Watch out for IRS CP2000 letters! It has come to our attention that we are receiving several calls regarding taxpayers receiving CP2000 letters from the IRS proposing corrections to their tax returns. If you have complicated tax returns, multiple streams of income, or you filed your taxes on your own, there is a chance you may receive a letter from the IRS claiming that you pay additional taxes.

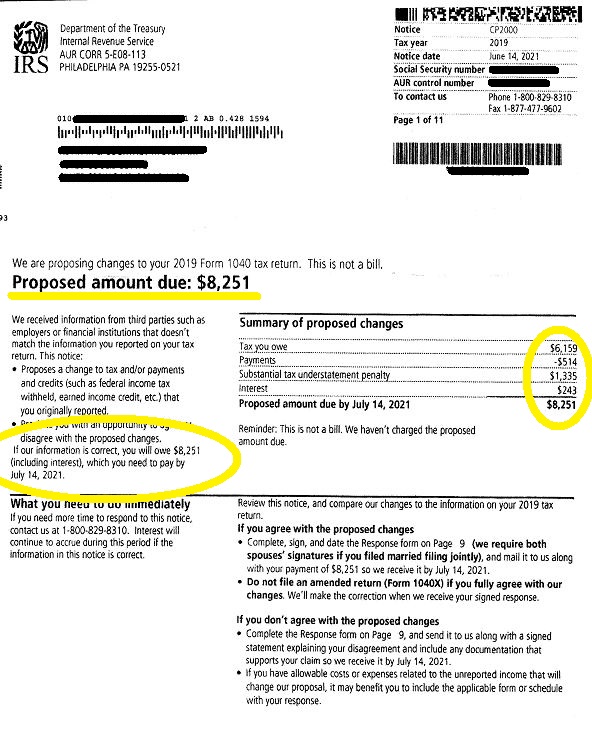

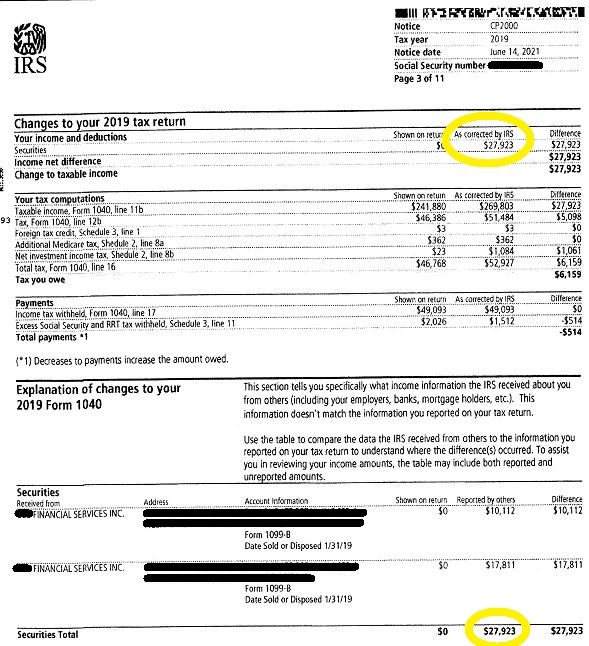

In 2019, before our client was engaged with us, our client filed her tax return using a free tax-filing software. There, she did as anyone else would: she input all of her revenue streams, calculated her taxes, and paid- all on time. She did as she was supposed to. What she didn’t realize, however, is that she forgot to include the sale of a stock that she had made earlier last year. During that time, the IRS was receiving her investment information from the financial institutions she had an activity with, and noticed that she did not report the stock sale. The discrepancy between the IRS tax calculations and her’s, prompted the IRS to send a CP2000 letter. Over two years later, in June of 2021, she finally receives the letter in the mail.

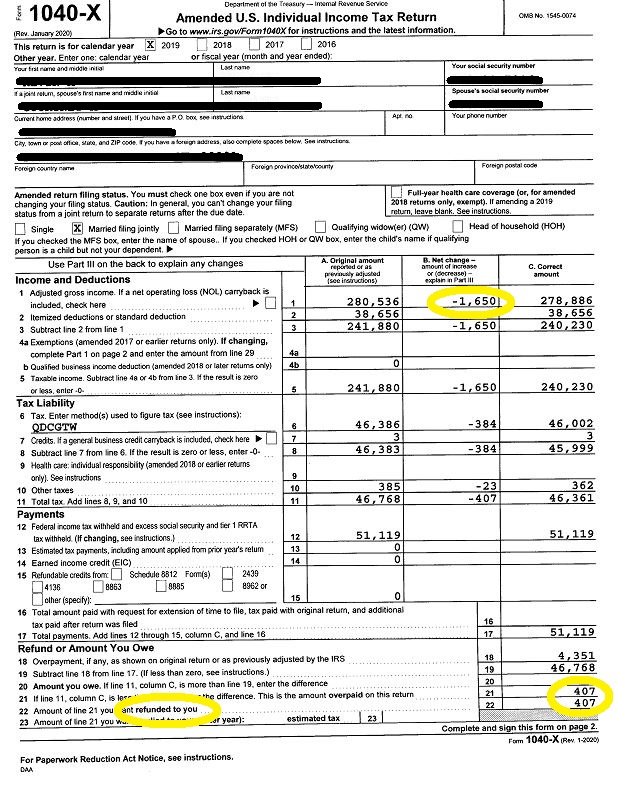

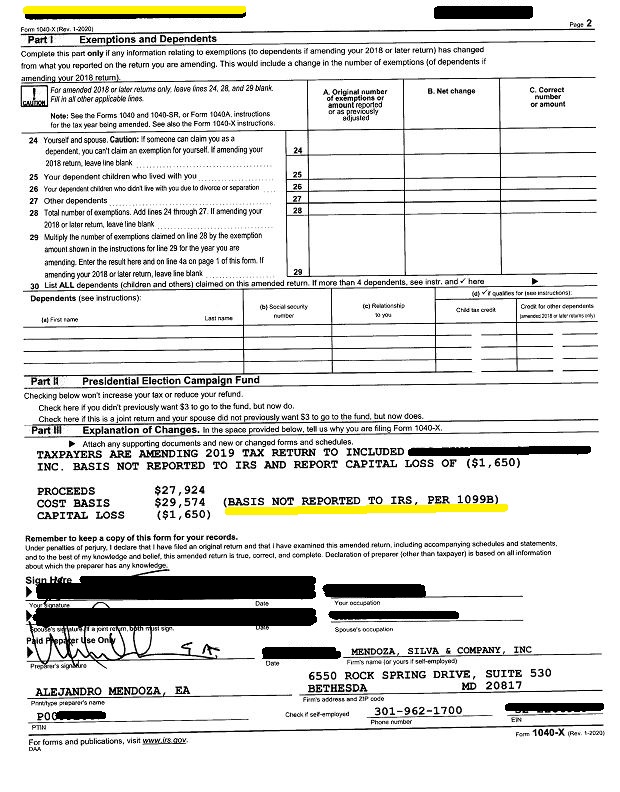

After reviewing the letter with the client, we asked her to send us a copy of her 2019 Investment Activity Summary. The first thing we thought to ask was, “did the IRS include her cost basis in their calculation?”. As we came to find out, as eager as the IRS was to send her a proposed tax bill, they were not nearly as eager to check her 1099B form to account for the stock’s cost basis. Although the stock was sold for $27,000, she had purchased it for $2,000 more than what she had sold it for. The stock was sold at a loss. We promptly amended her 2019 tax return, and our client left with a refund of $407.00 plus a refund from Maryland.

The key takeaway from this is in the event you receive a CP2000 letter, to have it reviewed by a tax professional. Sometimes, when using a free tax-filing software, mistakes can happen. The unfortunate fact is that there is more room for error, and you may end up paying more in taxes than you would if you had directly paid a tax professional to correctly file your taxes. If you have business income, foreign income, investments, capital gains income, rental income, or real estate income, consider Mendoza&Company, Inc. for your tax needs.

Our results in response to IRS CP2000: At the start the client owed the IRS $8251.00, but by the end, they left with $407.00 in their pocket.