Have you withdrawn a portion of your retirement funds due to COVID-19 and are now stuck with paying the 10% early withdrawal penalty? As we know, the pandemic left millions of Americans in economic despair- so it seems unfair that people are still required to pay these penalties when the transfer was made out of necessity. Many people have found themselves in financial hardship and have resorted to taking out some of their retirement funds to stay afloat. Luckily, the IRS has released some recent guidance.

In the recent publishing of IRS Notice 2020-50, the IRS addressed coronavirus-related distributions within the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Here is the basic rundown of the benefits:

|

To qualify for assistance, the IRS requires an ‘acceptable self-certification’:

|

|

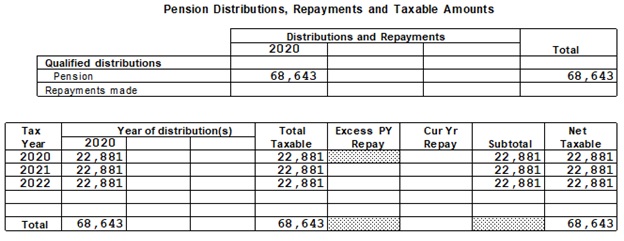

Learn how we turned Martha’s $22,000 tax liability into a tax refund:

Martha came to us after she withdrew $68,643 from her pension plan. Since she distributed her funds before the mandated retirement age, she accrued $6,864 in penalties. On top of the penalties, there are also federal and state taxes, adding $16,000 to her overall bill. Before Martha came to us, she owed $22,864 in taxes and penalties.

Her husband's furlough from his job last August qualified the couple for relief. After consulting Alejandro, our EA and tax advisor, she was able to abate the $6,864 penalty entirely and split her withdrawal into three separate, taxable distributions. For the years 2020, 2021, and 2022, she will recognize $22,881 from her retirement plan. This way, Martha can meet her family's needs while paying only a fraction of what she owed in taxes. In the end, reducing her taxable income resulted in Martha receiving a tax refund for the 2020 tax year. Thanks to Alejandro, Martha went from being tens of thousands of dollars in debt to the IRS to have the IRS owe her money back during a time of need.

Don't let the pandemic pressure you to go into debt with the IRS. Consult Mendoza&Co today to see how we can work for your tax needs.