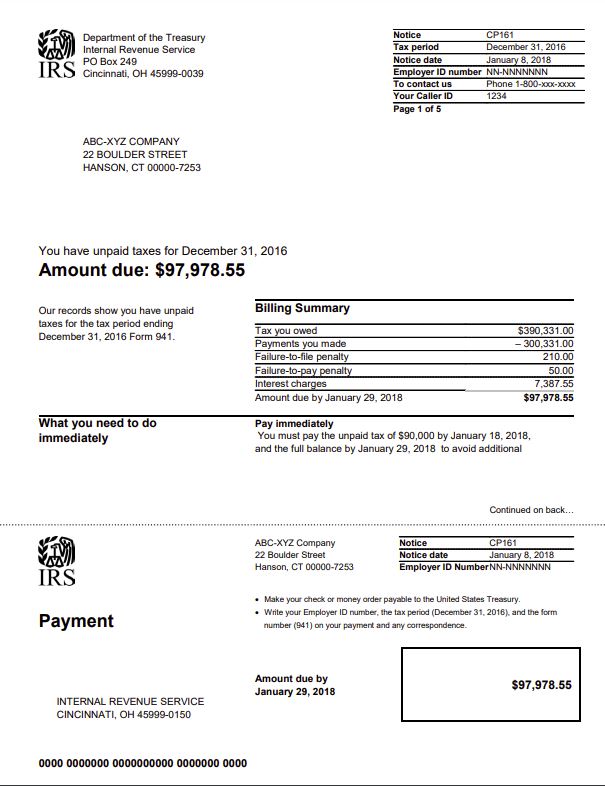

Many people don’t think twice about sending a check to the IRS to pay off their tax liability. They write the check, send it to the IRS, the check will clear, and they go about their day. That is until the IRS sends them a notice of intent to levy several months later, claiming that the debt was never paid off. The check could be cleared, the money could be taken out of your checking account, but the IRS can still claim that you owe a debt. But, this would be at no fault of your own. Sometimes the IRS will take payments and apply them to balances at their own discretion, even though you logically expect the payment to be applied to your debt. Now you are faced with additional penalties and interest, and the IRS is threatening to levy your property.

Aside from online payment, using a regular check from your normal bank account is the most simple method for the IRS to locate your payment. Each canceled check comes with an endorsement stamp when it is processed by the IRS. The endorsement will include an IRS confirmation number and where the payment was deposited. A stamped endorsement on the check is essential if you come to find out whether the IRS has misallocated your payment. At times, the IRS can make a mistake and deposit the payment into accounts belonging to the wrong SSN entirely. IRS employees can accidentally mix up the numbers while entering them. Although unlikely, it is often due to simple human error. More common are the cases where the payments are applied to current tax liabilities instead of previous debts. Without specifying the tax year, the IRS will use their own discretion and often designate the payment to the most recent tax year. The older liability will continue to accrue penalties and interest during that time and the debt will continue to grow larger, unbeknownst to the taxpayer.

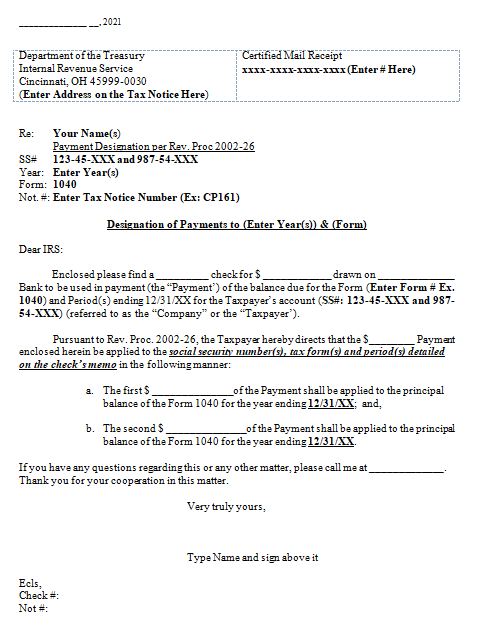

Here at MendozaCo, we formulated a reliable method of ensuring that your payment to the IRS goes to the right place. We went over the first step of the process: the importance of sending a check from your bank account. On the check, you should provide your SSN, the year of the liability in which you are paying, and the form you are addressing. We understand it can be uncomfortable to include sensitive details like your SSN on a check, but it is a crucial step in getting the check to the right place. For every check we send on behalf of our clients, we also attach a certified letter. The letter includes the name or person of reference, the purpose of the letter, the form, SSN, the year being paid, and a tax notice number if applicable.

Not sure how to write your certified letter? No problem! We are giving out a complementary template letter free of charge. It’s simple- just click here: Designation Letter Template and fill in the blanks. Now you will have everything you need to securely pay your debt and avoid additional letters or fees from the IRS.

**Note: All opinions discussed in this blog are for general informational purposes only. The contents of Mendoza & Company blog posts are not intended to, and shall not be construed as, provide specific legal, financial, or tax advice. The contents expressed by Mendoza & Company are from the personal research and experience of the owner of the site and are intended as educational material. We encourage you to seek professional advice on the complementary templates.