Blog - Tax Related

Watch Out for IRS CP2000

Written by Marina Stolbovaia & Alejandro MendozaWatch out for IRS CP2000 letters! It has come to our attention that we are receiving several calls regarding taxpayers receiving CP2000 letters from the IRS proposing corrections to their tax returns. If you have complicated tax returns, multiple streams of income, or you filed your taxes on your own, there is a chance you may receive a letter from the IRS claiming that you pay additional taxes.

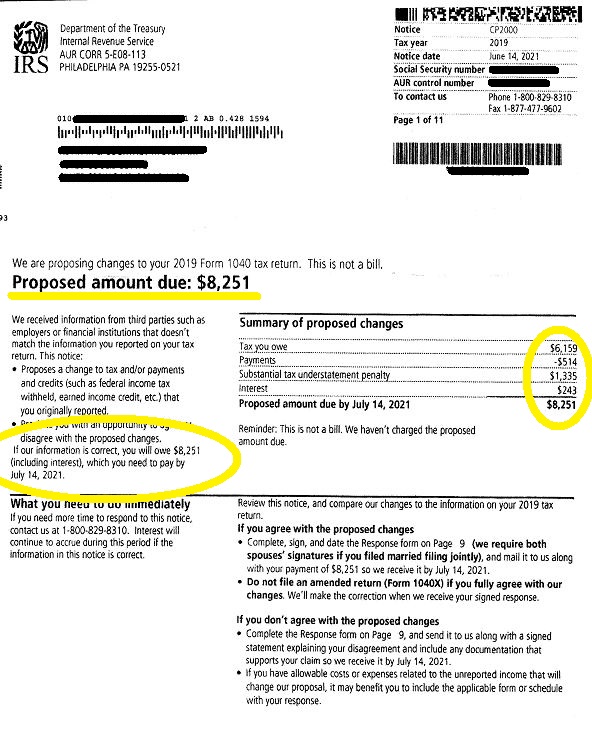

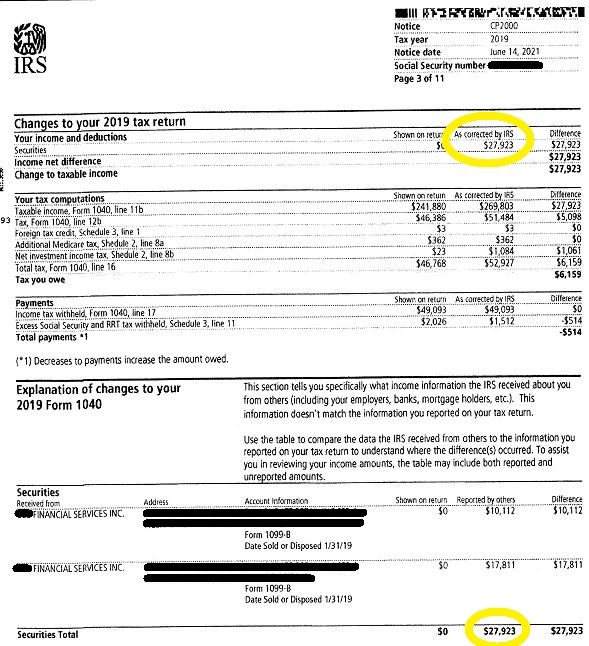

In 2019, before our client was engaged with us, our client filed her tax return using a free tax-filing software. There, she did as anyone else would: she input all of her revenue streams, calculated her taxes, and paid- all on time. She did as she was supposed to. What she didn’t realize, however, is that she forgot to include the sale of a stock that she had made earlier last year. During that time, the IRS was receiving her investment information from the financial institutions she had an activity with, and noticed that she did not report the stock sale. The discrepancy between the IRS tax calculations and her’s, prompted the IRS to send a CP2000 letter. Over two years later, in June of 2021, she finally receives the letter in the mail.

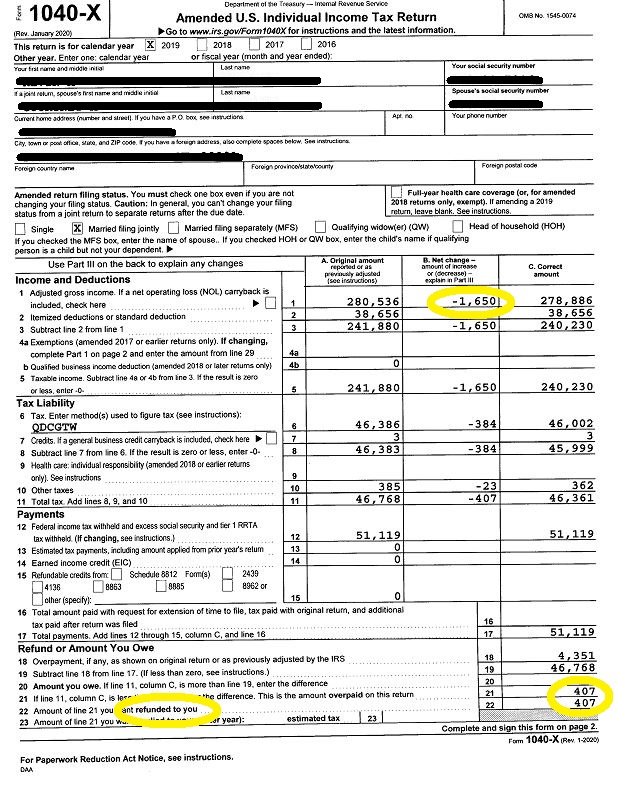

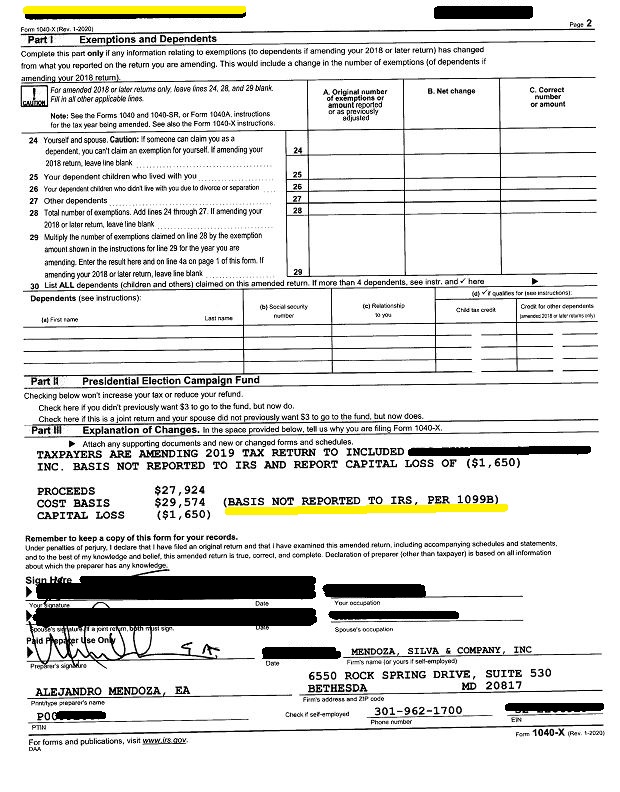

After reviewing the letter with the client, we asked her to send us a copy of her 2019 Investment Activity Summary. The first thing we thought to ask was, “did the IRS include her cost basis in their calculation?”. As we came to find out, as eager as the IRS was to send her a proposed tax bill, they were not nearly as eager to check her 1099B form to account for the stock’s cost basis. Although the stock was sold for $27,000, she had purchased it for $2,000 more than what she had sold it for. The stock was sold at a loss. We promptly amended her 2019 tax return, and our client left with a refund of $407.00 plus a refund from Maryland.

The key takeaway from this is in the event you receive a CP2000 letter, to have it reviewed by a tax professional. Sometimes, when using a free tax-filing software, mistakes can happen. The unfortunate fact is that there is more room for error, and you may end up paying more in taxes than you would if you had directly paid a tax professional to correctly file your taxes. If you have business income, foreign income, investments, capital gains income, rental income, or real estate income, consider Mendoza&Company, Inc. for your tax needs.

Our results in response to IRS CP2000: At the start the client owed the IRS $8251.00, but by the end, they left with $407.00 in their pocket.

The New IRS Budget May Lead to More Audits

Written by Marina Stolbovaia & Alejandro MendozaPresident Biden is proposing to increase IRS funding by $80 billion over the next ten years to aid in collecting taxes from America’s wealthiest individuals and businesses. The proposal aims to increase audits for individuals earning $400,000 or more in order to “ensure that the wealthy are paying their fair share” of taxes. The goal with the increase in funding is to generate $700 billion in revenue by the end of the decade. On the outside, it sounds like a good way to help fund the trillion dollars being allocated toward the infrastructure project. But, how can we make sure that the average American won’t increase their chances of being audited?

There is no debate that the IRS is severely underfunded, however. Even though counterintuitive, this can be a good thing from the perspective of our clients. From 2010 to 2020, the agency lost over 33,000 employees, with the number of millionaires nearly doubling during that same time period. With the increase in spending, the IRS will hire nearly 78,000 new employees over the next decade- with many delegated to tax enforcement and audit procedures. Although the goal of the agency is to decrease the levels of tax evasion among the wealthy Americans, there is no guarantee that the increase in spending will play out this way. The increase of new IRS employees will likely increase the cases of audits in Americans with an average income. With the additional employees, there will be an increase in audits overall, since new recruits have to gain experience in the audit field. In reality, the wealthier individuals and businesses have the resources for effective defense against audits, while the average citizen may not have the same resources to protect themselves from an audit- making the average American a likely target for upcoming audits.

It’s a common occurrence for the IRS to abuse their power and coerce individuals into paying more taxes than they owe. As a tax resolution firm, we see this very often. We often see audits where a client’s deductions are disputed, and the client ends up with a multi-thousand dollar bill. The occurrence of these scenarios don’t exclusively affect the ultra-wealthy. Individuals, and especially businesses, who do not have the means to have a bookkeeper or an accountant, face an increased chance of losing audits. In general, having proper documentation and representation to dispute audit allegations increases the likelihood of winning the audit. Hence why individuals and businesses with greater means are less likely to lose an audit. Newly hired IRS auditors, which will represent nearly half of IRS staff, likely won’t be handling these types of audits.

An increase in workers is going to increase the overall occurrence of audits- all around. Regardless of how much you or your business makes, you will have an increased chance of getting audited. So what should you do if you get a “notice of discrepancy” letter in the mail from the IRS? Don’t accept the proposal by simply paying the bill- no matter how small. If you are in compliance, provide the proper documentation, and dispute against the discrepancy. Otherwise, there will be a possibility of further investigations into previous years. That means more audits, and a larger bill. What might be a small proposal of discrepancy, can possibly grow into multiple years of audits.

Take for example our client, who had her business deductions dismissed by the IRS. In March 2019, she received the CP2000 letter claiming that she had a tax discrepancy of $11,000 from December 2016. With penalties and interest accumulating over the three years, the bill grew to $15,000. She is a classic example of the IRS chasing after regular Americans, not the ultra-wealthy. Our client only had a combined AGI of $90,000 with her husband. Her story is similar to what we see all the time: a new IRS agent conducted the audit, and misappropriated her rightful deductions, and now the taxpayer is faced with an inflated bill. After coming to us, we settled with the IRS and the agent conducting the audit, provided documentation, and eventually eliminated her proposed tax liability altogether. Not only did she win the audit, but she is also spared from any additional audits for previous years. With some help, she stopped the audit abuse at the hands of the IRS.

With the increase in IRS spending, please make sure that you or your business are in compliance with the agency. If you own a business, it is important that your business finances are well organized in the event of an audit. We recommend hiring a bookkeeper or accountant to help keep your business in compliance and increase your chances of success in winning an audit, if one were to ever occur. If you find yourself with a CP2000 letter, or notice of discrepancy letter, do not hesitate to reach out to your local tax professional. No matter how small the amount, it is important that you understand your rights.

Reasonable Compensation

Written by Alejandro Mendoza & Marina StolbovaiaAttention all S corporation shareholder-employees: be aware of upcoming IRS audits! If you own and perform business under an S corporation, you may already know to compensate yourself as an employee. Failing to provide yourself with compensation or providing too little compensation can get you into a problematic audit with the IRS. With IRS operations slowly going back to normal, expect an increase in audits.

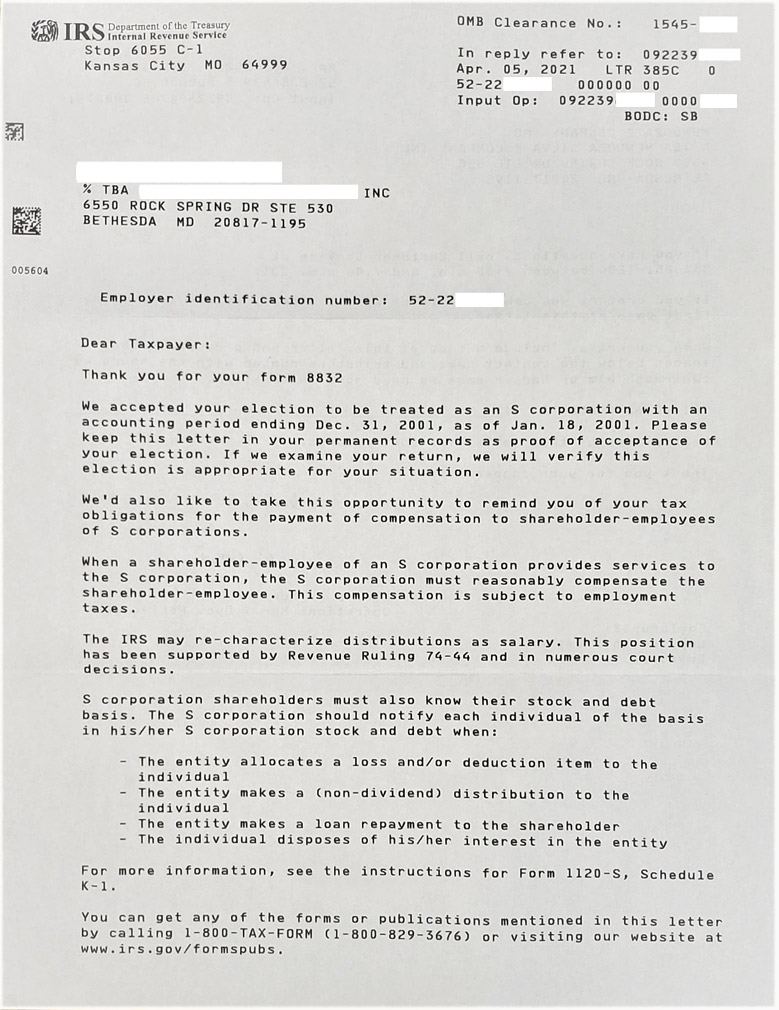

This morning while getting the mail, I noticed a letter from the IRS. The letter reminded us that our company was elected under an S corporation, which we had established nearly twenty years ago in 2001. What would be the motivation behind the IRS sending a friendly reminder? Without explicitly saying it, what the IRS means is ‘hey, we’re doing our due diligence by reminding you that you must pay payroll taxes on the compensation you received from your s corporation. Be prepared for the possibility of an audit.’ If you do not compensate for a ‘reasonable’ salary, the IRS can target you.

This morning while getting the mail, I noticed a letter from the IRS. The letter reminded us that our company was elected under an S corporation, which we had established nearly twenty years ago in 2001. What would be the motivation behind the IRS sending a friendly reminder? Without explicitly saying it, what the IRS means is ‘hey, we’re doing our due diligence by reminding you that you must pay payroll taxes on the compensation you received from your s corporation. Be prepared for the possibility of an audit.’ If you do not compensate for a ‘reasonable’ salary, the IRS can target you.

It can be difficult to determine what a reasonable salary is, so let’s tie everything together with a simple example:

Joe owns a plumbing company. He has eight employees, all under W2’s, and he pays them about $600,000 as a part of payroll. He also pays himself a ‘reasonable’ salary of $65,000, which is approximately the average salary for a plumber in his area.

He pays his employees and collects payroll taxes from them, relaying the tax amount to the government. Joe is in compliance. In the event of an audit, he is in good shape.

Mike, too, owns a plumbing company in the same state as Joe. He also has eight workers, but he classifies them under 1099-NEC even though they all work for him 40 hours a week and depend on him financially. According to the IRS, these are not workers; they are employees. Employees are paid under W2’s, similar to Joe’s employees. On top of that, Mike doesn’t pay himself a salary but instead withdraws the business’ profits into his account. He is not paying the payroll taxes from all workers, including Mike’s withdraw. Mike was sent the same friendly reminder but decided to take his chances and ignore the letter. A year later, the IRS knocks on his door and audits his plumbing business.

The IRS audit causes a ripple effect. His 2018 tax year gets audited, then the 2017 year, and the 2016, and the 2015 tax year. Mike gets audited for six years, and as a result, the IRS also reclassifies the workers as employees. The next thing he knows, his business owes $750,000, and he personally owes $480,000 in payroll taxes to the IRS. Mike will need to reclassify all of his employees and pay off his debt. If he can’t afford to pay off his personal debt, the IRS will threaten to levy his personal assets.

Luckily, Mike should not lose hope. Here at MendozaCo, we handle these kinds of situations often. The key in Mike’s scenario, like most scenarios with the IRS, is that he needs to get into compliance. Without compliance, negotiating with the IRS is near impossible, and penalties will continue to accrue. If Mike’s situation sounds similar to yours, please don’t hesitate to call us. We can take care of your IRS tax problems, as well as keep you in compliance by managing your payroll for you.

How are Maryland Unemployment Benefits Taxed?

Hundreds of thousands of people filed for state-led unemployment benefits as unemployment reached record numbers over the last year. Chances are you or someone you know has filed for some form of assistance. Under Maryland's new RELIEF Act, individuals will be exempt from state and local income taxes on unemployment benefits from 2020 and 2021 tax years. The exemption is estimated to save Maryland taxpayers more than $400 million and help people get more tax refunds during the tax season over the next two years.

The same income tax exemption is available at a federal level, as well. In other words: if you received Maryland unemployment benefits, income tax exemptions could apply to you at a local, state, and national level. According to the IRS, you don't have to pay federal taxes on your employment benefits up to $10,200- as long as your adjusted gross income is less than $150,000 for joint filers ($75,000 single filer). If you are married, each spouse receiving unemployment doesn’t have to pay taxes for up to $10,200 of the compensation received.

It’s important to note that you must request this exemption in your state and federal tax returns in order to receive the exemption. Unfortunately, it is not enough to simply be eligible for relief. The last year has been complicated enough- don’t hesitate to reach out to us at Mendoza&Co or a trusted tax advisor to maximize your return this tax season.

Updated Tax Filing Date 2021

In response to the pandemic, the IRS pushed the 2020 federal tax filing deadline. The Treasury moved the deadline from the expected date of April 15th to the following month, May 17th, 2021, to accommodate the “most vulnerable individuals” this tax season. For our DMV locals, Washington, D.C, Maryland, and Virginia have also adopted the filing day of May 17th.

There is significant confusion between the new filing deadline of May 17th and the first 2021 estimated quarterly tax deposit, which remains unchanged as April 15, 2021. Although the date to file has changed, the due date for estimated quarterly tax deposits has not. The 2021 estimated tax deposit applies to individuals owing more than $1,000 for income taxes for the year. For business owners, this means that the first-quarter estimated tax payments are still subject to the original estimated deposit date. Indeed, this can create some confusion.

Our recommendation at MendozaCo is to file the 2020 tax returns as soon as possible, and as for the 2021 estimated quarterly tax deposits to apply one of the “Safe Harbor” tests:

- 90% of the tax shown on the individual’s tax return for the current year (2021), or;

- 100% of the tax shown on the prior year’s return (2019) for adjusted gross income (AGI) less than $150,000 for married filing jointly (AGI less than $75,000 for single individuals) or;

- 110% if your previous year’s adjusted gross income was more than $150,000.

If you satisfy one of the three tests, you won’t have to pay the estimated tax penalty.

This tax season may be the most complicated yet. The unforeseen circumstances of the COVID-19 pandemic have brought both leniencies and more confusion into the equation. Starting sooner than later is the best way to avoid facing penalties or overpaying for your taxes- don’t wait until the last minute to file! Call MendozaCo to schedule an appointment today.

COVID Relief - 10% Penalty on Retirement Distribution

Written by Alex Mendoza and Marina StolboviaHave you withdrawn a portion of your retirement funds due to COVID-19 and are now stuck with paying the 10% early withdrawal penalty? As we know, the pandemic left millions of Americans in economic despair- so it seems unfair that people are still required to pay these penalties when the transfer was made out of necessity. Many people have found themselves in financial hardship and have resorted to taking out some of their retirement funds to stay afloat. Luckily, the IRS has released some recent guidance.

In the recent publishing of IRS Notice 2020-50, the IRS addressed coronavirus-related distributions within the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Here is the basic rundown of the benefits:

|

To qualify for assistance, the IRS requires an ‘acceptable self-certification’:

|

|

Learn how we turned Martha’s $22,000 tax liability into a tax refund:

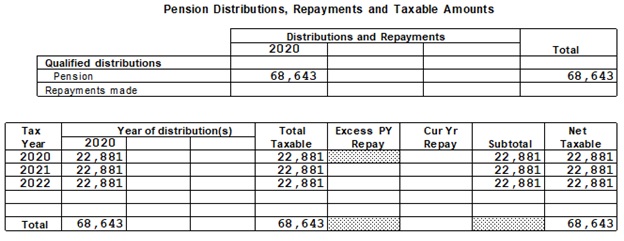

Martha came to us after she withdrew $68,643 from her pension plan. Since she distributed her funds before the mandated retirement age, she accrued $6,864 in penalties. On top of the penalties, there are also federal and state taxes, adding $16,000 to her overall bill. Before Martha came to us, she owed $22,864 in taxes and penalties.

Her husband's furlough from his job last August qualified the couple for relief. After consulting Alejandro, our EA and tax advisor, she was able to abate the $6,864 penalty entirely and split her withdrawal into three separate, taxable distributions. For the years 2020, 2021, and 2022, she will recognize $22,881 from her retirement plan. This way, Martha can meet her family's needs while paying only a fraction of what she owed in taxes. In the end, reducing her taxable income resulted in Martha receiving a tax refund for the 2020 tax year. Thanks to Alejandro, Martha went from being tens of thousands of dollars in debt to the IRS to have the IRS owe her money back during a time of need.

Don't let the pandemic pressure you to go into debt with the IRS. Consult Mendoza&Co today to see how we can work for your tax needs.

Partial Payment Installment Agreement (PPIA)

Written by Alex Mendoza and Marina StolboviaWhat is a Partial Payment Installment Agreement (PPIA)?

The Partial Payment Installment Agreement (PPIA) is a monthly payment plan with the IRS that allows a Taxpayer to pay only a portion of their tax debt. Although the IRS can sometimes be willing to accept a partial payment, securing an agreement is only possible for those Taxpayers that qualify under certain guidelines. Within the Internal Revenue Manual, IRS Code section 6502 states that the IRS is limited to a ten-year collection authority on taxes due from the Taxpayer. This statute is called the Collection Statute Expiration Date or CSED. Starting from the day you filed your tax returns, the statute begins. Here, it becomes essential to file your tax returns on time. If you or your business have unsubmitted tax returns or have had tax returns prepared by the IRS, called Substitute for Returns (SFRs), the CSED will not begin until you file.

To better understand if you may be eligible for a PPIA, let's consider a few examples:

Example # 1: Taxpayer (Jane Smith) filed her 2012 Form 1040 tax returns on April 15, 2013, but never had a chance to pay the taxes due. Following IRS Code 6502, Jane's CSED for the 2012 tax return will expire on April 15, 2023. Before she knew it, her overall tax liability grew to $80,400, including principal, interest, and penalties. As of December 31, 2020, the CSED for her unpaid 2012 tax return will expire in 28 months. Jane consults a local tax resolution firm, and they determine that her monthly ability to pay is $100.00. With the PPIA payment plan, Jane will pay only $2,800 out of her $80,400 tax debt. The IRS CSED then writes off the remaining $77,600 balance.

Example # 2: The IRS prepared a Substitute for Return (SFR) on behalf of the Taxpayer (Billy Miller) for the 2012 tax year. His assessed tax liability is $80,400, including principal, interest, and penalties. The CSED for 2012 has not started, and the ten-year collection period moves forward, benefiting the IRS. In this scenario, Billy will not qualify for the PPIA since the IRS still has plenty of time to collect his debts. Instead of a PPIA, he may be eligible for a full-pay installment agreement (IA).

Like Jane, Billy's ability to pay is $100.00 monthly, but he has 120 months to pay his debt. Suppose Billy's PPIA offer is accepted. The IRS will grant him the agreement, but the IRS will reassess his ability to pay every two years. If Billy's financial situation were to improve, and his ability to pay has increased, the IRS will see this improvement and request an increased monthly payment. Two years later, during Billy's evaluation, they determined that his ability to pay increased to $1,000 monthly. Billy's new monthly payment will then be $1,000 for the remaining 78 months.

Like the full-pay installment agreement, PPIA and Offer In Compromise require the Taxpayer to be in compliance with the IRS. In order to be in compliance, The Taxpayer will need to have filed all tax returns or the last six-year minimum in certain cases. Regardless of whether a PPIA or Offer in Compromise is used, it is important to file your taxes and start the statute of collections. Haven’t filed taxes in years? Visit our blog post to learn more.

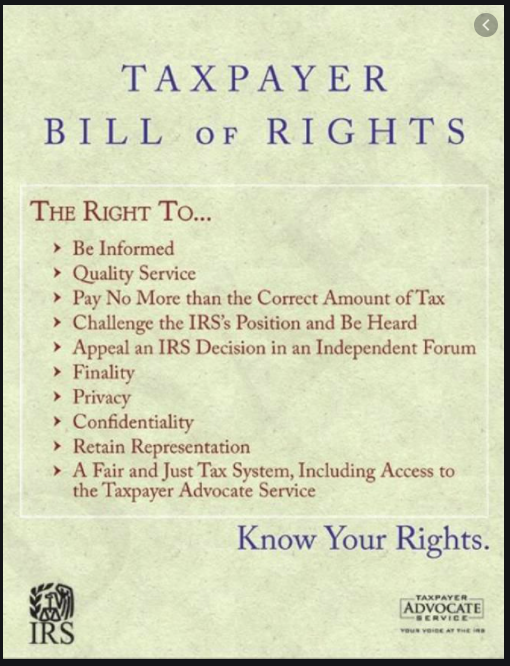

Knowing Your Rights - Be Informed

Most Taxpayers are not aware of their rights regarding the 10-year CSED when dealing directly with an IRS revenue officer (RO). Close to 100% of the time, taxpayers are pressured by the RO to sign a waiver, called Form 900, extending the CSED. In Example # 1 above, if Jane Smith signs a Form 900, the IRS would have gained the right to add 60 months or $6,000.00 to her bill. All when she was not required to sign the form in the first place. Don’t fall into this trap!

IRS Internal Revenue Manual (IRM 5.14.2.2.3(2)) clearly states “A waiver is no longer required to be secured when the taxpayer’s only ability to satisfy the tax liability after the CSED expiration is through a continuation of the installment agreement and there is no significant change in ability to pay as identified through the two-year financial review process”

AND confirmed in the following federal act;

The 2004 American Jobs Creation Act: I.R.C §6159(a) “A waiver is no longer required to be secured when the taxpayer’s only ability to satisfy the tax liability after the CSED expiration is through a continuation of the installment agreement and there is no significant change in ability to pay as identified through the two-year financial review process.”

What We Do!

Step 1: Evaluating your Financial Assets and Tax Compliance

For the IRS to accept your PPIA settlement, you must be in compliance. Without compliance, negotiating with the IRS will be very challenging. The IRS will not consider a full-pay installment agreement, PPIA, or an Offer in Compromise if you haven't filed your tax returns. We begin strategizing how to tackle your debt by first preparing unfiled tax returns and analyzing your asset's risks. The assets can include your bank account balances, cash value life insurance, 401ks, equity in your house, and your vehicle(s). If you do not have assets, that could be a good thing when dealing with the IRS.

Step 2: Statute of Limitations

A significant component of how the IRS will review your PPIA application is how close your tax debt is from the statute of limitations for collections ('CSED'). The IRS has only ten years to collect your debt, and once the ten-year statute of limitations has expired, the remaining debt balance is diminished. It is essential to know how much time you have left until your CSED comes into effect. A debt closer to the CSED will have a better chance of obtaining the PPIA than one with eight years left, for example. In the case that there are eight years until the CSED, it will be unlikely that the IRS will accept a PPIA as the IRS has plenty of time to collect your payment. In this case, the Taxpayer is most likely qualified to enter into an installment agreement rather than a PPIA based on the Taxpayer's ability to pay for the eight years.

Step 3: What is your ‘Ability to Pay’?

If the statute of limitations for collections is coming into effect, then the IRS only has a short period to collect as much as the law allows the IRS to collect from you. In example # 1, the Taxpayer's ability to pay is a $100 monthly payment for the PPIA; the IRS will have no choice but to accept the PPIA before they cannot collect within the CSED.

Example # 3

Let's consider a scenario where you have a tax debt of $150,000. You have the ability to pay $100 per month, and your financial condition is unlikely to change in the future, you have no assets besides your home which is worth $350,000 and the mortgage on your home is $200,000. The IRS sees that you have equity in your home and threatens to levy your property. You are in compliance but you are lacking funds to fully pay the tax liability. You tried to refinance the house and you’re unable to utilize the equity. In most cases, our clients have equity in their homes, but because their credit has been ruined by the IRS tax lien placed on the home, the bank will deny any form of refinancing. This is a good thing from a bad situation.

IRS IRM 5.14.2.2.2(2) Asset Equity and Partial Payment Installment Agreement “Asset Cases: A PPIA may be granted if a taxpayer does not sell or cannot borrow against assets with equity because: (b) the taxpayer is unable to utilize equity”

If the IRS is pressing for the available equity in your home, we will stop the IRS request by proving that you were unable to obtain financing from the bank. When the bank denies your request to refinance, this shows that you were unable to acquire the equity from your home, and ultimately, the IRS will not be able to seize the equity. Additionally, suppose the property is jointly owned and the non-liable spouse declines to go along with the attempt to borrow against the equity to pay the IRS. The spouse has the right to deny refinancing. Since the non-liable spouse has a right to deny refinancing, this will freeze the IRS from obtaining the equity.

Step 4: Stoping IRS Collections and Evaluating Options

Before we submit a PPIA, we will first analyze the Offer in Compromise (OIC) option. An OIC is a minimum amount you can pay and ‘settle’ with the IRS. In some special cases that we have handled, we could settle a tax debt for $1. However, not all cases are alike. This is the best-case-scenario. If you cannot pay the entirety of the debt and have a limited ability to pay, the IRS may grant an OIC. After you pay the agreed-upon amount, you will no longer be in tax debt!

OICs are complicated to do alone. We have a solid team of experts working on OIC year-around. Not all cases qualify for an OIC, but it may likely be your first solution to settle.

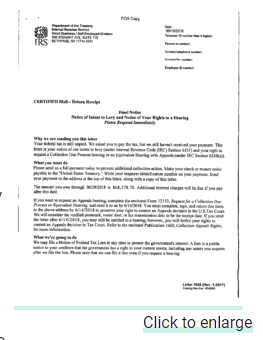

Example # 4 The IRS is knocking on your door with the “Final Notice – Notice of Intent to Levy and Notice of Your Rights to a Hearing” Letter 1058, but you only have 40 months remaining on your CSED - What steps should I take?:

|

1. Fax and Certified Mail “Request for a Collection Due Process or Equivalent Hearing” Form 12153 ASAP or within 30 days. This step is important. You don’t want to lose your appeal rights by not responding on-time. |

|

|

2. Compliance, Compliance, and Compliance – File unfiled tax returns, |

|

|

3. Here, we would prepare your financial statements to show the IRS that you are only able to pay $100 a month and demonstrate your financial condition is unlikely to change in the future. Like we had mentioned earlier, the IRS will try to take as much as they can get by collecting your tax debt. If the IRS sees that you are unable to pay your tax balance in full, they will grant your request for a PPIA. |

|

| 4. Instead of paying $150,000 of tax debt, you will only pay $100 for 40 months- so only $4,000! | |

PPIA's have a strict application process, and they are often the 'last resort’ for the IRS to collect your debts. As nice as only paying-off only a portion of your debt sounds, the IRS does not make obtaining this agreement easy. Not only does the taxpayer have to check all of the requirements, if the PPIA is granted, the taxpayer also consents to be financially re-evaluated every two years. This means that if the taxpayer’s financial situation were to improve, then they can be subject to an increase in their monthly payments.

PPIA is complicated, but not difficult to obtain if you qualify. The good news is that we are here to help. At Mendoza & Co, our tax experts will position your PPIA in the light most favorable to you and not the IRS. Every tax solution is different. Don’t wait and tackle the IRS on your own- schedule an appointment now!

Haven’t paid your taxes in 5 years? 10 years? Have unfiled tax returns?

Have a tax debt of $30,000 or more?

Don’t panic! At MendozaCo, we are here to help.

Failing to file or pay for your taxes can bear some serious consequences. Not only is it the law to file your taxes, but the unfiled tax return debt will also continue accumulating penalties and interest. On top of that, the IRS can legally levy your assets, stop business operations, garnish future tax refunds and your paychecks, and can even prevent you from obtaining your professional license or a passport. Although it is relatively unlikely that you will be sent to jail, the penalties and interest alone are enough to get anyone nervous. Even famous celebrities can’t escape the fright:

|

“In my daily life, the goal was to muffle the anxiety that I’d feel as I tried to drift off to sleep knowing that, at any point, what little money I had in my bank account could be garnished by the IRS”. -Anthony Bourdain |

We understand that filing or paying your taxes can be a daunting task. Many Americans overlook their taxes for a multitude of reasons - maybe you were sick in the hospital, you were afraid to file because you didn’t have the money to pay, or you just never got around to it. Regardless of your reasoning, you are not alone. In fact, approximately seven million Americans fail to file federal income tax returns every year. We see these kinds of things all the time; it is nothing to be ashamed about. Together, we can come to an effective solution.

Step 1: You need to be in COMPLIANCE:

If you haven’t filed, you should first file your current return and the prior six years' tax returns as soon as possible to begin to bring yourself into compliance with the IRS. Remember: compliance is key! This will be essential for subsequent actions to get you back on track to being tax debt-free. The IRS considers a taxpayer to be in compliance if returns have been filed up to six years and the current tax year.

For some filings, however, the IRS will file the tax return for you, a procedure called a Substitute Filed Return (“SFR”). The IRS is not filing the tax returns to help you. The SFR creates the assessment (Inflated IRS tax bill) and starts the collection process against you without you being aware. The SFR is a legal procedure within the IRS IRM (Internal Revenue Manual).

In the case that there are SFRs, we will need to replace them with your actual tax return in order to adjust the IRS inflated assessment (the tax bill). Remember, we only need to file the prior six years to be in compliance, but if we can identify any SFRs beyond the sixth non-file years, we would need to also file those additional tax returns. SFRs can significantly inflate your tax bill for the Installment Agreement (IA), so it is important to identify and replace the SFRs with your actual tax returns. Make sure to file the required tax returns and stop the bleeding. If we perpetuate the cycle of non-filing, the bleeding of additional penalties will continue to flow.

Here is the tricky part - we need to be careful about how many unfiled tax returns to submit. Sometimes submitting too few can result in a criminal act called tax evasion or audit exposure, while filing too many may end up paying more than you should! But don’t worry, tax resolution is our specialty!

|

- IRS Internal Revenue Manual (5.14.1.4.1) |

|

|

“Six-Year Rule: When a taxpayer is unable to full pay immediately and does not qualify for a streamlined installment agreement, the taxpayer may still qualify for the six-year rule. “ |

|

- IRS Internal Revenue Manual (5.14.1.4.2.8) |

|

|

"Compliance and Installment Agreements (IA): Prior to granting IAs, ensure that tax returns due within the past sixteen months were filed. If not filed, address compliance even if a Del Ret is not indicated using the procedures provided in IRM 5.14.1.4.1" |

Now what?

Now the clock starts ticking. Don’t worry, though, not in a bad way! It’s important to submit your returns and be in compliance with the IRS in order for the statute of limitations on the collection period to begin. The IRS has a statute of limitations for collections of 10 years. Meaning, once you file your taxes, the collection period begins, and if your debt has not been collected within 10 years, the remaining balance of your debt will be removed and you will no longer be liable to pay it. Of course, a ten-year-long waiting game sounds exhausting, which it is, but it will at least get the ball rolling!

Now that we are in compliance with the IRS, we now need to look into your financial situation and your ability to pay.

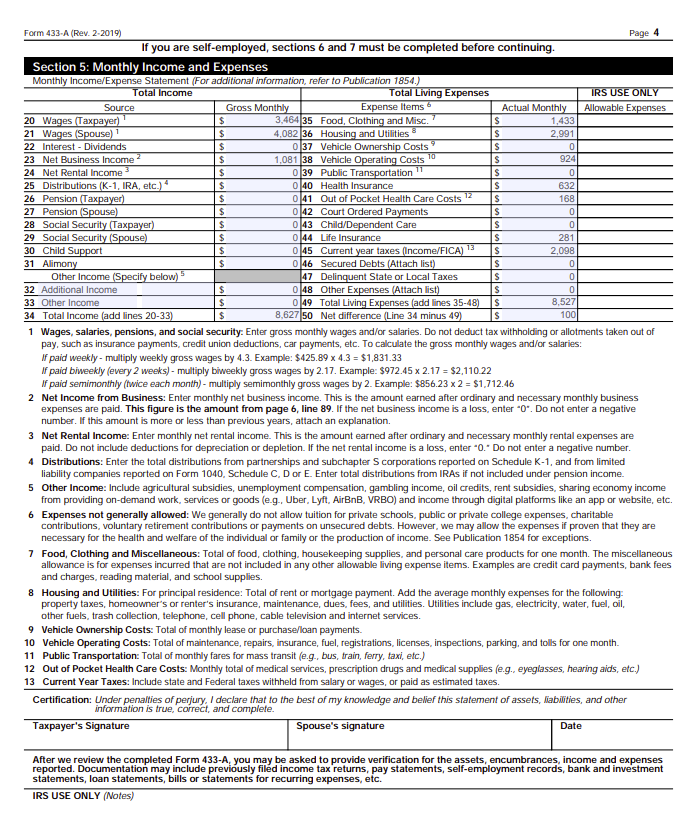

Step 2: What Are my Payment Options with Uncle Sam?

Once we stop the bleeding, we finally start to strategize a game plan. This is where we come in and do what we do best. There is no one-size-fits-all solution. We approach each individual tax problem with a unique and individual strategy, placing you in the best outcome possible. In assessing your financials, we first prioritize you and your family’s needs. Before you address your tax burden, we first need to make sure that you have food on your plate, a roof over your head, and you are able to pay all of your necessary living expenses such as;

- Food, Clothing and Other Items (Housekeeping supplies, Apparel & Services, Personal Care Products & Services, and other Miscellaneous,

- Out of Pocket Health Care, Health and Dental Insurance,

- Housing and Utility Expenses (Including Mortgage and Property Taxes),

- Local Standard Transportation Cost such as Car Ownership Costs, Operating Cost or Public Transportion.

This will allow us to see your ability to pay. Your ability to pay is the remaining disposable income after we take into account all of your necessary living expenses. Then, we will look into the following options:

Step 3: Installment Agreements:

An installment agreement is an IRS program that allows you to pay back your tax debt in monthly payments. We determine the monthly payment amount using your ability to pay. After taking into account your financial needs, the remaining amount is the disposable income and this amount is what is available to be used to pay back your tax debt. Even if your ability to pay is one-hundred dollars on a one-hundred thousand dollar tax debt, that can be your monthly IRS installment agreement. In order for an installment agreement to be accepted, though, you will need to be in compliance. This is why compliance is key - the IRS will not work with us unless you have followed the correct requirements.

You must evaluate other conditions as well. For instance:

- If you’re considered self-employed, you must be up-to-date on all your quarterly estimated tax payments for the year.

- Do you have equity in your assets? If you cannot access the equity, the IRS can't garnish it.

We need to evaluate your ability to pay, assets and safeguard what the IRS can garnish.

Don’t tackle your tax debt alone. Consult your local tax experts and save yourself the money, time, and energy needed to fight the IRS alone. Settle your tax debt and close this chapter. At MendozaCo we understand how stressful and possibly embarrassing this process can be.

Remember, this is what we do best! We are here for you and are determined to help.

Effectively Connected Income (ECI)

TAXATION OF FOREIGN REAL ESTATE INVESTORS IN THE U.S.

30% FLAT TAX ON RENTAL PROPERTY

The article was prepared for educational purposes only. The article is neither legal nor tax advice, nor is it to be construed as such. Each individual’s circumstances are different; you should seek legal and/or tax advice to address any specific question you may have.

RENTAL INCOME: FDAP

U.S. “Fixed, Determinable, Annual or Periodic” (FDAP) Income Tax for Nonresident Alien

Under U.S. Title 26, IRS section code § 871(a)(1), FDAP income includes rental real estate income received on rental property as passive income. FDAP rental income is taxed at a flat tax rate of 30% of the “Gross Rental Income” for the calendar year. The tax applies to foreign persons earning rental income in the U.S. or the lower tax rates under a tax treaty between the investor’s country of residence and the U.S.

In a tax examination, the IRS determines taxable income (FDAP income) as the total rental income collected during the taxable year. All expenses are foregone and non-deductible. No deductions for management fees, property taxes, mortgage interest expenses, depreciation, repairs and maintenance, and other rental costs on the IRS Form Schedule-E “Supplemental Income and Loss” are allowed. FDAP disallows all rental deductions unless the Effectively Connected Income (ECI) is filed.

Example: Mathis and Carol Dubois are Argentinian citizens living in Argentina, and in December 2016, they purchased a rental property at Pike & Rose in North Bethesda. In 2017, the couple contracted a local rental management company to rent out a two-bedroom condo with two baths and a living space of 1,291 square feet for $3,000.00 monthly, a bargain in the area.

The property was rented in 2017 for the entire year. The total annual rental gross income was $36,000.00, and it had $37,257 in qualified rental expenses. The rental LOSS was ($1,257), and the couple’s nontaxable cash-flow for the year was $10,970.00. The benefit of rental property is the deprecation deduction allowed for rental real estate. For the Dubois, the rental property depreciation for 2017 was $12,197.00, and the same amount is to be deducted for the next 27.5 years. During the period, the Dubois nontaxable cash-flow is estimated to be $301,675.00. Not a bad deal for investing in the U.S.

Without knowing about the tax implications of FDAP, the couple engages a local tax preparer to help file the 2017 Form 1040NR “U.S. Nonresident Alien Income Tax Return” and reports the ($1,257) loss on their Schedule-E.

The Dubois are excited with the zero tax liability for the next 27.5 years and consider buying a second investment property in October 2019. In May 2019, the couple calls their friend Rachel, a Maryland licensed real estate agent, about making an investment in a new property. Rachel was involved in the previous acquisition, and the Dubois regard her as the couple's real estate guru.

Rachel is excited about getting a call from the Dubois and equally enthusiastic that her international investor ledger is growing. The plan is set for October 2019, and Rachel puts on her real estate guru hat and searches properties for the Dubois to evaluate. The Dubois’ investment goals are as follows; two bedrooms, two baths, 1,300 square feet, Fair Market Value of $700,000, with a $140,000 down payment plus closing cost.

In September 2019, The IRS audited the Dubois’ 2017 tax return and disallowed the $37,257 rental expenses under the FDAP regulations. The IRS assesses a tax liability of $10,800.00 plus a 75% civil fraud penalty (Section 6663(a)), plus failure to deposit penalty, plus failure to pay penalty and interest. Total tax assessment for 2017 is $20,000+. Further, $10,800 is the yearly estimated tax for each year the property is rented. According to this annual number, the couple will pay an estimated $297,000 in taxes for the next 27.5 years under FDAP ($10,800.00 x 27.5 years).

The new investment property deal is off the table after the bad news from the IRS. Rachel is fired on the spot, and she is blamed for not providing them with tax advice. Rachel is not responsible for the tax problems, but in the real world, real estate agents are to blame for all matters. Rachel loses the Dubois and the opportunity to grow her international ledger.

All this could have been prevented if Rachel and the Dubois knew about the Effectively Connected Income (ECI) tax incentive, which allows Nonresident Alien Investors to file an IRS tax election in order to be taxed at the “NET BASIS” or the ($1,257) loss in the Dubois’ case. The tax election could have allowed the zero tax result for Dubois’ just the same as US Citizens and resident aliens.

SOLUTIONS:

A foreign investor will need to contact a real estate tax accountant and amend three years of tax returns before an IRS examination. The “key” is before the IRS examination. The investor will need to amend 2018, 2017, and 2016 Form 1040NR and include the ECI election with each amended tax return. Under IRS 6501 and IRS Internal Revenue Manual IRM-25.6.1.6.4 “Statute of Limitations on Assessment,” the IRS has three years to audit and access additional taxes from the due date of the return, or three years after the date the return was filed, whichever is later.

Real estate agents and management companies may have clients at risk for the FDAP regulations and IRS examination. Inform your clients of the risk of FDAP and give us a call for assistance.

EFFECTIVELY CONNECTED INCOME

RENTAL INCOME: ECI

Under U.S Title 26, IRS 871 (d) “net basis” election, the IRS code allows an Effectively Connected Income (ECI) election “to treat real property income as income connected with United States business. In general, a nonresident alien individual who during the taxable year derives any income - from real property held for the production of income and located in the United States” can deduct qualified rental expenses.

The ECI regulations are good news for foreign investors and real estate agents. In the Dubois’ case, the election would have allowed $37,257 in real estate expenses and zeroed out their tax liability. Rachel would have kept the Dubois as clients and grown her international investor ledger.

To qualify for ECI benefits, the investor must;

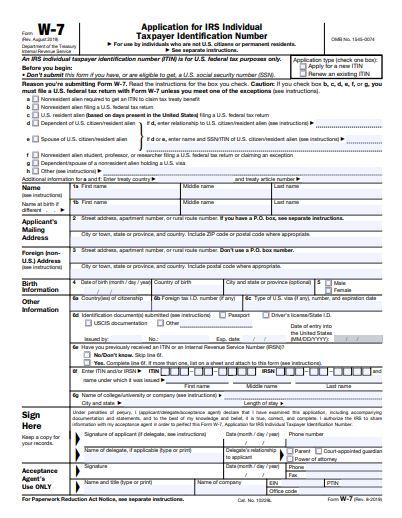

- Obtain an ITIN or EIN number from the IRS,

- Under IRS 871(d), treat the rental income as EIC,

- Make annual EIC elections for each year the property is rented on Form 1040NR, and

- Provide the correct W-8 form to the management company.

The Dubois represents the typical foreign investor we represent in our Bethesda office nationwide. As a tax firm, we can provide the following services to foreign investors.

Our services include:

- IRS ITIN or EIN investors numbers,

- File annual “Effectively Connected Income” elections with the IRS,

- Prepare and provide management company an annual signed Form W-8ECI,

- File IRS Form 1040NR annually for investors,

- Report Income and Expenses on Schedule E,

- If applicable, represent investors in the IRS examination, audits and tax resolution matters.

You need the right tax team working with you. Consider us, Mendoza, Silva & Company for all of your tax services. Consult with an enrolled agent, CPA, or Tax Attorney to assist with foreign investors buying rental property in the United States.

Call us for a complimentary evaluation at 301-962-1700. Mendoza, Silva & Company is located in Bethesda, Maryland, and Miami, Florida.

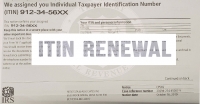

Do You Know When Your ITIN Expired?

The IRS issues Individual Taxpayer Identification Numbers (ITIN) to individuals who are not eligible to obtain a Social Security Number.

Under the Protecting Americans from Tax Hikes (PATH) Act, IRS had established in 2016 tax year the ITIN’s Renewal Program. The rule is simple if an ITIN holder had not filed taxes for the tax years 2016, 2017, or 2018, there ITIN numbers will expire on December 31, 2019. Also, for ITIN’s with middle digits of 83, 84, 85, 86, or 87 (e.g., 9XX-83-XXXX), they will expire at the end of 2019 as well.

Expired ITIN numbers (Middle two digits);

| 2016 | 78 & 79 |

| 2017 | 70, 71, 72 & 80 |

| 2018 | 73, 74, 75, 76, 77, 81 & 82 |

To Expired In 2019 (Middle two digits);

| 2019 | 83, 84, 85, 86 & 87 |

The IRS is sending the Notice “CP-48” to all ITIN holders who must renew their number before December 31, 2019. However, the ITIN holder is not required to wait until receiving this notice to begin the process. If you have an ITIN with middle digits of 83, 84, 85, 86 or 87, you can start the process anytime from now until the end of the year. It is recommended to comply with the renewal as soon as possible to avoid delay from the IRS.

The ITIN renew process is simple, and a tax return is not required to be filed with the request. The taxpayer will need to submit a new Form W7 and supporting documentation to the IRS. However, the IRS does not accept copies of taxpayer supporting documentation unless it is issued by an IRS Agent, Certifying Acceptance Agents (CAA’s).

The Mendoza, Silva & Company team is certified to request your renewal and authenticate your supporting documentation for you. Therefore, you are not at risk of losing your original documents or waiting for weeks until it is returned to you. In our office, we will certify copies of your documents and return your originals to you at the time of your appointment. It is faster and easier!

Avoid common errors now and prevent delays next year

Federal tax returns that are submitted in 2019 with an expired ITIN will be processed. However, certain tax credits and any exemptions will be disallowed. Taxpayers will receive a notice in the mail advising them of the change to their tax return and their need to renew their ITIN. Once the ITIN is renewed, applicable credits and exemptions will be restored and any refunds will be issued.

Additionally, several common errors can slow down and hold some ITIN renewal applications. These mistakes generally center on missing information or insufficient supporting documentation, such as name changes. The IRS urges any applicant to check over their form carefully before sending it to the IRS.

As a reminder, the IRS no longer accepts passports that do not have a date of entry into the U.S. as a stand-alone identification document for dependents from a country other than Canada or Mexico, or dependents of U.S. military personnel overseas. The dependent’s passport must have a date of entry stamp, otherwise the following additional documents to prove U.S. residency are required:

- U.S. medical records for dependents under age 6,

- U.S. school records for dependents under age 18, and

- U.S. school records (if a student), rental statements, bank statements or utility bills listing the applicant’s name and U.S. address, if over age 18.

Link to Acceptance Agents - Maryland

More...

2019 Tax Organizer - Maximize Your Deductions

Download a Tax Organizer Form-Fill-In PDFs for 2019 tax season

These Tax Organizers are designed to help you gather the tax information needed to prepare your personal income or business tax return for 2018. A Tax Organizer is a great tool to help you reduce your taxes or increase your tax refund.

Individuals

2018 Basic Organizer (4 Pages) –This organizer is suitable for clients that are not itemizing their deductions and DO NOT have rental property or self-employment expenses.

2018 Full Organizer (8 Pages) – This organizer includes the information included in the basic organizer, plus entries for itemized deductions, rental properties, and self-employment expenses.

Business

2018 Basic Organizer (4 Pages) – This organizer is suitable for clients with self-employment income, partnership income, and corporation income. (Schedule C, 1065 & 1120s)

We can help you file your tax returns. Schedule Online.

The following are examples of supporting documentation:

- Forms W-2 for wages, salaries, tips, and gambling winnings.

- All Forms 1099 for interest, dividends, retirement, miscellaneous income, social security, state or local refunds, etc.

- Form 1099B Brokerage statements showing investment transactions for stocks, bonds, options, etc.

- Schedule K-1 from partnerships, S-corporations, estates, and trusts.

- Statements supporting educational expenses, deductions or distributions, including any Forms 1098-T, 1098-E, or 1099-Q.

- All Forms 1095-A, 1095-B, and/or 1095-C related to health care coverage for the Premium Tax Credit.

- Statements supporting deductions for mortgage interest, taxes, and charitable contributions, including any Form 1098-Mort.

- Copies of closing statements regarding the sale or purchase of real property.

- Legal papers for adoption, divorce, or separation involving custody of your dependent children.

- Any tax notices sent to you by the IRS or other taxing authority.

- A copy of your income tax return from last year, if not prepared by Mendoza, Silva & Company.

Call us today at 301-962-1700.

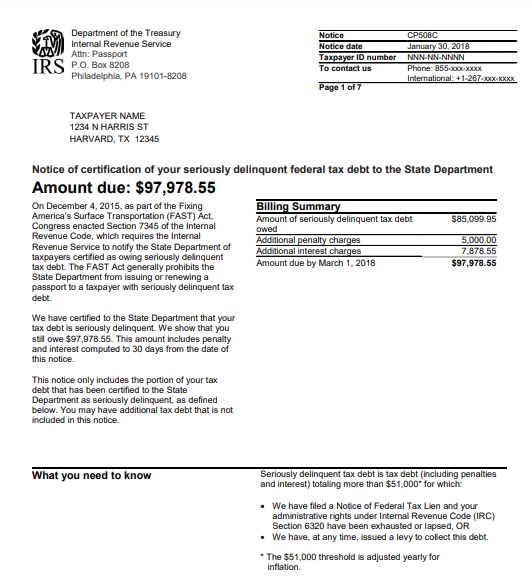

Passport Alert – IRS Tax Debts May Revoke Your Passport Featured

Written by Super UserOwing more than $51,000.00 of taxes can stop your travel plans.

Beginning in 2018, The IRS started mailing to Taxpayers owing more than $51,000.00 a notice called "CP508C - Notice of Certification of your Seriously Delinquent federal tax debt to the State Department".

If you owe taxes over $51,000, the IRS may inform the State Department which can then revoke your passport. And you might not even know until you get to the airport.

"On December 4, 2015, as part of the Fixing America’s Surface Transportation (FAST) Act, Congress enacted Section IRC §7345 of the Internal Revenue Code, which requires the Internal Revenue Service to notify the State Department of taxpayers owing more than $51,000.00 and certifying the Taxpayer as “Seriously Delinquent. The FAST Act generally prohibits the State Department from issuing or renewing a passport to a Taxpayer with seriously delinquent tax debt. (per IRS)"

The IRS has the following power if you don’t act soon;

- Filed a Notice of Federal Tax Lien,

- Issued a levy to collect the debt to your employer or from your customers,

- If you apply for a passport or passport renewal, the State Department will deny your application,

- If you currently have a valid passport, the State Department may revoke your passport or limit your ability to travel outside the United States.

It is estimated that about 270,000 Taxpayers are about to receive Notice CP508C in 2019.

Step 1: What to Do?

- Give us a call,

- Request the IRS to provide the detail of accounting for the years and the balances under question. We will call on your behalf and request IRS “Account Transcripts.”

- Evaluate the Account Transcripts for missing payments and locate the canceled check(s) for account adjustments.

- Verify if the amount owed is correct.

Step 2: Propose a Viable Collection Alternative

- Stablish Installment agreement (IA). The installment agreement must be accepted with the IRS prior the passport revocation can be reversed.

- Offer in Compromise (OIC). Same as IA, it must be accepted.

- Request for an Innocent Spouse Relief. While the request is pending, reversal is available. IRC §6015(e)(1)(B) prohibits enforcement while the application is pending. If the debt is related to your spouse income or business and you did not participate in the business activity, Innocent Spouse Relief can be a good avenue for passport revocation reversal. The key is that the request does not need to be accepted by the service. It only needs to be pending.

Key Facts

Before denying a passport, the State Department will hold the application for 90 days to allow a citizen to:

Before denying a passport, the State Department will hold the application for 90 days to allow a citizen to:

- Resolve any erroneous assessment issues (Incorrect tax debts or identity theft matters)

- Make full payment of their debt,

- Enter into a satisfactory payment arrangement – IRM 5.1.12.27.7(6).

Reversal Certification under IRC §7345(c)

You have established a collection alternative with the IRS and accepted. The IRS must give notice to the State Department reversing the certification if:

- Certification is found to be erroneous,

- Debt is legally unenforceable,

- Debt is fully satisfied,

- Debt is no longer “seriously delinquent” per §7345(b),

- Installment Agreement is entered into,

- Offer in Compromise is accepted,

- Justice Department enters into a settlement agreement,

- Innocent Spouse Relief is requested.

Once the (IA) and (OIC) are accepted or Innocent Spouse Relief request is pending, the IRS will mail the “Reversal” notice to taxpayer CP508R and to the State Department.

If you have questions or concerns about the passport revocation, please call Mendoza, Silva & Company today!

We are here to help.

2018 Child & Dependent Tax Credits

Increased to $2,000 in 2018

The child tax credit increases in 2018 to $2,000 (up from $1,000) with up to $1,400 being refundable. The earned income threshold is reduced to $2,500 (down from $3,000 in 2017) allowing more taxpayers to qualify for the credit. A child has to be under the age of 17 and have a valid Social Security number issued before the return due date to qualify for the credit.

In addition, a non-refundable tax credit of $500 is available for each non-child dependent that does not qualify for the child tax credit. The AGI thresholds at which the credit begins to phase out are substantially increased: to $400,000 for married filing jointly and $200,000 for all other taxpayers.

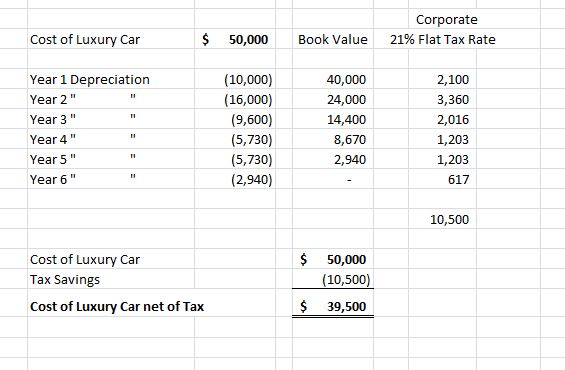

2018 Luxury Auto Limits for Business Auto Deductions

Luxury Auto Limits for Business Autos

The 2018 tax bill increased the luxury auto depreciation deduction limits for the 1st, 2nd, 3rd and subsequent years with the year first increased to $10,000 and the second year to $16,000.

What is a Luxury Auto?

The IRS definition of a "luxury vehicle," is a four-wheeled vehicle regardless the cost of the vehicle, used mostly on public roads, and has an unloaded gross weight of no more than 6,000 pounds.

What is the Corporate Tax Savings?

The most dramatic changes made by the 2018 Tax bill is on the corporate rate. For starters, the bill lowers the corporate tax rate to a flat 21% on all profits from 35% through January 1, 2026. This is not only a massive tax-cut, but is a major simplification as compared to the 2017 corporate tax rates. The flat 21% corporate tax change can save an entity up to $10,500.00 in corporate taxes for an auto costing $50,000.

Here is an example of a Luxury Auto costing $50,000 and put in services on January 1, 2018. Notice, the tax saving is $10,500 over five and half years and resulting in the actual cost to $39,500 net of corporate taxes.

If you have questions about your Luxury Auto tax saving for a corporation, please give this office a call at 301-962-1700.

H.R.1 - An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for the fiscal year 2018.

Search

Categories

Recent Posts

-

23 Jan, 202322 Questions About 2022 Taxes

-

23 Jan, 2023Tax Updates for 2022

-

15 Dec, 2021Medical Expense Deductions

-

06 Oct, 2021The IRS Crackdown on Venmo, Zelle Payments

About Us

Mendoza & Company, Inc. is a full-service accounting, Payroll, and Tax Resolution firm in Bethesda, MD and Miami, FL. As a client, you gain a professional team with expertise in multiple fields, providing you the right advice to strengthens your organization and long-term goals.