help fund the trillion dollars being allocated toward the infrastructure project. But, how can we make sure that the average American won’t increase their chances of being audited?

There is no debate that the IRS is severely underfunded, however. Even though counterintuitive, this can be a good thing from the perspective of our clients. From 2010 to 2020, the agency lost over 33,000 employees, with the number of millionaires nearly doubling during that same time period. With the increase in spending, the IRS will hire nearly 78,000 new employees over the next decade- with many delegated to tax enforcement and audit procedures. Although the goal of the agency is to decrease the levels of tax evasion among the wealthy Americans, there is no guarantee that the increase in spending will play out this way. The increase of new IRS employees will likely increase the cases of audits in Americans with an average income. With the additional employees, there will be an increase in audits overall, since new recruits have to gain experience in the audit field. In reality, the wealthier individuals and businesses have the resources for effective defense against audits, while the average citizen may not have the same resources to protect themselves from an audit- making the average American a likely target for upcoming audits.

It’s a common occurrence for the IRS to abuse their power and coerce individuals into paying more taxes than they owe. As a tax resolution firm, we see this very often. We often see audits where a client’s deductions are disputed, and the client ends up with a multi-thousand dollar bill. The occurrence of these scenarios don’t exclusively affect the ultra-wealthy. Individuals, and especially businesses, who do not have the means to have a bookkeeper or an accountant, face an increased chance of losing audits. In general, having proper documentation and representation to dispute audit allegations increases the likelihood of winning the audit. Hence why individuals and businesses with greater means are less likely to lose an audit. Newly hired IRS auditors, which will represent nearly half of IRS staff, likely won’t be handling these types of audits.

An increase in workers is going to increase the overall occurrence of audits- all around. Regardless of how much you or your business makes, you will have an increased chance of getting audited. So what should you do if you get a “notice of discrepancy” letter in the mail from the IRS? Don’t accept the proposal by simply paying the bill- no matter how small. If you are in compliance, provide the proper documentation, and dispute against the discrepancy. Otherwise, there will be a possibility of further investigations into previous years. That means more audits, and a larger bill. What might be a small proposal of discrepancy, can possibly grow into multiple years of audits.

Take for example our client, who had her business deductions dismissed by the IRS. In March 2019, she received the CP2000 letter claiming that she had a tax discrepancy of $11,000 from December 2016. With penalties and interest accumulating over the three years, the bill grew to $15,000. She is a classic example of the IRS chasing after regular Americans, not the ultra-wealthy. Our client only had a combined AGI of $90,000 with her husband. Her story is similar to what we see all the time: a new IRS agent conducted the audit, and misappropriated her rightful deductions, and now the taxpayer is faced with an inflated bill. After coming to us, we settled with the IRS and the agent conducting the audit, provided documentation, and eventually eliminated her proposed tax liability altogether. Not only did she win the audit, but she is also spared from any additional audits for previous years. With some help, she stopped the audit abuse at the hands of the IRS.

With the increase in IRS spending, please make sure that you or your business are in compliance with the agency. If you own a business, it is important that your business finances are well organized in the event of an audit. We recommend hiring a bookkeeper or accountant to help keep your business in compliance and increase your chances of success in winning an audit, if one were to ever occur. If you find yourself with a CP2000 letter, or notice of discrepancy letter, do not hesitate to reach out to your local tax professional. No matter how small the amount, it is important that you understand your rights.

2019 Tax Organizer - Maximize Your Deductions

Download a Tax Organizer Form-Fill-In PDFs for 2019 tax season

These Tax Organizers are designed to help you gather the tax information needed to prepare your personal income or business tax return for 2018. A Tax Organizer is a great tool to help you reduce your taxes or increase your tax refund.

Individuals

2018 Basic Organizer (4 Pages) –This organizer is suitable for clients that are not itemizing their deductions and DO NOT have rental property or self-employment expenses.

2018 Full Organizer (8 Pages) – This organizer includes the information included in the basic organizer, plus entries for itemized deductions, rental properties, and self-employment expenses.

Business

2018 Basic Organizer (4 Pages) – This organizer is suitable for clients with self-employment income, partnership income, and corporation income. (Schedule C, 1065 & 1120s)

We can help you file your tax returns. Schedule Online.

The following are examples of supporting documentation:

- Forms W-2 for wages, salaries, tips, and gambling winnings.

- All Forms 1099 for interest, dividends, retirement, miscellaneous income, social security, state or local refunds, etc.

- Form 1099B Brokerage statements showing investment transactions for stocks, bonds, options, etc.

- Schedule K-1 from partnerships, S-corporations, estates, and trusts.

- Statements supporting educational expenses, deductions or distributions, including any Forms 1098-T, 1098-E, or 1099-Q.

- All Forms 1095-A, 1095-B, and/or 1095-C related to health care coverage for the Premium Tax Credit.

- Statements supporting deductions for mortgage interest, taxes, and charitable contributions, including any Form 1098-Mort.

- Copies of closing statements regarding the sale or purchase of real property.

- Legal papers for adoption, divorce, or separation involving custody of your dependent children.

- Any tax notices sent to you by the IRS or other taxing authority.

- A copy of your income tax return from last year, if not prepared by Mendoza, Silva & Company.

Call us today at 301-962-1700.

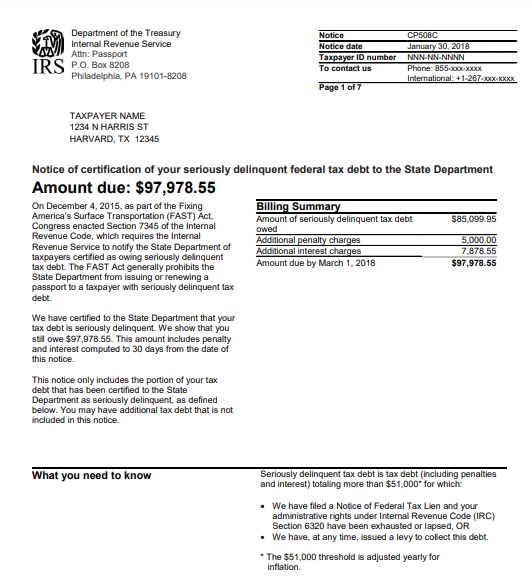

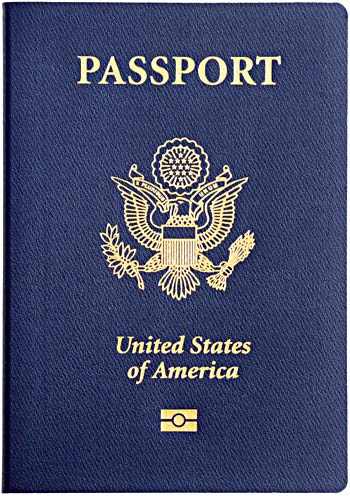

Passport Alert – IRS Tax Debts May Revoke Your Passport

Owing more than $51,000.00 of taxes can stop your travel plans.

Beginning in 2018, The IRS started mailing to Taxpayers owing more than $51,000.00 a notice called "CP508C - Notice of Certification of your Seriously Delinquent federal tax debt to the State Department".

If you owe taxes over $51,000, the IRS may inform the State Department which can then revoke your passport. And you might not even know until you get to the airport.

"On December 4, 2015, as part of the Fixing America’s Surface Transportation (FAST) Act, Congress enacted Section IRC §7345 of the Internal Revenue Code, which requires the Internal Revenue Service to notify the State Department of taxpayers owing more than $51,000.00 and certifying the Taxpayer as “Seriously Delinquent. The FAST Act generally prohibits the State Department from issuing or renewing a passport to a Taxpayer with seriously delinquent tax debt. (per IRS)"

The IRS has the following power if you don’t act soon;

- Filed a Notice of Federal Tax Lien,

- Issued a levy to collect the debt to your employer or from your customers,

- If you apply for a passport or passport renewal, the State Department will deny your application,

- If you currently have a valid passport, the State Department may revoke your passport or limit your ability to travel outside the United States.

It is estimated that about 270,000 Taxpayers are about to receive Notice CP508C in 2019.

Step 1: What to Do?

- Give us a call,

- Request the IRS to provide the detail of accounting for the years and the balances under question. We will call on your behalf and request IRS “Account Transcripts.”

- Evaluate the Account Transcripts for missing payments and locate the canceled check(s) for account adjustments.

- Verify if the amount owed is correct.

Step 2: Propose a Viable Collection Alternative

- Stablish Installment agreement (IA). The installment agreement must be accepted with the IRS prior the passport revocation can be reversed.

- Offer in Compromise (OIC). Same as IA, it must be accepted.

- Request for an Innocent Spouse Relief. While the request is pending, reversal is available. IRC §6015(e)(1)(B) prohibits enforcement while the application is pending. If the debt is related to your spouse income or business and you did not participate in the business activity, Innocent Spouse Relief can be a good avenue for passport revocation reversal. The key is that the request does not need to be accepted by the service. It only needs to be pending.

Key Facts

Before denying a passport, the State Department will hold the application for 90 days to allow a citizen to:

Before denying a passport, the State Department will hold the application for 90 days to allow a citizen to:

- Resolve any erroneous assessment issues (Incorrect tax debts or identity theft matters)

- Make full payment of their debt,

- Enter into a satisfactory payment arrangement – IRM 5.1.12.27.7(6).

Reversal Certification under IRC §7345(c)

You have established a collection alternative with the IRS and accepted. The IRS must give notice to the State Department reversing the certification if:

- Certification is found to be erroneous,

- Debt is legally unenforceable,

- Debt is fully satisfied,

- Debt is no longer “seriously delinquent” per §7345(b),

- Installment Agreement is entered into,

- Offer in Compromise is accepted,

- Justice Department enters into a settlement agreement,

- Innocent Spouse Relief is requested.

Once the (IA) and (OIC) are accepted or Innocent Spouse Relief request is pending, the IRS will mail the “Reversal” notice to taxpayer CP508R and to the State Department.

If you have questions or concerns about the passport revocation, please call Mendoza, Silva & Company today!

We are here to help.

2018 Child & Dependent Tax Credits

Increased to $2,000 in 2018

The child tax credit increases in 2018 to $2,000 (up from $1,000) with up to $1,400 being refundable. The earned income threshold is reduced to $2,500 (down from $3,000 in 2017) allowing more taxpayers to qualify for the credit. A child has to be under the age of 17 and have a valid Social Security number issued before the return due date to qualify for the credit.

In addition, a non-refundable tax credit of $500 is available for each non-child dependent that does not qualify for the child tax credit. The AGI thresholds at which the credit begins to phase out are substantially increased: to $400,000 for married filing jointly and $200,000 for all other taxpayers.

Using Online Agents to Rent Your Home Short Term?

You May Be Surprised at the Tax Ramifications

Article Highlights:

- Schedule C vs. Schedule E

- Rentals of Less Than15 Days

- Rentals of 7 Days or Less

- Rentals of 8 to 30 Days

- An exception to the 30-Day Rule

If you are among the many taxpayers renting your first or second home using rental agents or online rental services that match property owners with prospective renters, such as Airbnb, VRBO and HomeAway, then you should know the IRS has special rules related to short-term rentals.

When property is rented for short periods, special (and sometimes complex) taxation rules come into play, which can make the rents excludable from taxation; other situations may force the rental income and expenses to be reported on Schedule C (as opposed to Schedule E). If you have been renting your home or second home for short periods of time, here is a synopsis of the rules governing short-term rentals so you can prepare yourself for the upcoming tax season.

- Rented for Fewer Than 15 Days During the Year: If you rent your property for fewer than 15 days during the tax year, the rental income is not reportable, and the expenses associated with that rental are not deductible. However, interest and property taxes are still deductible as itemized deductions on your Schedule A.

- Rented for an Average of 7 Days or Less: Under normal circumstances, rentals are treated as passive activities, which are reported on a Schedule E, and net profit from the rental activity is not subject to self-employment tax. But the special rules treat short-term rentals averaging 7 days or less as a trade or business similar to that of a hotel or motel, with the income and expenses reported on Schedule C, and the profits are subject to both income tax and self-employment tax.

- Rented for an Average of 8 to 30 Days: Even rentals for longer than 7 days are treated as a trade or business when substantial personal services are provided to the short-term tenant. Substantial services are those that are primarily for your tenant's convenience, such as regular cleaning, changing linen, or maid service. Substantial services do not include the furnishing of heat and light, the cleaning of public areas, trash collection, and such.

When extraordinary services are provided, the rental is treated as a trade or business and reported on Schedule C regardless of the average rental period. However, it would be extremely rare for this to apply to short-term rentals of your home or second home.

- Exception to the Significant Services Rule – If the personal services provided are similar to those that generally are provided in connection with long-term rentals of high-grade commercial or residential real property (such as the cleaning of public areas and trash collection), and if the rental also includes maid and linen services at a cost of less than 10% of the rental fee, then the personal services are neither significant nor extraordinary for the purposes of the 30-day rule.

A loss from this type of activity, even when reported on your Schedule C as a trade or business, is still treated as a passive activity loss and can only be deducted against passive income. The $25,000 loss allowance that applies to some Schedule E rentals is not available for rental activities reportable on Schedule C.

It is important that you keep a record of not only the rental income from each tenant but also the duration of each rental, so the average rental term for the year can be determined. If you have questions about your rental activities, please give this office a call.

Reembolso de impuestos a nuevo residentes

El programa de radio se detalla sobre el reembolso de impuestos del IRS a familias que acaban de recibir su residencia “Green Card”. En lay fiscal existe la oportunidad a nuevos residentes recibir un reembolse de impuestos hasta $13,000 por familia. Para cualificar para esta oportunidad, el contribuyente debe de haber preparado impuestos por tres años antes de recibir la residencia. Durante los tres años del impuestos, el contribuyente por falta de el estatuss de residencia no calificaba para ciertos crédito y beneficios otorgados para residentes of ciudadanos. La ley fiscal le da la oportunidad para retroactivamente pedir los beneficios perdidos durante el periodo de no tener la residencia. Para más información llamamos para una consulta.

Tax Time Has Arrived! Are You Ready?

Article Highlights:

|

|

If you're like most taxpayers, you find yourself with an ominous stack of "homework" around TAX TIME! Pulling together the records for your tax appointment is never easy, but the effort usually pays off in the extra tax you save! When you arrive at your appointment fully prepared, you'll have more time to:

|

|

Choosing Your Best Alternatives - The tax law allows a variety of methods of handling income and deductions on your return. Choices you make as you prepare your return often affect not only the current year but future returns as well. Topics these choices relate to including:

- Sales of property - If you're receiving payments on a sales contract over a period of years, you can sometimes choose between reporting the whole gain in the year you sell or over a period of time as you receive payments from the buyer.

- Depreciation - You're able to deduct the cost of your investment in certain business properties. You can either depreciate the costs over a number of years; or, in certain cases, deduct them all in one year.

Where to Begin? Preparation for your tax appointment should begin in January. Right after the New Year, set up a safe storage location, such as a file drawer, cupboard, or safe. As you receive pertinent records, file them right away, before you forget or lose them. Make this a habit, and you'll find your job a lot easier on your appointment date. Other general suggestions to prepare for your appointment include:

- Segregate your records according to income and expense categories. File medical expense receipts in one envelope or folder, mortgage interest payment records in another, charitable donations in a third, etc. If you receive an organizer or questionnaire to complete before your appointment, fill out every section that applies to you. (Important: Read all explanations and follow instructions carefully. By design, organizers remind you of transactions you may otherwise miss.)

- Call attention to any foreign bank account, foreign financial account, or foreign trust in which you have an ownership interest, signature authority, or controlling stake. We also need to know about foreign inheritances and ownership of foreign assets. In short, bring any foreign financial dealings to our attention so we know if you have any special reporting requirements. The penalties for not making and submitting required reports can be severe.

- If you acquired your health insurance through a government Marketplace you will receive Form 1095-A, issued by the Marketplace that will include information needed to complete your return. In addition, you will need to provide proof of insurance to avoid a penalty or qualify for one of the many exemptions from the penalty. If you received a hardship penalty exemption from the Marketplace you will have been issued an exemption certificate number (ECN). That number must be included on your tax return. The 1095-A and ECN documentation need to be included with the other material you bring to your appointment. If your insurance coverage was through an employer, and the employer issued Form 1095-B, 1095-C or a substitute form detailing your coverage, bring it to the appointment.

- Keep your annual income statements separate from your other documents (e.g., W-2s from employers, 1099s from banks, stockbrokers, etc., and K-1s from partnerships). Be sure to take these documents to your appointment, including the instructions for K-1s!

- Write down questions so you don't forget to ask them at the appointment. Review last year's return. Compare your income on that return to your income in the current year. A dividend from ABC stock on your prior-year return may remind you that you sold ABC this year and need to report the sale, or that you haven't yet received the current year's 1099-DIV form.

- Make sure you have social security numbers for all your dependents. The IRS checks these carefully and can deny deductions and credits for returns filed without them.

- Compare deductions from last year with your records for this year. Did you forget anything?

- Collect any other documents and financial papers that you're puzzled about. Prepare to bring these to your appointment so you can ask about them.

Accuracy Even for Details - To ensure the greatest accuracy possible in all detail on your return, make sure you review personal data. Check name(s), address(es), social security number(s) and occupation(s) on last year's return. Note any changes for this year. Although your telephone numbers and e-mail address aren't required on your return, they are always helpful should questions occur during return preparation.

Marital Status Change - If your marital status changed during the year, if you lived apart from your spouse or if your spouse died during the year, list dates and details. Bring copies of prenuptial, legal separation, divorce or property settlement agreements, if any, to your appointment. If your spouse passed away during the year, you should have a copy of his or her trust agreement or will available for review.

Dependents - If you have qualifying dependents, you will need to provide the following for each (if you previously provided us with items 1 through 3 you will not need to supply them again):

|

|

For anyone other than your child to qualify as your dependent, they must pass five strict dependency tests. If you think one or more other individuals qualify as your dependents (but you aren't sure), tally the amounts you provided toward their support vs. the amounts they provided. This will simplify the final decision.

Some Transactions Deserve Special Treatment - Certain transactions require special treatment on your tax return. It's a good idea to invest a little extra preparation effort when you have had the following transactions:

- Sales of Stock or Other Property: All sales of stocks, bonds, securities, real estate and any other property need to be reported on your return, even if you had no profit or loss. List each sale, and have purchased and sale documents available for each transaction.

The purchase date, sale date, cost, and selling price must all be noted on your return. Make sure this information is contained in the documents you bring to your appointment. - Gifted or Inherited Property: If you sell the property that was given to you, you need to determine when and for how much the original owner purchased it. If you sell the property you inherited, you need to know the original owner's death-date and the property's value at that time. You may be able to find this on estate tax returns or in probate documents; otherwise, ask the executor.

- Reinvested Dividends: You may have sold stock or a mutual fund in which you participated in a dividend reinvestment program. If so, you will need to have records of each stock purchase made with the reinvested dividends.

- Sale of Home: The tax law provides special breaks for home sale gains, and you may be able to exclude up to $500,000 of the gain from your primary home if you file a married joint return and meet certain ownership, occupancy, and holding period requirements. The maximum exclusion is $250,000 for others. Since the cost of improvements made in your home can also be used to reduce any gain, it is good practice to keep a record of them. The exclusion of gain applies only to a primary residence; so keeping a record of improvement to other property, such as your second home, is important. Be sure to bring a copy of the sale documents (usually the closing escrow statement).

- Purchase of a Home: Be sure to bring a copy of the final closing escrow statement if you purchased a home.

- Vehicle Purchase: If you purchased a new plug-in electric car (or cars) this year, you may qualify for special credit. Please bring the purchase statement to the appointment with you.

- Home Energy-Related Expenditures: If you installed a solar-electric system on your home or second home, please bring the details of the purchase and manufacturer's credit qualification certification to your appointment. You may qualify for a substantial energy-related tax credit.

- Identity Theft: Identity theft is rampant and can impact your tax filings. If you have reason to believe that your identity has been stolen, please contact this firm as soon as possible. The IRS provides special procedures for filing if you have had your identity stolen.

- Car Expenses: Where you have used one or more automobiles for business, list the expenses of each separately. The government requires your total mileage, business miles, and commuting miles for each business use of your car to be reported on your return, so be prepared to have those numbers available. If you were reimbursed for mileage through an employer, know the reimbursement amount and whether it is included in your W-2.

- Charitable Donations: You must substantiate cash contributions (regardless of amount) with a bank record or written communication from the charity showing the name of the charitable organization, date and amount.

Unreceipted cash donations put into a "Christmas kettle," church collection plate, etc., are not deductible. For clothing and household contributions, items donated must generally be in good or better condition, and items such as undergarments and socks are not deductible. You must keep a record of each item contributed that indicates the name and address of the charity, date, and location of the contribution, and a reasonable description of the property. Contributions valued under $250 and dropped at an unattended location do not require a receipt. For contributions above $500, the record must also include when and how the property was acquired and your cost basis in the property. For contributions above $5,000 and other types of contributions, please call this office for additional requirements.

If you have questions about assembling your tax data prior to your appointment, please give this office a call.

How Small Businesses Write Off Equipment Purchases

Article Highlights:

|

|

From time to time, the owner of a small business will purchase equipment, office furnishings, vehicles, computer systems, and other items for use in the business. How to deduct the cost for tax purposes is not always an easy decision because there are a number of options available, and the decision will depend upon whether a big deduction is needed for the acquisition year or more benefit can be obtained by deducting the expense over a number of years using depreciation. The following are the write-off options currently available.

- Depreciation – Depreciation is the normal accounting way of writing off business capital purchases by spreading the deduction of the cost over several years. The IRS regulations specify the number of years for the write-off based on established asset categories, and generally for small business purchases the categories include 3-, 5- or 7-year write-offs. The 5-year category includes autos, small trucks, computers, copiers, and certain technological and research equipment, while the 7-year category includes office fixtures, furniture, and equipment.

- Material & Supply Expensing – IRS regulations allow certain materials and supplies that cost $200 or less, or that have a useful life of less than one year, to be expensed (deducted fully in one year) rather than depreciated.

- De Minimis Safe Harbor Expensing – IRS regulations also allow small businesses to expense up to $2,500 of equipment purchases. The limit applies per item or per invoice, providing a substantial leeway in expensing purchases. The $2,500 limit is increased to $5,000 for businesses that have an applicable financial statement, generally large businesses.

- Routine Maintenance – IRS regulations allow a deduction for expenditures used to keep a unit of property in the operating condition where the business expects to perform the maintenance twice during the class life of the property. Class life is different than a depreciable life.

Depreciable Item Class Life Depreciable Life Office Furnishings 10 7 Information Systems 6 5 Computers 6 5 Autos & Taxis 3 5 Light Trucks 4 5 Heavy Trucks 6 5 - Unlimited Expensing – The Tax Cuts and Jobs Act passed in December 2017 includes a provision allowing 100% unlimited expensing of tangible business assets (except structures) acquired after September 27, 2017, and through 2022. Applies when a taxpayer first uses the asset (can be new or used property).

- Bonus Depreciation – The tax code provides for a first-year bonus depreciation that allows a business to deduct 50% of the cost of the newest tangible property if it is placed in service during 2017. The remaining cost is deducted over the asset's depreciable life. The 50% rate applies for new property placed in service prior to September 28, 2017, and, by-election, to new or used property, acquired and first put into use by the taxpayer after September 27, 2017, and before December 31, 2017.

- Sec 179 Expensing – Another option provided by the tax code is an expensing provision for small businesses that allows a certain amount of the cost of tangible equipment purchases to be expensed in the year the property is first placed into business service. This tax provision is commonly referred to as Sec. 179 expensing, named after the tax code section that sanctions it. The expensing is limited to an annual inflation-adjusted amount, which is $510,000 for 2017 and $1 million for 2018. To ensure that this provision is limited to small businesses, whenever a business has purchases of property eligible for Sec 179 treatment that exceeds the year's investment limit ($2,030,000 for 2017 and $2.5 million for 2018), the annual expensing allowance is reduced by one dollar for each dollar the investment limit is exceeded.

An undesirable consequence of using Sec. 179 expensing occurs when the item is disposed of before the end of its normal depreciable life. In that case, the difference between normal depreciation and the Sec. 179 deduction is recaptured and added to income in the year of disposition. - Mixing Methods – A mixture of Sec. 179 expensing, bonus depreciation and regular depreciation can be used on a specific item, allowing just about any amount of write-off for the year for that asset.

For some individual taxpayers, the alternative minimum tax (AMT) may be a concern. Bonus depreciation and Sec. 179 expensing are not preference items, and therefore their use will not trigger an AMT add-on tax. However, the difference between 200% MACRS depreciation, if claimed, and 150% MACRS depreciation is a preference item for AMT and could cause or add to the AMT tax

Maximize Your Tax Refunds with Our Checklist and Organizers

Tax Season is Here. We can help you with your tax preparation. Call us and schedule an appointment today! .....

Open Monday through Friday 9-7pm and Saturdays from 9-6pm. Our professionals are licensed and in good standing with Maryland Department of Licenses and Regulations.

You will need the following personal information to do your taxes;

|

|

Tax Documents for the current year;

|

|

Before you begin to organize your documents download the attached organizers to help you maximize your refund.

New Tax Changes on Home Mortgage Interest

Tags: Home and Mortgage, Tax Planning

Article Highlights:

|

|

Note: The is one of a series of articles explaining how the various tax changes made by the GOP's Tax Cuts & Jobs Act (referred to as the "Act" in the article), passed late in December 2017, might affect you and your family in 2018 and future years, and offering strategies you might employ to reduce your tax liability under the new tax laws.

For years, taxpayers have been able to deduct home mortgage interest on their primary and second homes as an itemized deduction, subject to certain limitations. The interest deduction was limited to the interest on up to $1 million of acquisition debt and $100,000 of equity debt.

Acquisition debt is the debt incurred to purchase, construct or substantially improve a taxpayer's principal or second home. So when you purchased your home, that original loan was acquisition debt, and if you later borrowed additional money that you used to add a room, pool, etc., that loan was also acquisition debt. However, if the total of all of your acquisition loans exceeded the $1 million limit, then the interest on the excess debt over $1 million was not deductible as acquisition debt interest.

Consumer debt interest, such as interest on auto loans and credit card debt, is not deductible as an itemized deduction. However, years ago, Congress allowed homeowners to deduct the interest on up to $100,000 of equity debt. This allowed homeowners to use the equity in their homes for any purpose and deduct the interest on the equity debt as an itemized deduction.

Well, That Has All Changed. For 2018 through 2025, the new tax law reduces the $1 million limit on home acquisition debt to $750,000 ($375,000 for married separate filers), except that the lower limit won't apply to indebtedness incurred before December 15, 2017. That is, the $1M cap continues to apply to acquisition mortgages on primary and second residences that were already in existence prior to December 15, 2017, as well as for taxpayers who entered into a binding written contract before that date to close on the purchase of a principal residence before January 1, 2018, and who purchase that residence before April 1, 2018.

The Equity Debt Interest Deduction Is No More – Congress has yanked the rug out from under those with equity debt on their homes. Beginning in 2018, interest paid on equity debt will no longer be allowed as a deduction, regardless of when the debt was incurred.

This seems a little unfair and can have an adverse impact on individuals who used their home as a piggy bank for personal expense purposes.

Whether any of this makes any difference in light of the new higher standard deduction amounts for 2018, and whether you should be looking for ways to pay down the equity debt, will depend upon the amounts of your other itemized deductions. Please call this office if you have any questions.

Search

Categories

Recent Posts

-

23 Jan, 202322 Questions About 2022 Taxes

-

23 Jan, 2023Tax Updates for 2022

-

15 Dec, 2021Medical Expense Deductions

-

06 Oct, 2021The IRS Crackdown on Venmo, Zelle Payments

About Us

Mendoza & Company, Inc. is a full-service accounting, Payroll, and Tax Resolution firm in Bethesda, MD and Miami, FL. As a client, you gain a professional team with expertise in multiple fields, providing you the right advice to strengthens your organization and long-term goals.